The last time treasury yields were this high, neither the iPhone nor Google Search existed. The Fed’s rate increases bring us back to a more traditional interest rate environment. Short-term interest rates are generally tied to the Federal Funds rate, which consequently impacts mortgages, credit cards, lending, and directly impacts the yield on short-term US Government securities.

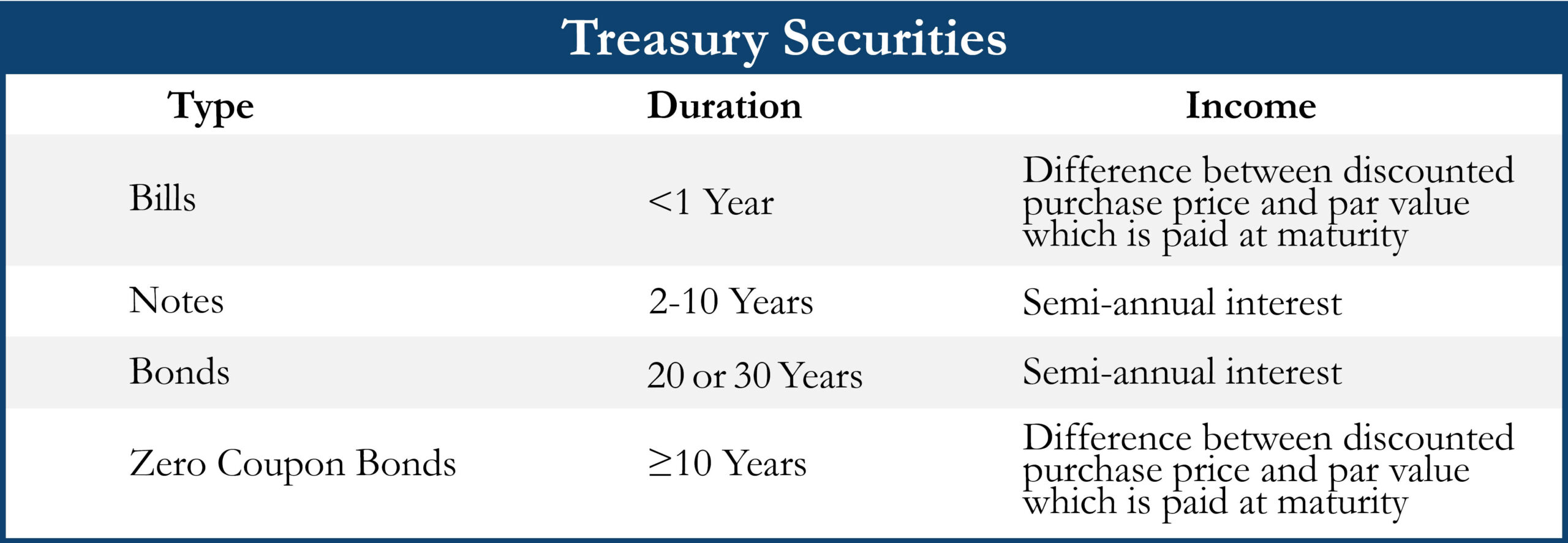

Treasury securities are the safest investments as they are backed by the full faith and credit of the US Government. There are several different methods to invest in Treasury securities. Investors can buy bills (up to 1 year), notes (2-10 years), bonds (20 or 30 years), or zero-coupon bonds. While each has its unique advantages and disadvantages, they all have some appeal in today’s market environment. Yields on savings accounts continue to hover around all-time lows, while the yields on these Treasury securities are currently much higher. This higher yield, coupled with the federal guarantee, presents a rare opportunity for higher returns with no additional risk.

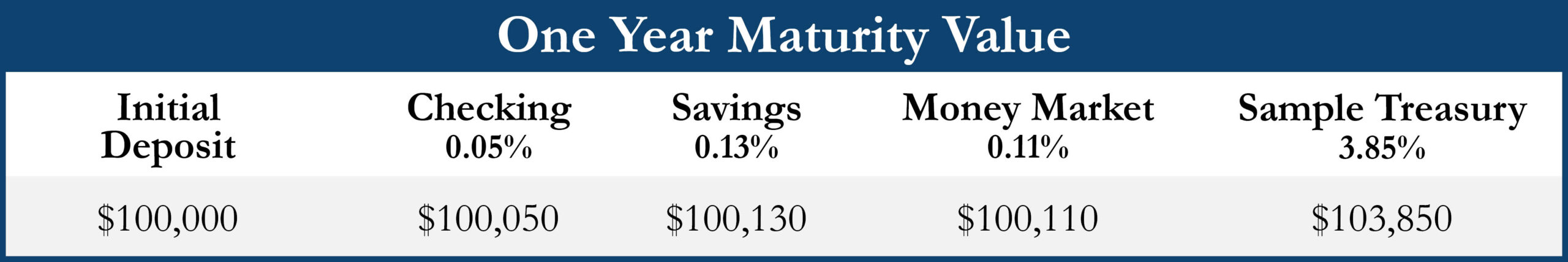

As an example, at the writing of this article, a one-year Treasury bill is yielding approximately 3.85% compared to the national average interest rates for a savings account of 0.13%, checking account of 0.05%, and money markets at 0.11%. If a deposit of $100,000 were made into a checking account, the interest accumulated would be $50. However, if the same $100,000 were invested in a Treasury security, the interest accumulated over the same amount of time would be $3,850.

Bonds are an important piece of a diversified portfolio, which we actively incorporate on behalf of our clients. The steady income from bonds helps offset the volatility of equity prices. Another advantage of investing in Treasury securities is the income earned is taxed at the federal level and exempt at the state and local levels.

There tends to be a silver lining even during times like these. We will continue to look for and take advantage of these opportunities for you.

Sources:

Business Insider, Personal Finance

Principle Wealth Partners LLC (“PWP”) is an SEC registered investment advisor. Advisory services are only offered to clients or prospective clients where PWP and its representatives are properly licensed or exempt from licensure.