Federal Finances: A Quick Glance

With the recent media obsession surrounding the debt ceiling, we thought it would be helpful to take a brief look at the finances of the largest business in the world, the United States Government. The Government has income, assets, expenses, and a budget. Below are a few infographics highlighting some key data points.

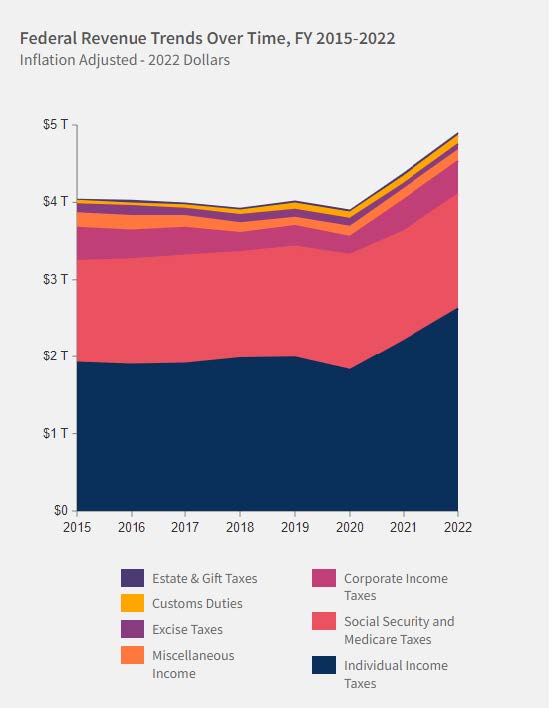

The Government’s income is primarily comprised of individual income tax and withholdings from Social Security and Medicare (Employment Tax). In total, the Government brought in about $4.9 trillion dollars of income in 2022 (fiscal year ending 9/30).

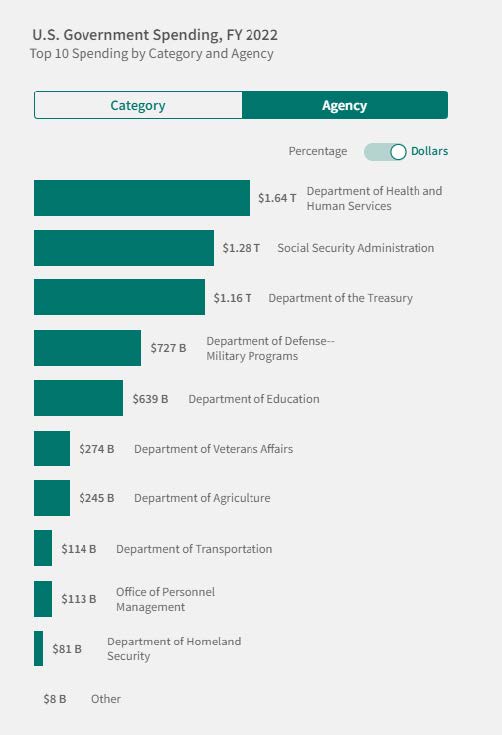

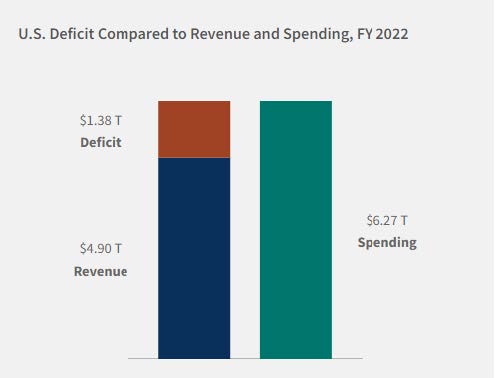

Total expenses in fiscal year 2022 totaled $6.27 trillion dollars. The majority of the money was spent on mandatory expenses like Social Security, Medicare, national defense, and interest on U.S. government debt. The difference between income and expenses created a $1.38 trillion dollar deficit.

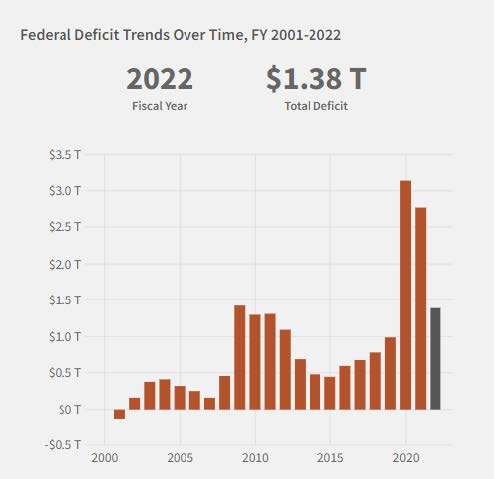

Annual deficits have become the norm. As seen in the chart below, the U.S. Government has had an annual deficit for 21 consecutive years.

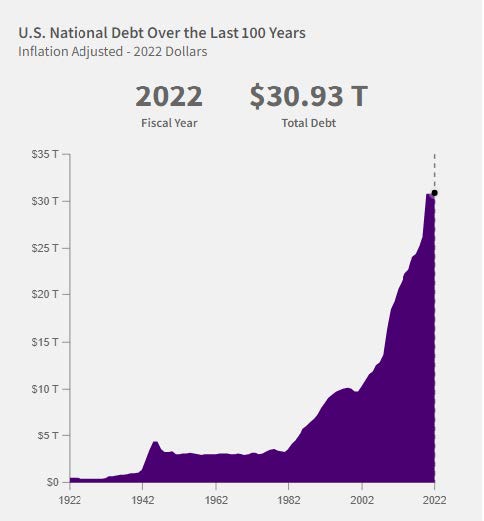

These annual deficits have created a massive mountain of debt. A debt that is rapidly compounding. We estimate that if the current spending rate continues and interest rates remain elevated, the interest on the debt will become the Government’s single largest expense within a decade.

Will higher taxes help? A 100% tax rate on all personal income would only cut the debt in half over the next 36 months. The best way to save money is to reduce spending.

Ultimately, our political leaders will have to lay out a strategy to deal with this rapidly compounding expense. Don’t hold your breath.

Andrew Cialek, CFP®