What is Going on in the Bond Markets?

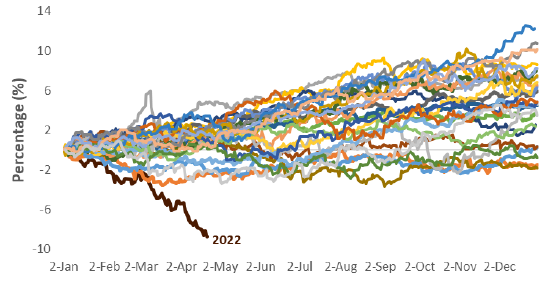

Barclay's Aggregate Performance By Year

Source: Bloomberg via Holbrook Income

Note: Each line is the calendar year performance of the Barclays Aggregate Bond Index since inception in 1996

We tend to think of bonds as relatively safe assets. In simple terms, stocks tend to be the most volatile, then bonds and cash is generally deemed safest. In return for stomaching volatility, investors on average, are rewarded more for holdings stocks, less so bonds, and not at all for cash.

In the broader context of a diversified portfolio, historically, bonds and other fixed-income are used to help provide a zig to the equity zag. As stocks rise, bonds might fall a bit, but when stocks drop, bonds should provide a ballast that helps mitigate some of that loss.

Volatility is not created equal in these asset classes either. A 10% drop in stocks happens about once per year on average, but a 10% drop in bonds is historically rare, as the figure above shows. 2022 is a significant outlier.

As of the end of April, the total return on the U.S. Aggregate Core Bond Index, which is a combination of investment-grade corporate bonds and government bonds, was -9.42%. One of the largest core bond funds, iShares investment-grade corporate bond index, was down -14.52%.1 This is the worst start for the bond market in history. This aggressive repricing is due in part to the Federal Reserve’s comments this year. While the Federal Reserve has only raised interest rates by 0.25% so far in 2022, the bond market is listening to the words of Jerome Powell and the Fed, and trying to get ahead of any action.

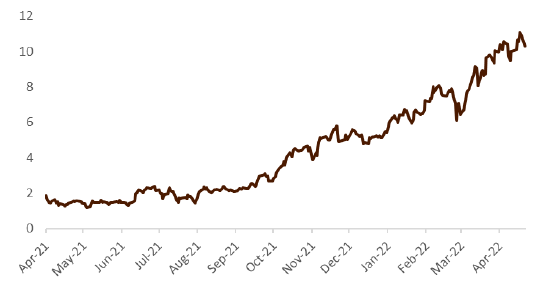

Market Implied Pace of Rate Hikes in Next 24 Months

According to Morgan Stanley Global Macro Strategy, the market is now pricing in upwards of 10 rate hikes in the next 24 months. This action is causing current bond yields to look worse and thus driving down their price as new bonds coming to the market offer a higher yield. This bond math, paired with fund outflows has caused some rapid declines over the past few months.

What is important to consider throughout all of this is how much downside could still be left in the fixed income market. Is the market getting ahead of the Fed’s actions? If the Fed changes its tone to be more dovish (say for mid-term elections, or declining inflation numbers), then the sell-off in the bond market might have gone too far, and we could see a reversal in fixed income across the board. The same applies to the stock market which takes its cues from the bond market. Stay tuned.

1Source: YCharts

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com