Key Takeaways:

- Behavioral biases can cloud decision-making – especially during stressful times

- Awareness of biases is the first step in controlling them

- A focus on the desired outcome can go a long way toward avoiding emotionally driven pitfalls

As Meir Statman, the Glenn Klimek Professor of Finance at Santa Clara University and one of the leading thinkers in behavioral finance argues, “Investors are ‘normal,’ not rational.”

Investing should be a rational exercise driven by clear goals and an objective, data-driven view of the markets. But we are human, and our decision-making is clouded by emotions especially during times of stress when an overload of information is coming at us from every direction. During the current period of heightened health, social and financial turmoil, knowing how investors sabotage themselves, can help us control our behavior and follow a course of action that better serves our life goals.

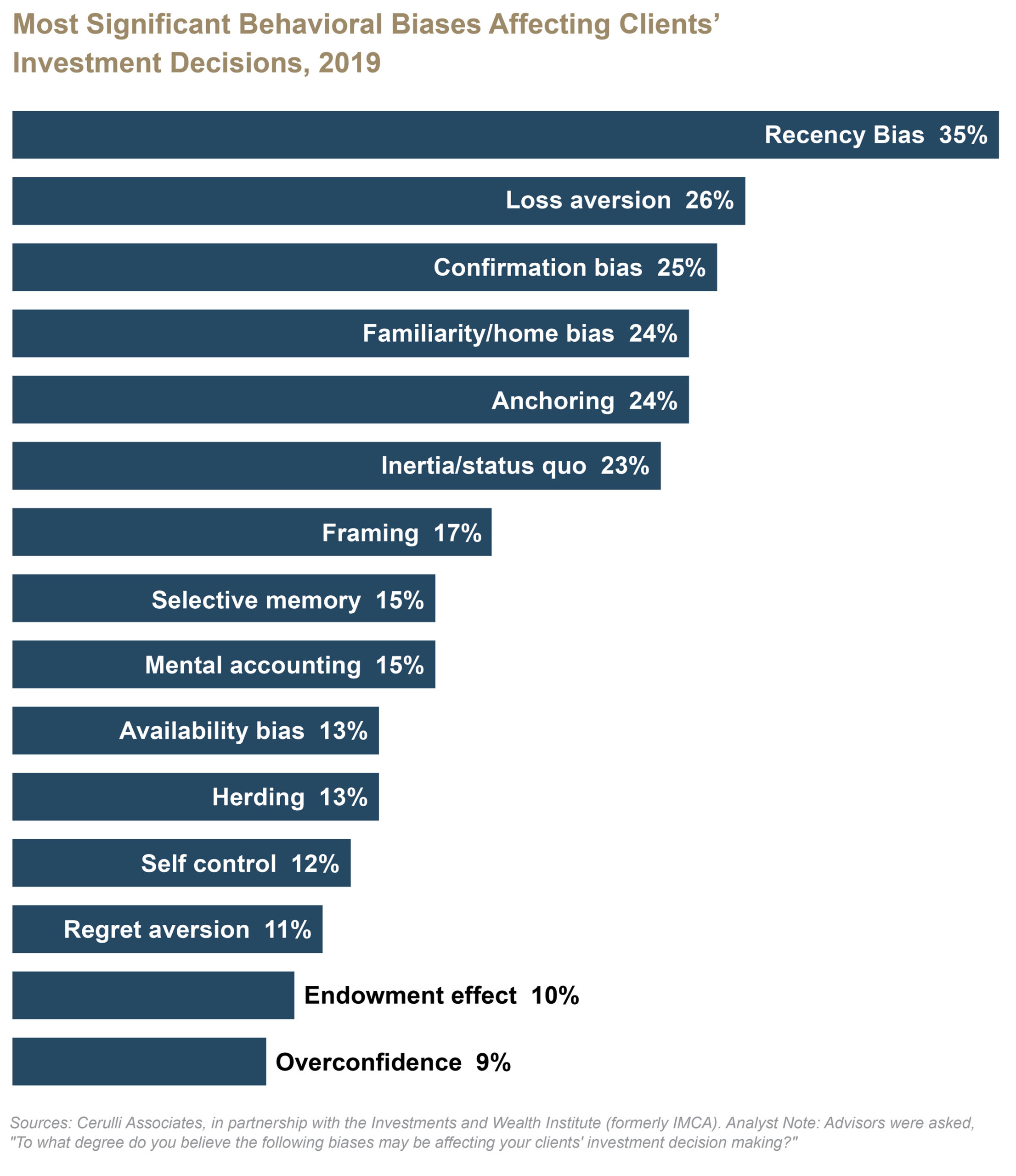

The chart below shows the results of a 2019 survey of financial advisors conducted by Cerulli Associates on behalf of Charles Schwab. In the survey, advisors identified the behavioral biases that they recognized most often in their clients.

Recency Bias

At the top of the list, by a wide margin, is recency bias. Recency bias is the tendency to be overly influenced by recent news or events. This is particularly common among investors when markets are near their peaks or troughs. Investors mistakenly believe that because investments have been rising or falling recently that they will continue in the same direction for the indeterminate future.

Acting on recency bias can cause significant harm to an investor’s portfolio. ‘Chasing returns’ as this behavior is often called, can lead investors to buy at the peak or sell at a market bottom. For example, panic selling in March, in response to the current pandemic, would have caused an investor to miss out on the market rebound in April and May.

Loss Aversion

In “Confessions of a Winning Poker Player,” well-known gambler Jack King said, “few players recall big pots they have won, strange as it seems, but every player can remember with remarkable accuracy the outstanding tough beats of his career.” This colorful quote captures the all too common bias of loss aversion, next on the list of behavioral biases. Extensive testing, by leading behavioral theorists, has shown that most people prefer avoiding losses to acquiring equivalent gains. In other words, for most people, it’s better to not lose $5 than to make $5.

Investing on this bias can have negative effects on investment outcomes. For example, a particular stock holding may be down 20% for legitimate reasons. So, the best decision may be to realize the loss and move on to better opportunities. Unwillingness to accept the loss, however, may lead an investor to hang on and even double down on a losing stock in the hopes of breaking even. Unfortunately, this aversion to loss grows as the stakes rise, making it difficult to weigh risk accurately when it counts the most.

Confirmation Bias

The third most common bias among investors is confirmation bias. People are naturally drawn to information or ideas that validate their existing beliefs or opinions. Many cable TV viewers, for example, choose to watch the news channels that represent their political views, avoiding those with commentators on the opposing side of the political spectrum.

Investors with confirmation bias tend to select financial news that supports their preset investment beliefs and discounts information that leads to contrary positions. Naturally, this leads to suboptimal decisions if their personal beliefs diverge from objective reality.

The biases discussed above impact the way we select and process information and ultimately how we act. In considering our investments it is important to be aware of our biases and counterbalance our fears and anxieties by holding them up to critical inspection. We should try to determine if we are acting rashly or favoring rational decisions, based on a wealth of data, weighed in the context of our long-term plans.

Watching the News Heightens our Biases

Paying too much attention to the financial media and financial news can perniciously reinforce many of our natural biases. By its nature, the “news” overemphasizes the relevance and urgency of current events at the expense of a more balanced and realistic longer-term perspective. The quest for ratings has driven the financial news to adopt the histrionic tones of popular programming, which promotes often simplistic and hyperbolic viewpoints, whether they are dire or ebullient.

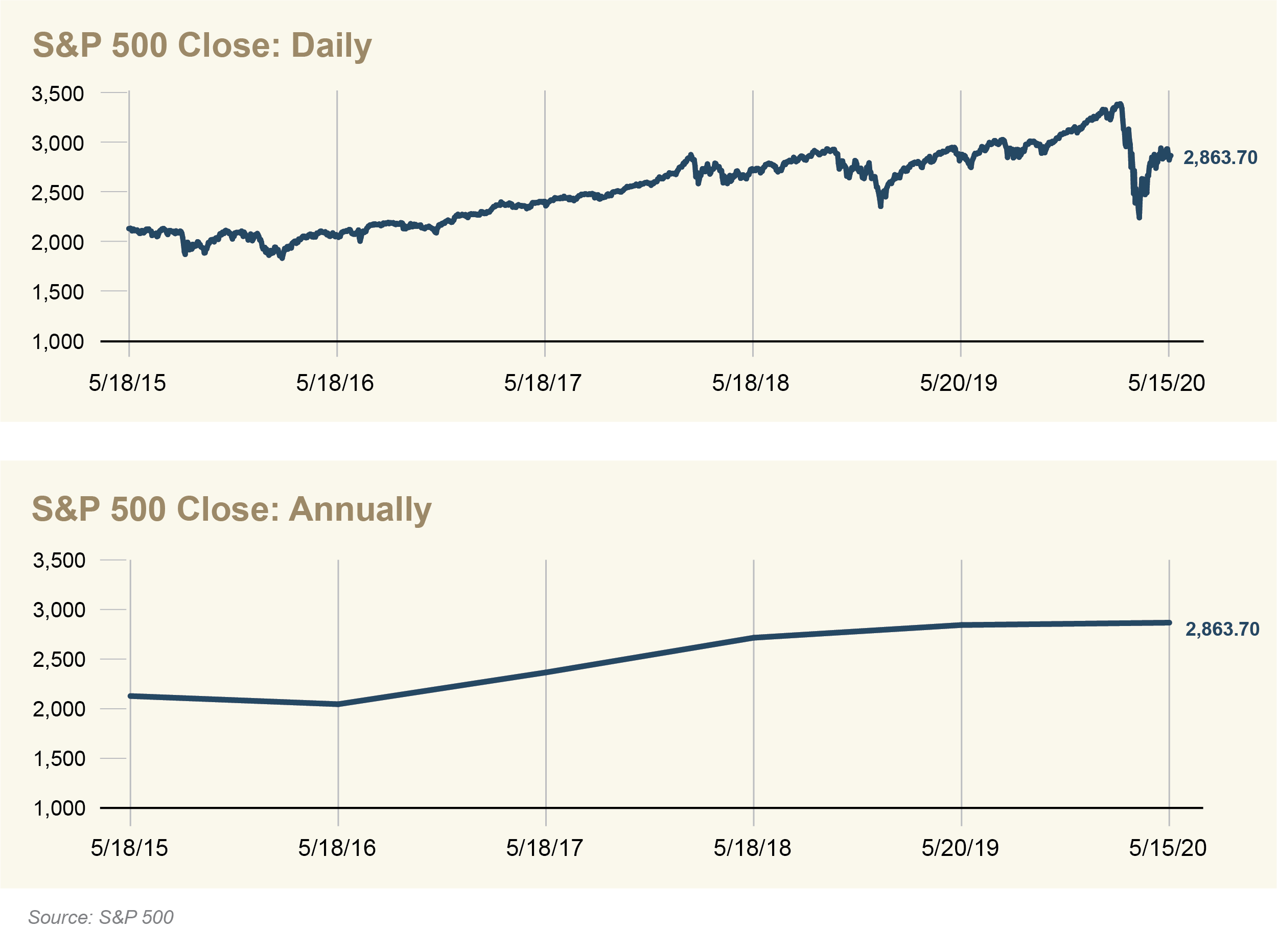

Let’s see how investors can be misled by paying too much attention to short-term market gyrations, which can result in suboptimal investment decision-making. Take the S&P 500 as an example. Each chart, below, shows the S&P 500 index returns for five years ending on 5/15/2020, and each has the same starting point, ending point and market gains. Yet, regardless of how often you check on the market, the end results are still the same.

The difference between each chart is the frequency of how often returns are shown or “viewed.” The first depicts daily returns. If this is how often you look, your investment journey will seem very choppy and volatile. However, as you can see, when we move to an annual view, the apparent volatility drops off dramatically.

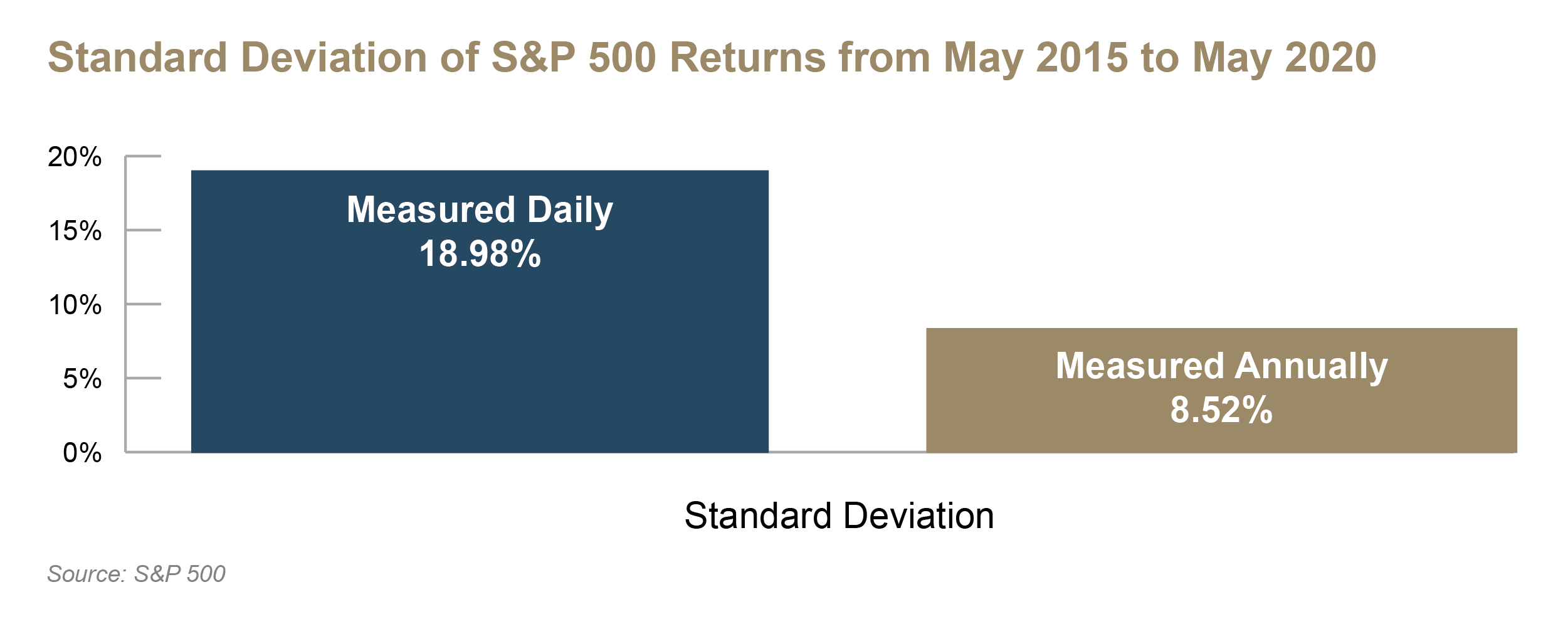

This phenomenon can be observed mathematically by standard deviation, a measurement of variability above and below the mean return. The standard deviation shows the movement of prices, up or down from their averages as a percentage over a specific period of time.

The table below shows the standard deviation of the S&P 500 for the last five years using daily and annual returns. A lower standard deviation indicates lower volatility in returns. Viewing the table, you can see that the standard deviation drops significantly when returns are viewed at longer intervals. In fact, the volatility when measured using daily returns is more than twice that of the annual measure. But the reality is that no matter how often you look, over the same period of time, your real returns are actually the same.

The impact of simply checking your portfolio returns too often can lead to investment decisions that are out of alignment with your long-term goals. Recency bias at each market spike coupled with anxiety from loss aversion at each downturn can drive unwarranted and misguided short-term trading. This in turn will likely lead to suboptimal long-term results.

Stay Focused

We all seem to be exposed to an unlimited amount of biased information. It feels like most media outlets are strumming our emotions as if they are guitar strings. We need to be mindful that media outlets are most profitable when there is fear in the streets. The news leads us very reliably into the crucible of human horror. Unfortunately, many of us are at home desperately seeking facts, yet all we seem to hear are extreme opinions. I constantly remind my staff that we provide advice to decision makers. The best advice today is to limit your intake of “information” or in other words, look less often.

I’ll end with a quote from Rob Arnott, the founder and chairman of Research Affiliates, a global asset manager, “In investing, what is comfortable is rarely profitable.” To be successful investors we need to learn to live with our discomforts and act rationally, learning to put our emotions aside.