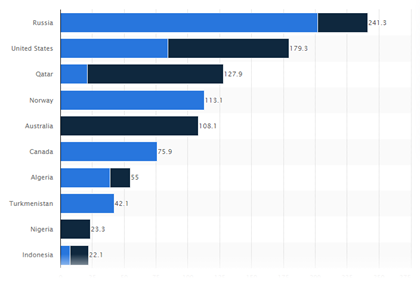

Blue = Pipeline exports; Black = Leading Natural Gas (LNG) Exports, Source: Statista.com

There is an ongoing energy crisis in Europe. In addition to high inflation and a depreciating currency, the war in Ukraine has disrupted Europe’s natural gas supplies from Russia and has created a larger problem than originally anticipated.

Russian natural gas supplies accounted for 8% of the EU’s energy usage and 40% of EU gas imports. They also contributed upwards of 20% of the EU’s oil imports.1 The problem Europe is experiencing is on the Liquid Natural Gas (LNG) side. Oil is fungible, so it can easily be moved around and shipped, making global prices more competitive and dynamic. LNG on the other hand is mainly transported through pipelines which cannot be built quickly. This is important because while the US does export a lot of LNG overseas, it has to pump it into tankers, ship it across the ocean and then convert it back to pipelines to transport to consumers, a cumbersome and slow process. Currently, Russia is the largest global exporter of Natural Gas, but the US is the second largest globally and most of our export total comes from this slower LNG shipping compared to Russia exporting directly to Europe via pipeline. Most of the US’s LNG exports go to Europe, so this overseas transport adds to the supply crunch as Russian supplies are disrupted.2

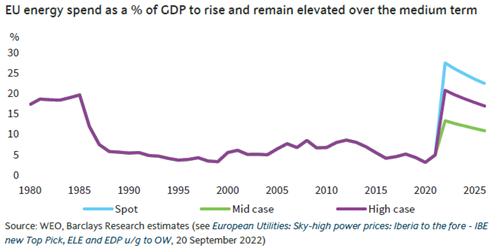

Currently, the main pipeline supplies come from Russia to parts of Europe. Recently, Russia shut off the Nord Stream 1 pipeline to Europe, citing maintenance issues, but it was later revealed they intended to keep the pipeline shut off until western sanctions were removed against Russia. This type of supply restriction devastates the European economy as many depend on the LNG from Russia for personal and business use. Since few available pipelines are built in Europe, the area is dependent on Russian imports for fuel. Building and constructing new pipelines from other areas could take years, so Europe is seeing higher prices. To put the price disparity in perspective, imagine paying $22/gallon for gas in the US. This is what Europe is feeling currently.

Natural gas usage increases during European winters, so this supply issue is becoming bigger. European officials will need to dip into the reserve storage capacity to prevent further rationing of energy usage throughout Europe this winter. The EU has asked member countries to reduce their natural gas usage by 15% until March to help cope with this. If the countries can hit this target reduction, the EU should be able to avoid further crisis and rationing according to Barclays internal research.3

While avoiding further crises is a good thing, companies in Europe are looking ahead and trying to decide if they are in the best place to be for the future. With higher natural resource costs, companies will look to find cheaper locations to produce and run their businesses as they may not be able to sustain prolonged price increases forever without passing it through to the consumer, which may likely cause further demand destruction.

1Barclays Special Report: Burning Bridges

3Barclays Internal European Energy Usage Report

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.