One of the key equity themes at Principle Wealth Partners in Madison, Connecticut, is growth at a reasonable price, or GARP for short.

Andrew Cialek, its director of finance and analysis, points to this style of investment having a strong track record of outperforming major US equity indices on both an absolute and risk-adjusted basis. Another attraction is that GARP does not subject investors to sector or size constraints, nor does it force them to pin their colors to the growth or value mast.

The firm uses two investments to gain exposure to this theme. T Rowe Price Capital Appreciation is one of its favorite active funds.

‘It is a flexible allocation fund where the equity exposure is focused on GARP and high return on invested capital,’ says Cialek. ‘David Giroux and his team have consistently done a phenomenal job with security selection and risk management, creating superior returns through various phases of the business cycle.’

For tax-sensitive accounts, the firm prefers the Invesco S&P 500 GARP ETF, a relatively concentrated portfolio of 75 securities that rank highest in the underlying index’s growth and quality formula. The portfolio is rebalanced and reconstituted semi-annually.

Principle’s average balanced portfolio has 7.5-10% of its equity exposure in GARP strategies.

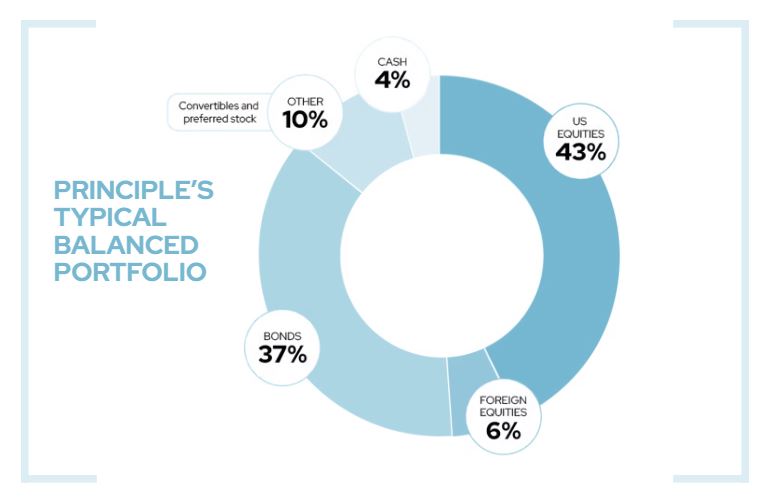

At a headline level, half of a balanced portfolio is typically in equities, with 43% in domestic and 6% in other developed and emerging markets.

‘We will look to add exposure to foreign equities if the US dollar continues to weaken, interest rates start coming down, and foreign economic and equity fundamentals improve,’ says Cialek.

‘Until then, we firmly believe that the US is the best place to invest to capture exposure to both US and foreign consumers as companies here have anywhere from 30% to 50% of revenue exposure coming from foreign dollars.’