Seasonality of the Stock Market

Source: Carson Investment Research

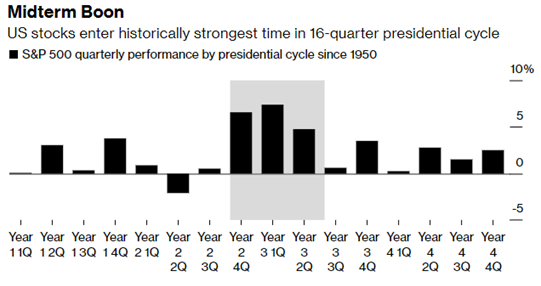

Political Cycle

The effect that grabs the most headlines is the anomaly of the midterm election on the market and the last two years of each presidential cycle. As elections grow closer, the markets react as the current administration looks to bolster its reelection chances. At the same time, the incoming party makes promises that boost the morale of investors alike. Looking at the bar graph above, we see that the following three quarters are historically strong.

What’s more interesting is, according to Bespoke Research, “historically, year two of the Presidential cycle (this year) has been the worst for the S&P 500, while year three (next year) is historically the best. Year two of the election cycle has seen the S&P gain just 56.5% of the time, but year three has seen the S&P gain 82.6% of the time.”1 While every year brings challenges and new issues, this historical increase in probability of positive returns is something to pay attention to.

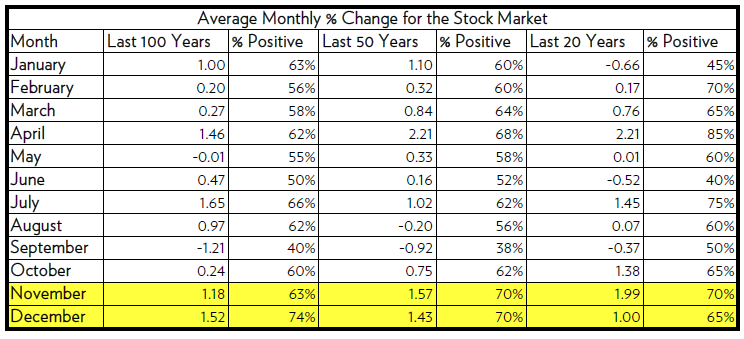

End of Year

Looking deeper, the end of the year itself tends to be good for investors. In the chart below2, historically, November & December have some of the most substantial one-month returns and the highest chance of those returns occurring if we look historically.

As seen in the chart above, the monthly returns for November and December were positive 70% of the time, with average returns of 1.57% and 1.43%, respectively, for the past 50 years.

Other Anomalies

In addition, large pensions and institutions tend to do all their rebalancing at quarter-end per mandate; these large movements can cause inadvertent upward or downward pressure on various asset classes depending on what they buy or sell. This coincides with year-end mutual fund rebalancing as portfolio managers look to balance out gains and losses as the year ends. This level of activity can lead to positive market performance as they all try to find ways to finish their reporting period on a high note.

Finally, and if you’re still reading, there is something called the January effect. This is when investors who sold positions in the prior year to capture tax losses buy back their securities at the start of the new year. This increase in volume puts further upward pressure on the stock market. Last year’s market losers become this year’s winners.

When measuring market trends in years, positive fundamentals push markets higher, and declining fundamentals drive them lower. When measured over shorter periods (days and months), the markets are influenced by many things, and the seasonal effects mentioned above happen more often than not. Still, they tend to be minimized over time.

Andrew Cialek, CFP®

1, 2 Bespoke Premium Research

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.