The Dollar and Black Swans

Black Swan: “An unpredictable event beyond what is normally expected of a situation and has potentially severe consequences.”

Financial markets are constantly pricing in risks. While some risks can be easier to manage and mitigate over the long term, a black swan-type risk is nearly impossible to predict or ensure. What makes these catastrophic risks less terrifying is their probability of occurrence very low. While we can’t always avoid exposure to these risks, we try to understand what is going on to best prepare portfolios against this. One area of interest this year has been the strength of the dollar and its ripple effects within the global economy. Is there a type of Black Swan risk floating into the picture?

What Has Happened

This year we’ve seen the dollar gain in strength compared to other currencies worldwide. This strong dollar has occurred because the US economy has remained resilient compared to other countries and the Federal Reserve has continued to raise interest rates. This combination of continued strength and increasingly hawkish behavior has caused the dollar’s relative strength to skyrocket to its strongest level in 20 years.

Why It Is Important

While a strong dollar sounds great because American consumers can afford more travel abroad and imported goods, there are plenty of negatives. Companies that do business internationally will be hurt by weaker demand overall as foreign consumers’ currencies will buy less of their overall product. Developing nations that are vulnerable to rising prices for food, fuel, and medicine will be especially affected and unfortunately, those same types of countries have their debt usually denominated in US dollars since their currency is too unstable. That means as the dollar gets stronger, their debt payments become more and more expensive over time.

Probably the biggest issue in all of this is the negative feedback loop occurring. As the Fed raises rates, other countries can’t do the same since their economies are already in a much weaker position, so the dollar gets stronger, hurting other economies more. This is a potential black swan. With currency in general, how one currency is priced in comparison to another is very difficult to moderate effectively due to the complexity, so getting control of something spiraling can become harder and harder over time.

This sounds great for US consumers, but those dependent on their investment returns could be impacted more than others. The US Based S&P 500 companies make 40% of their revenues outside the US.1 If those companies get less foreign business, their revenues and stock prices will be affected accordingly.

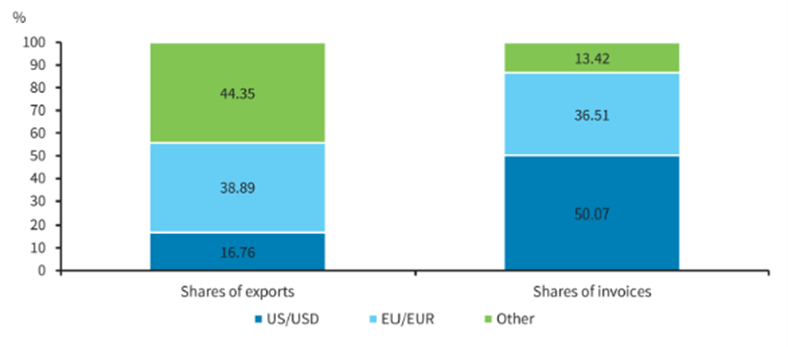

Most trades are invoiced in USD, despite US taking a smaller share in global trade

Note: The figure represents trade and invoice data for the top 20 largest exporters that capture 60% of world exports. The presented data are for 2018. Source: Boz et al., 2020 dataset, Barclays Research

What To Look For

Given the current setup globally, we expect the dollar to remain strong as long as the Fed keeps raising interest rates. If we find that the Fed pauses further rate hikes or begins to lower rates again, the dollar should be expected to weaken. The real question here is when that happens, what will be the ripple effect and how much damage will be done globally? The G20 Summit in November should provide some further clarity from global leaders to see if any coordinated response could be achieved, but experts are unsure if they could achieve a coordinated plan and have any meaningful effect. Until we see a change in direction for the dollar’s strength, we will be watching how other countries’ currencies are moving to better understand the ripple effect.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.