Key Takeaways:

- As the presidential election approaches, investors will be bombarded with emotionally charged predictions on the impact of potential outcomes

- In the past, U.S. stock market returns have typically correlated with the presidential election cycle, with weak returns in the first two years of a term and strong returns in the second half of the term

- Taking a balanced, long-term view that focuses on the fundamentals, such as the economy, interest rates and corporate earnings, will help investors avoid common behavioral biases

In a vibrant democracy like ours, the months approaching presidential elections are typically full of strong opinions, predictions and heightened emotions. Since it does not look like this time around will be any different, anxious investors should prepare to look away from the potential onslaught of information and news.

November’s Election: What are the Odds?

Since 1912, history shows that an incumbent president is re-elected three out of four times except when there is a recession in the two years prior to election day. This led oddsmakers to give Trump a better-than-even chance of winning the election as recently as February of this year, given that the longest economic recovery in U.S. history had continued unabated through his administration.

But then came COVID-19, bringing with it one of the sharpest recessions and highest levels of unemployment since the Great Depression.

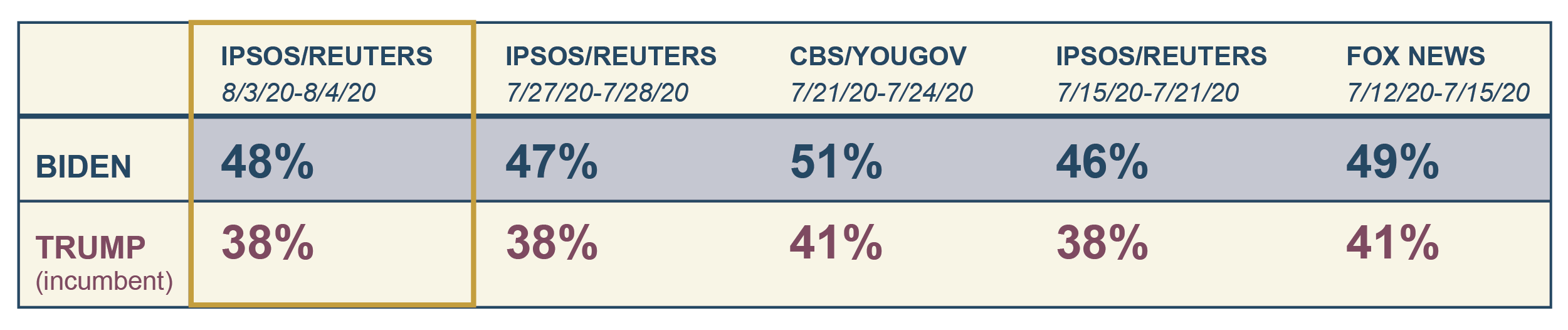

Most polls shifted in favor of Biden and the possibility rose of a Democratic sweep of the White House and Congress in the fall. Admittedly, three months is a long time in politics and the picture could change, but at the moment, momentum appears to be in Biden’s direction.

The Noise and Uncertainty

In a recent survey, RBC Capital Markets asked 107 institutional equity investors “what keeps you up at night?” For nearly three-quarters of the respondents, the biggest worry (topping everything from a second wave of COVID-19 infections to renewed U.S.-China trade tensions) was the November elections.

Sixty percent of these respondents viewed Biden as bearish for the stock market and Trump as a bullish signal. This perception may be driven by the prospect that Democratic control of the presidency and Congress could potentially institute a substantial change in tax and regulatory policy.

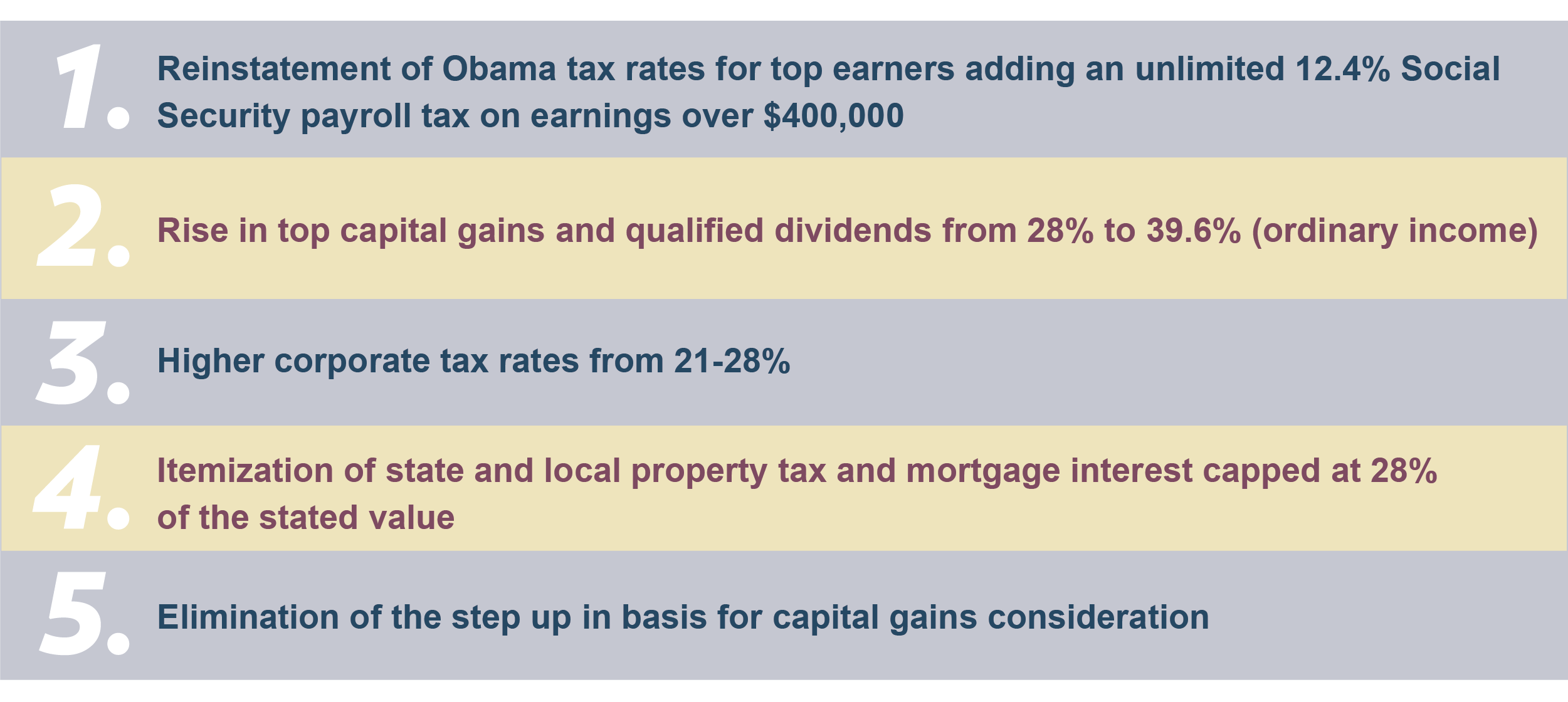

To this point, Joe Biden recently unveiled his “Buy American” plan which included the following:

The nonpartisan Tax Foundation concluded the Biden tax plan could potentially reduce the size of the economy by 1.5% in the long run, and Goldman Sachs announced that the plan may lower S&P 500 earnings per share from $170 to $150 next year.

Market Performance and the Presidency

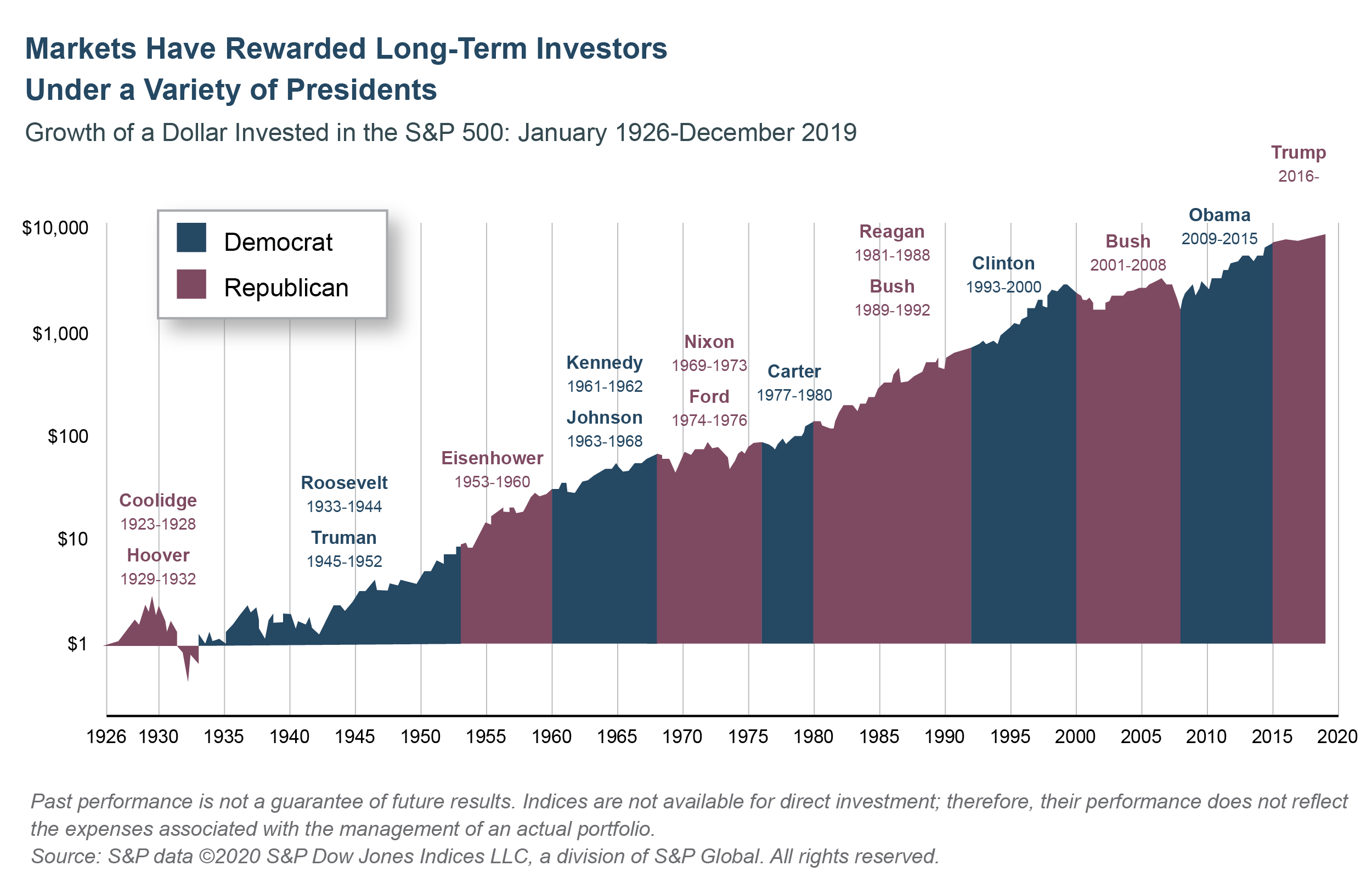

While we understand the concerns raised in the RBC Capital Markets survey, it would be presumptuous to assume that Democratic presidents are overall bearish for the markets while Republicans are bullish.

Historically, as the chart below shows, markets in the modern era have advanced and declined under both Democrats and Republicans.

In fact, among the presidents since Eisenhower, Democrats Obama and Clinton posted the strongest percentage stock market gains in their first terms and among presidents that have served the full eight years in the White House. Republicans Nixon and George W. Bush, in contrast, occupied the Oval Office through the most challenging markets in the period.

Regardless of party affiliation, there is some correlation of stock market returns with the “Presidential Cycle” itself. Stock market returns in the first two years of a president’s term have generally been below average, while the latter two years have typically been above average. In the early years of an administration, it may take time for a new president’s agenda and policies to have an economic impact. But past the halfway mark, thoughts may be turning to re-election, encouraging the incumbent to implement fiscal and, in the past, monetary stimuli intended to give the economy a bump, positively affect the markets and support re-election prospects. In fact, until COVID-19 hit in the first quarter of 2020, the current Presidential Cycle was on track to follow the trend, with weak 2018 performance followed by strong performance in 2019. But after the full four years, the difference in average returns is virtually gone. When you look at performance over the full four-year term, in fact, the difference between the two parties, 8.6% for Republican presidents versus 8.8% for Democrats, is minimal.

It could be that mid-term elections are a factor in the difference between 2- and 4-year returns, depending on the outcome, and may either support the president’s agenda or counterbalance it. On the other hand, this could also be proof that fundamental factors including, earnings, interest rates, employment and GDP data and trends, as well as the tendency of monetary policy to revert to the mean are what truly drive long-term market performance.

The critical point for investors to remember in this election season is to keep political bias and emotion out of their market judgments. While outside events like the presidential election can create emotion and impact the stock market in the short term, what really drives stock returns over the long term are the fundamentals: corporate earnings, interest rates, and economic growth.

What Then Should Be Considered to Influence the Economy?

According to J.P. Morgan, in the long term, presidential election outcomes can influence the economy when major reforms are implemented that impact specific sectors or regions or change expectations for growth and inflation. However, it states, there are two considerations in this election to consider.

- The president traditionally has limited ability to pursue large policy changes without congressional consent, outside of foreign affairs and trade negotiations. It really comes down to the likelihood that they can enact their proposals. As high degrees of partisanship seem to be driving legislation in more recent years, high-impact proposals seem more likely to be adopted only if one party controls all three (White House, Senate and House).

- There are many areas where the presidential candidates differ, including foreign policy, energy policy and tax and regulatory policy to name a few. However, we expect the battle against COVID-19 to dominate this environment and both parties appear to support the stimulus and will pursue this until the health crisis is mitigated. During this pandemic, it would be unlikely to advance any policy unless it was viewed as stimulative to the economy.

The Media: Emotions and Biases

In an election year, interested parties, such as media pundits, are known to take advantage of our heightened emotions and use them to influence our thinking. In this environment, it is critical to maintain a reflective stance and be aware of common biases that can influence our behavior and cloud or misdirect our thinking. For example:

- Confirmation Bias: Particularly in stressful and confrontational times, such as election periods, we naturally tend to seek information that confirms our pre-existing beliefs. This creates a “rigidity” in our viewpoint and a reluctance to establish a common ground in a discussion or solution.

- Coverage Bias: This is a form of media bias where certain politicians or topics are covered disproportionately to others. This can mislead consumers by omission, forcing them to make misjudgments from lack of balanced information.

- Concision Bias: Politicians and/or media selectively focus on aspects of information that are easy to get across. It is common to see sound bites taken out of a speech without understanding the context of the entire discussion. This does not help with the increased polarization that we have seen in this nation.

We remain focused on market fundamentals

As important as an election is, our political views should not dictate our investment decisions. Rather, we should rely on an understanding of historic trends, combined with an objective assessment of market drivers and outcomes, both political and otherwise. As history has demonstrated, staying invested for the long-term translates to asset growth over time.

We remain focused on helping you, our clients, achieve your life and financial goals. If you have questions or think we can be of assistance to your friends or family members, we are here to help.

Be well,

Julina Ogilvie