Lithium and Its Impact

The Salar de Atacama salt flats store more than a quarter of the world’s lithium supply. Source: David Maise1

As we continue to wade through 2022 and what the market has thrown at investors, we want to take a step back and help you understand some lesser-known but important pieces that drive overall news stories and trends in the investment landscape.

With gas prices increasing rapidly this year, more emphasis has been placed on Electric Vehicle (EV) adoption and the potential for EVs to overtake traditional automobiles. While, in theory, that sounds good for everyone involved, it is vital to understand the dynamics of what goes into EV production and how it is not as easy as one might think. We attempt to shed some light on this by reviewing one major component involved in many batteries and other everyday goods, lithium.

Lithium is becoming increasingly popular due to EV Adoption, but its usage is widespread in many products from medication, glass/ceramics, solar panels, to batteries. Chile and Argentina are the two largest global producers of raw lithium.

Mining lithium can be done in various ways. Chile extracts its lithium through its salt lakes, known as salars. Lithium-containing saltwater underneath the earth is pumped out and left to evaporate in large basins. The resultant material is further processed into the lithium that is commercially used for battery products. Australia, on the other hand, mines its lithium through the use of hard-rock mines, the more traditional way of “mining”.2 The major difference between the two methods is initial capital investment, with hard-rock mines being more capital intensive. Compared to hard-rock mining, exploration and drilling costs can be reduced up to 50% with brine deposits.3

Drilling and mining are only small parts of the process, though. According to the Department of Energy, China refines 60% of the world’s lithium used in battery technology. This is the main concern behind all the headlines. As supply chains figure themselves out, establishing dominance over these rare earth metals is paramount, given their scarcity and importance in today’s modern society. China is estimated to control 55% of global rare earth mining capacity and 85% of rare earth refining.4 The US cannot afford to sit back at watch China take global control in processing these materials.

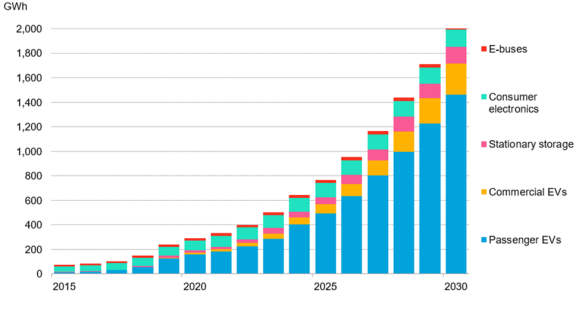

Worldwide Anticipated Use Applications of Lithium-Ion Batteries5

According to a recent White House report on Supply Chains, the demand, for lithium could increase upwards of 4000 percent by 2040.6 This increased demand paired with scant supply and lack of control could cause issues for domestic security when it comes to products and goods containing lithium. The tradeoff the US and domestic companies will have to make is one of the economies of scale and environmental degradation. Domestically, we have strict environmental expectations and more expensive labor compared to China and other emerging nations, making this transition tricky.

An estimate by 6k, a lithium battery startup in the US, pulling these battery materials onshore to the US would be an environmental disaster. “You’re talking about over the course of five years, 135,000 Olympic pools worth of waste and the need to plant trees [in an area equivalent to] close to one of your medium-sized states to offset the CO2 footprint. You take those technologies from Asia, and you put them on US soil, you’re talking about a 20% cost premium, and no auto manufacturer that I know will be willing to pay a 20% cost premium long term, just because it’s produced domestically.”7

We should consider balancing the need and desire to progress forward with future technologies while remaining aware and cognizant of the limitations currently put in place given the current setup. While we will see increased EV interest over time, automakers and other technology providers will need to figure out this balance and how to best move their companies forward. Aside from business dynamics and profitability, it all comes back to national security and making sure the US can operate through a global crisis. As we continue to increase our technological dependency, our leaders need to ensure that we are best set up for continued safety and success.

3https://www.visualcapitalist.com/lithium-key-ingredient-powering-todays-technology

4https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

5BloombergNEF, Long-Term Electric Vehicle Outlook 2019; Accessed March 5, 2021

6https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.