The economy and the stock market don’t move in lockstep

Even though we’re in an economic downturn, the equity markets have substantially recovered their first quarter losses. How can this be so? The simple reason is that economic data is backward looking and the stock market is forward looking, so they are not always correlated. And, while in the long term the stock market is driven by fundamentals, in the short term it’s often driven by emotions and expectations.

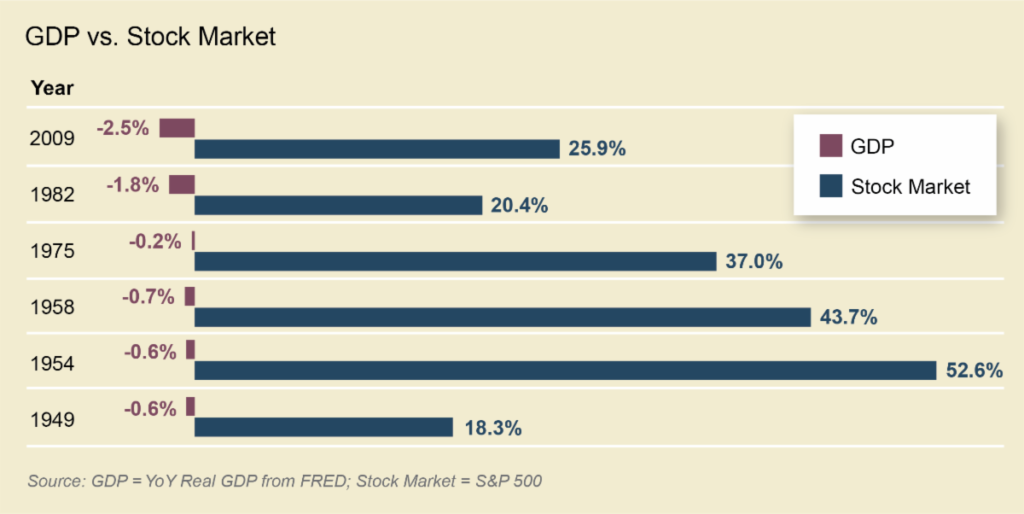

Looking at the chart below, you can see that there have been many instances since World War II when the economy was in decline, yet the stock market rallied.

We can learn from the past

In our latest Economic Update webinar, it explains how examining historical experiences can help guide us forward. You’ll learn:

- Where we are in the current economic cycle, and how the economy grew in the eleven expansions since World War II

- Whether you should be worried, based on the economic data, not the news

- How the average investor (who reacted emotionally) fared over the past twenty years – spoiler alert, they did not do well

Rely on Principle Wealth Partners for guidance

We help clients stay focused on their long-term financial plans and avoid making irrational investment decisions based on fear. The principles of investing still apply, and we continue to take a strategic, long-term approach to diversification while also seeking to identify tactical opportunities.

Please don’t hesitate to reach out with any questions or concerns.