Defining a Recession

If most people were asked to define a recession, they would probably use the definition heard on CNBC or Bloomberg, “two consecutive quarters of declining Real GDP.” Given the turbulent first half of the year, talks of recession have only accelerated as media outlets ramp up their coverage of the financial world in place of a shortage of actual newsworthy items. This firestorm of coverage was fueled by second quarter GDP data released last week, which came in at (-0.9%), making it the second consecutive quarter of declining Real GDP.1

What is missed in all of this is that the group which puts out the official recession language, the National Bureau of Economic Research (NEBR), doesn’t define a recession in exactly the same way. While two consecutive quarters of declining GDP is considered one of their criteria’s components, many other indicators are included. According to the NEBR’s website, their official definition is “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”2

While this definition does seem vague, that is precisely the point. The economy operates in cycles, the reported data is backward-looking and is continuously revised up or down in the coming months and quarters. While, yes, most recessions do check the box of having two consecutive quarters of declining Real GDP, not all do. For example, the NEBR technically called the period from February 2020 to April 2020 a recession, given the dramatic decline in economic activity due to the COVID-19 pandemic. That “recession” only lasted 2 months. Another example is the recession of 2001 where we did not see two consecutive quarters of declining Real GDP…So while it is convenient to simplify for purposes of news headlines, it’s important to understand that it’s not always correct. Another important note to make in all of this is that the Real GDP numbers are estimates.

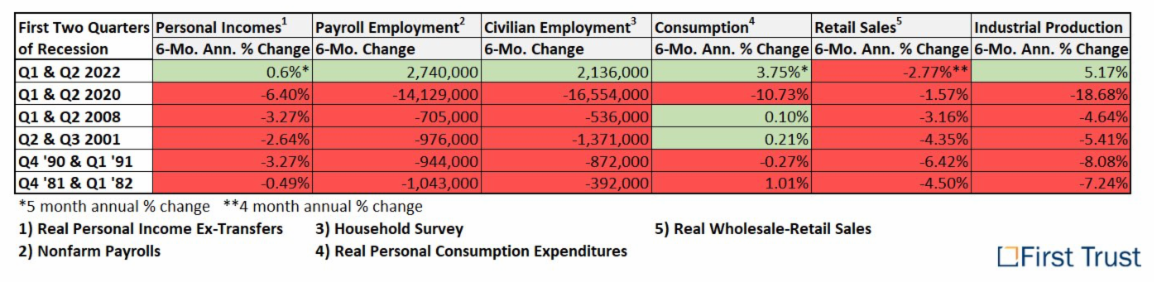

The NEBR broadly looks at three measures (depth, diffusion, and duration) to create a better picture of the economy. Yes, the committee will review GDP, but they also consider and place substantial weight behind, employment numbers, personal income levels, business sales, industrial production, home starts, and sales, in addition to a few others. This complete mosaic allows the NEBR to look at the data, make a comprehensive assessment, and then add the “recession” label in a backward-looking fashion.3

All of this brings us to today – inflation is still high, and the economy seems to be slowing, based on the recent second quarter GDP data. When looking at the expanded definition of a recession based on NEBR’s measures, we see job openings and employment remain at historic levels, consumer spending has continued to grow since the end of 2021, home prices and rents are near all-time highs, durable goods orders are holding up, industrial production is still strong, housing permits and new home starts falling, and borrowing costs rising. We see a mix of positive and negative economic activity. So, are we in a recession? No, or not yet, seem to be the accurate answer for now.4

1https://www.nber.org/research/business-cycle-dating

3https://www.bea.gov/news/2022/gross-domestic-product-second-quarter-2022-advance-estimate

4https://www.nber.org/research/business-cycle-dating

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.