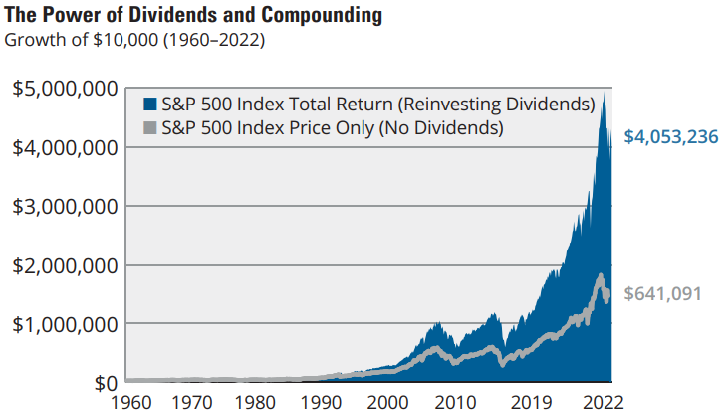

The Power of Dividends

Source: Morningstar and Hartford Funds, 12/22

Dividend reinvestments are similar to receiving a company match in your 401(k). You are acquiring more shares and more value without having to make additional contributions, as future purchases are made using the company’s money.

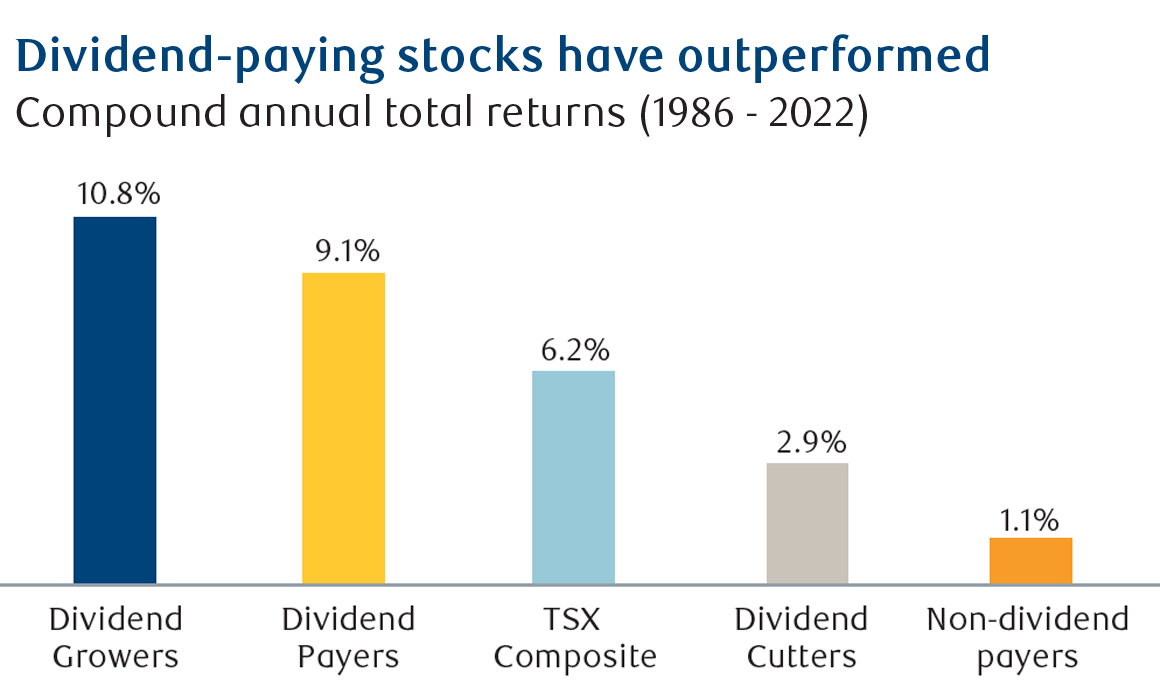

Source: RBC Capital Markets Quantitative Research, RBC GAM. Performance from October 1986 -December 2022. Equal weighted equity only total return indexes.

History shows that companies that pay dividends and consistently grow their dividends have outperformed non-dividend payers over time. We have a preference for consistent dividend growers because they have a focus on positive cash flow, business growth, and a commitment to sustainable shareholder return.

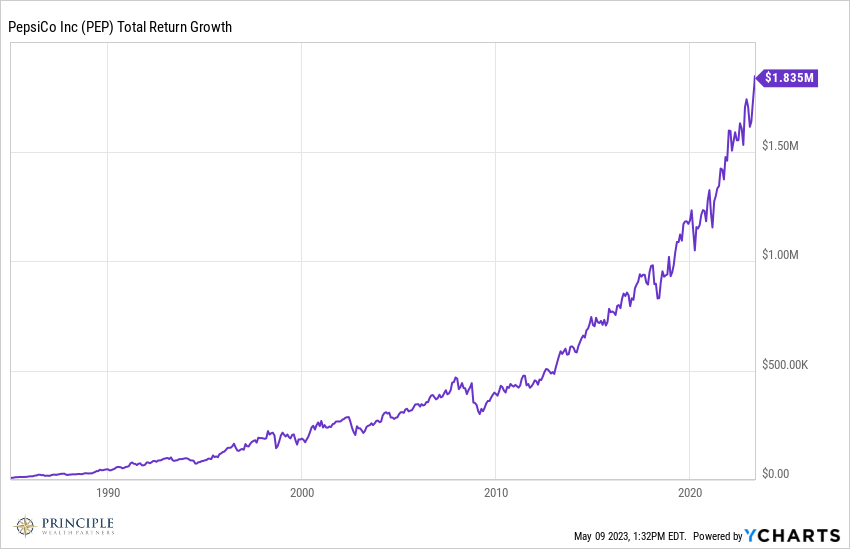

Let’s look at a specific example to illustrate the power of compounding dividends. The chart below reflects the results of a $10,000 investment in Pepsi shares in 1985. The single $10,000 investment would be worth close to $2 million today if you reinvested all the dividends without any additional purchase. Fifty five percent of this return came from dividends! In 2023, the annual dividend payment for this $10,000 investment is approximately $45,000. That’s powerful.

We believe dividends and the power of compounding are foundational principles of successful investing. We hope that after reading this, you have a better understanding of why dividends play a critical role in your portfolio.

Andrew Cialek, CFP®

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.