Key Takeaways:

- Bond yields dropped to historic lows clouding the outlook for price gains in the foreseeable future

- Dispersion in fixed income sector returns reflects significant market dislocations

- Fixed income opportunities will come from identifying mispricings

The Fed intervenes

To help support the economy, in February of this year, Federal Reserve Chairman, Jerome Powell, committed to lowering the federal funds rate. Then in March, the Fed further lowered the Fed Funds rate, effectively to 0%, and began another round of at least $700 billion in QE, beginning with an immediate purchase of $80 billion in Treasury bonds and mortgage-backed securities. The Fed suggested that they would provide an “unlimited” amount of support to bring liquidity back to the bond market.

Bond yields have no place to go

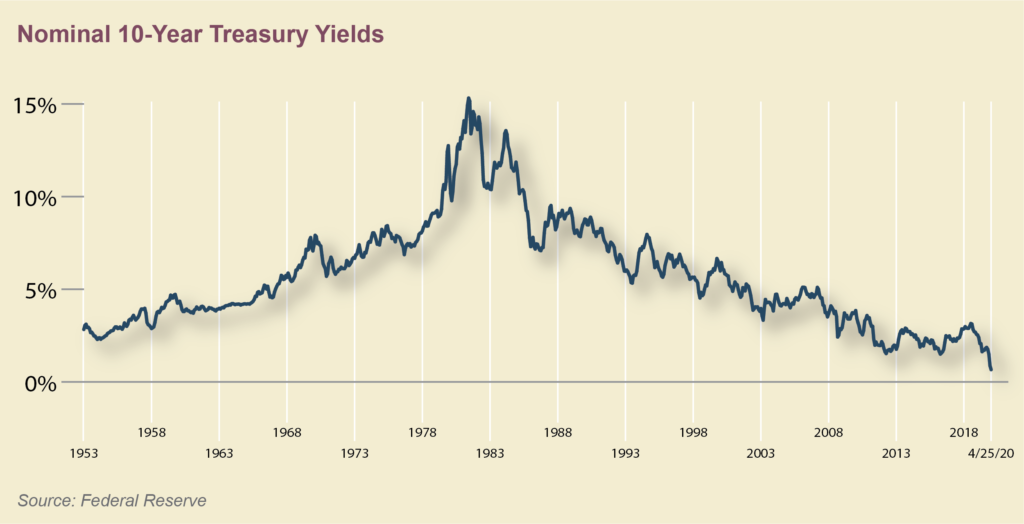

As you can see in the chart below, after a bull market of nearly 40 years (1981-2020), bond yields have dropped to an unprecedented low of less than 1% (compared with a peak of just under 16% in 1981). There are a couple of ways that bond prices increase, which ultimately increases the value of bond holdings. The most notable is when interest rates go down, as shown in the chart below. We can’t rely on interest rates going lower to see appreciation moving forward. Instead, the dislocation in the bond market will present unforeseen opportunities.

Inconsistencies create opportunities

The unusual conditions and growing uncertainty we are facing have resulted in market volatility and a flight to safety. Due to perceived levels of risk and a supply and demand imbalance, returns of fixed income sectors have become unanchored resulting in sector returns all over the map. So far this year, we have seen a historically high variance, 20%, in sector returns between winners and losers.

Since the 80s, bonds have benefited from price appreciation due to declining rates. However, with rates near rock bottom, gains will come from identifying favorable yield plays from market breakdowns.

There is a trade-off between risk and return

In addition to learning more about what’s been happening in the bond market, watch our Bond Market Webinar to understand:

- What the Federal Reserve is doing to stabilize the markets, including fixed income

- How long-term yields and potential risks of common investment options compare

Stay the course

Despite numerous irregularities in the fixed income market, bonds remain an important component of a diversified plan. Many investors are interested to know how market fluctuations can impact their portfolios. Have confidence knowing we continually evaluate the market to identify opportunities that align with your goals and desired outcomes. Don’t hesitate to reach out if we can answer any questions for you.

All the best,

Julina Ogilvie