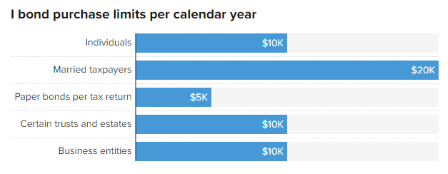

Note: Business entity purchases are electronic only

Source: TreasuryDirect

What You Need To Know

The interest rate of an I Bond is comprised of two rates, an annual fixed rate and a variable inflation rate. The Treasury Department announces the fixed rate in May and November; the current fixed rate is 0.00%. The inflation rate adjusts every six months (also May and November), and the current rate is 9.62%. This rate, however, is good for six months. The actual return for the six-month period is 4.81%. Sounds great, so what’s the catch?

First is the dollar limit you can purchase. As seen in the chart above, individuals can only purchase up to $10,000 worth of bonds per calendar year. If you have a tax refund, you can purchase up to an additional $5,000. The second is the lock-up period. Once you purchase the bond, you cannot cash in the bond for 12 months. After 12 months, you can cash in the bond but will be subject to an early withdrawal penalty if not held for five years. Third, because the “inflation rate” resets every six months, you will earn a lower rate than today as inflation trends back to normal. Fourth, while the interest is tax-free at the state level, the interest income will be classified as ordinary income at the Federal level. The last issue is that you have to purchase them through TreasuryDirect.gov.2

1https://www.fdic.gov/resources/bankers/national-rates/

2https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm

Principle Wealth Partners LLC (“PWP”) is an SEC registered investment advisor. Advisory services are only offered to clients or prospective clients where PWP and its representatives are properly licensed or exempt from licensure.