Key Takeaways:

- Investors face competing goals and numerous risks when it comes to retirement planning, and it’s important to set priorities

- You need enough money to last through retirement, which may last longer, and cost more than you think, with an asset allocation designed to meet your goals and keep up with inflation

- Know your sources of assets and income before your retirement, and plan for a sustainable withdrawal strategy that helps preserve your funds

We base retirement planning on the concept of “financial security” — the peace of mind that results when retirees feel confident that they will attain all of their future financial goals.

The roadmap to financial security can be broken down into four steps.

1) Determine your retirement goals

2) Understand your risks

3) Assess available financial resources

4) Develop a plan to achieve goals and mitigate risk

Step 1: Determine Your Retirement Goals

To achieve financial security, investors must first establish and prioritize their unique goals for retirement. This provides them with a starting point for the planning process, from which they can then determine the appropriate allocation of resources toward meeting these goals. We group common goals, along with associated expenses, as follows:

Most retirees should have a clear strategy to meet basic living expenses first and foremost, but after that, each investor may prioritize other goals, such as travel and entertainment versus longer-term legacy objectives, differently. Identifying the goals that matter most and feeling confident in the ability to meet them will be the primary driver in achieving financial security.

Step 2: Understand Your Risks

Before you can begin building a practical roadmap to financial security, you’ll need to understand—and integrate into your plan—five key risks that could limit your success in reaching your retirement income goals:

Longevity

When thinking about how long you might need income, many people tend to think in terms of life expectancy. But, statistically, half of the population will live longer than expected, which means that those individuals will underestimate how long they will need their savings to last. A more realistic approach is to plan for longevity—a long continuance of life. As a result, you should consider planning for income well into your nineties to reduce the risk of running out of money late in life.

Health Care Expenses

Longer life spans, rising medical costs, declining employer-sponsored medical coverage, and possible shortfalls ahead for Medicare all add up to make meeting health care expenses a critical challenge for retirees and pre-retirees alike. In addition, retirees will need to fund the portion of their health care coverage not covered by Medicare, such as co-pays, deductibles and over-the-counter drugs, especially if they do not have other coverage through an employer.

Asset Allocation

A significant imbalance favoring either conservative or risky investments can expose you to risk, which may prevent you from meeting your long-term retirement goals. Too

aggressive a portfolio can increase your vulnerability to market volatility, while a portfolio that’s too conservative may not outpace inflation, thereby increasing the risk that you will outlive your assets. An appropriate asset allocation strategy seeks to strike a balance between conservative and aggressive investments and aligns with an investor’s specific situation, risk profile, time horizon and other important criteria.

Inflation

Inflation, which is a rise in the general price level and corresponding loss of purchasing power, can chip away at retirement income in two ways. First, it increases the future cost of goods and services, and second, it potentially erodes the value of assets set aside to meet those costs. What many do not realize is that even a low level of inflation can have a significant effect on purchasing power. For example, a 2% rate of inflation will result in an almost 40% drop in purchasing power after 25 years, all other factors held constant. That’s why it’s so important for your investment portfolio to outpace inflation to maintain expected purchasing power.

Excess Withdrawal

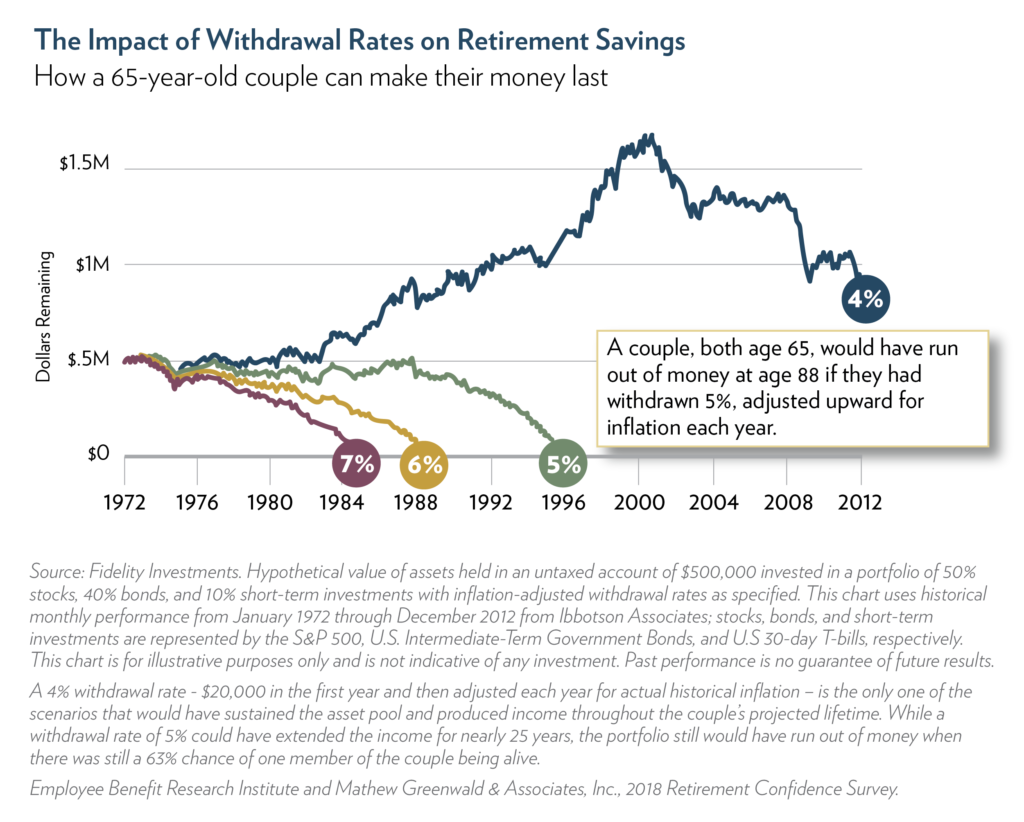

The withdrawal rate on your investments can dramatically affect how long your money will last, and it’s a variable that is largely in your control. The chart below shows what might have happened to the retirement savings of a couple who retired in 1972 at the age of 65. It takes a balanced portfolio of $500,000 and tracks it over the period between 1972 to 2012 using a range of inflation-adjusted withdrawal rates.

As you can see below, had the couple withdrawn 7% of their assets each year they would have run out of money by the age of 77 in 1984. A withdrawal rate of 5% would have lasted them until the age of 88, when there was still greater than 60% chance one of them would have still been alive. However, reducing withdrawals slightly more to 4% would not only have preserved their assets until the ripe old age of 105, but also allowed them to pass along more assets than they started with in 1972 to their heirs.

Step 3: Assess Available Financial Resources

We group the resources retirees can use into three primary categories:

- Guaranteed income: Nearly all retirees will have some form of guaranteed income that includes a government- or employer-provided defined benefit pension.

- Liquid assets: Liquid investment assets include defined contribution assets or any other savings for which the retiree controls the investment decision. Investment strategies are the primary levers that determine the outcomes of these assets. They include asset allocation—how the portfolio is invested, and spending policy—how portfolio assets are converted to income throughout retirement.

- Additional resources: These can supplement guaranteed income and liquid assets. They include insurance, work, and housing wealth.

Step 4: Develop a Plan To Achieve Goals and Mitigate Risks

While the planning process can seem daunting, we can make the retirement planning process smoother and easier by working alongside of you each step of the way. Here’s how the process works:

Identify your income needs in retirement: Create a realistic budget based on your desired lifestyle and determine which of your expenses are essential and which are discretionary.

Consider all sources of income: Review all the income and assets you have to fund retirement and decide when might be the optimal time to begin Social Security benefits or structure any defined benefit payments.

Compare income and expenses: Earmark predictable sources of income to cover essential expenses and assign less predictable sources to fund discretionary expenses.

Allocate your investment portfolio: Invest to meet growth and income needs—while taking into account such factors as your age, withdrawal rates, and risk tolerance. We will work closely with you to monitor your plan regularly.

Periodically review your plan: Your Principle Wealth advisor will work closely with you to monitor your plan regularly.

Financial security is central to everyone’s retirement. Having a plan that prioritizes your goals and considers your risks and resources can help you retire with confidence. This, combined with ongoing oversight and evaluation, gives you the best chance to achieve financial security in retirement — and we strive to simplify your planning to give you peace of mind. For more information, view our Retirement Planning Webinar and contact us

All the best

John Hannigan