Key Takeaways:

- The markets have been on a wild ride for most of 2020, with robust gains and historically high volatility

- The broad market may appear overheated, but opportunities have been created in out-of-favor sectors and non-traditional asset classes

- Investors’ flight to cash this year may be another teachable moment on the pitfalls of emotion-driven investing

The Stock Market Rebound of 2020

The markets have been on quite a rollercoaster ride this year. We began with the S&P 500 index reaching a historic high in mid-February. The country then went into quarantine in March, shut down 95% of the economy and entered a bear market with a decline of 34% in just one month. In April, the index was back up again, posting the best monthly return in over 30 years, bolstered by fiscal and monetary stimulus, and coupled with expectations of an economy re-opening. By August, we had surpassed the February highs. But after further downside volatility in September, the index ended the quarter battered, albeit still up a healthy 10% for the year.

The Variance of Stock Performance

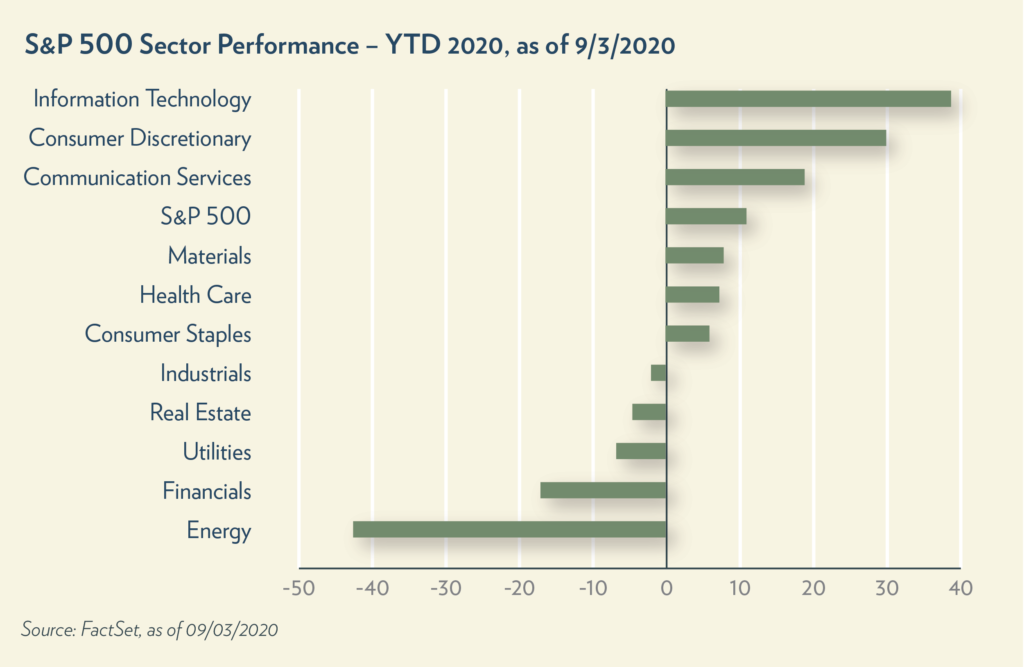

With the equity markets now near all-time highs, there is legitimate concern about investing in an asset class that appears to have run ahead of itself. But when you look under the hood of the S&P 500, not all industry sectors have performed the same. In fact, as the chart below indicates, the variance of return between the best and worst performing sectors for this year is a staggering 80%, with Information Technology up almost 40% and Energy down over 40%. When such a barbell of returns exists, history teaches us that there is opportunity for investors with an understanding of fundamentals to still find bargains in the equity markets.

Convertibles: Alternative Asset Class Opportunity?

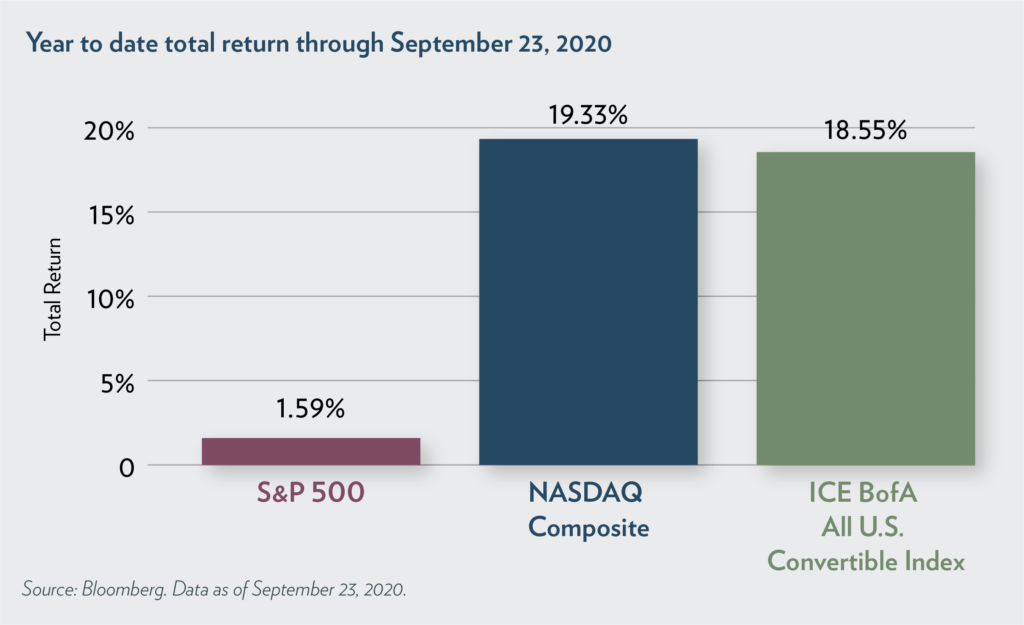

In addition to opportunities in selected sectors, stock investors may also want to consider alternative asset classes; one example has been convertible bonds. Convertible bonds are a fixed income corporate debt security that yields interest but can be converted into equity shares. Historically, convertible bonds have produced equity-like appreciation while providing better downside protection than traditional equities. As the table below shows, convertible returns did that and more. They far surpassed the gains of the S&P 500 so far this year and were more in line with the robust advance of the tech-heavy NASDAQ. Also, during the recent selloff of September, while the S&P 500 fell 9.5%, convertibles lost just 5.45%.

Cash Positions

Emotion in volatile times can be an investor’s worst enemy. After the onset of the pandemic, many fearful investors fled to safe-haven investments, like cash. In fact, cash levels are reaching the peak set in the financial crisis of 2008. The personal savings rate soared from 8% in February 2020 to 33% in April, all of this occurring while money market rates plunged and the stock market rebounded.

Final Thoughts

Patient equity investors have enjoyed robust gains this year, but the ride has been bumpy, to say the least. Each quarter has introduced new and unique circumstances that have tested investors’ resolve and commitment to their long-term strategies. Many of those who have reacted emotionally have ended up with significant missed opportunities. Our job is to help you avoid emotional decision-making and find opportunities in market dislocations. As always, please reach out if you have any questions.

Julina Ogilvie