The Return of Yield

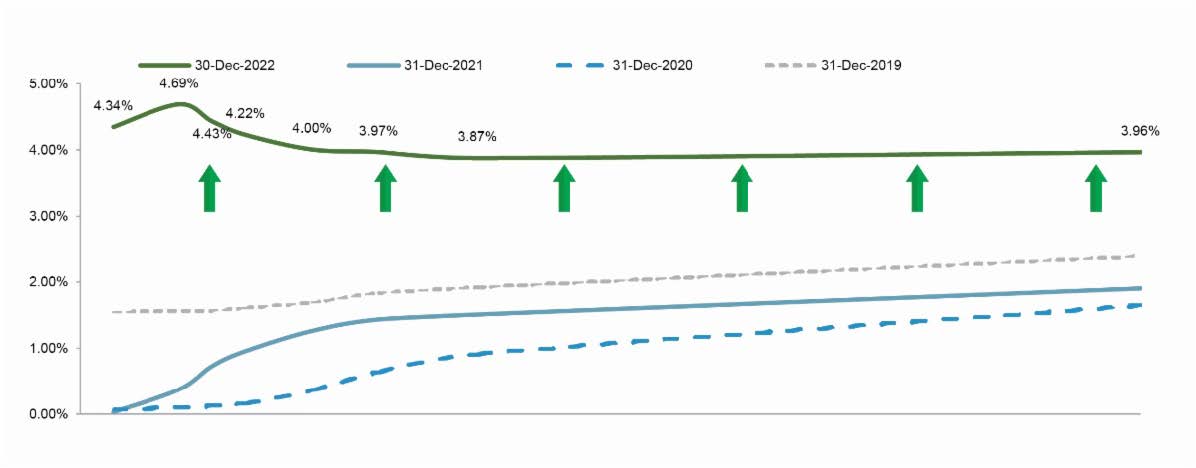

US Treasury Yield Curve Shift

Yields moved sharply higher in 2022 amid a rapid increase in rate hikes, inflationary concerns, and the Fed beginning to shrink its balance sheet.

Source: Fidelity Institutional

2022 was a year to forget when it comes to bonds. Recording the worst performance in the past 200 years. Why did this happen? Well, the Federal Reserve chose to increase interest rates from close to 0% to close to 5%…or in plain English, the largest relative percentage change in interest rates in the shortest amount of time, ever. This has created a great opportunity across the fixed income spectrum. Now that interest rates have risen to levels not seen in a long time, these increased yields give investors several viable alternatives when looking for income as a piece of total return. Seen in the figure above, the yield curve has shifted rapidly. This dramatic shift upwards created a poor showing in 2022 for bonds, but these higher yields now allow investors to find

returns in fixed income moving forward.

Let’s look at this change another way to further illustrate how severe this upward move has been. For example, just looking year over year, on a percentage basis, the one-month rate increased by 15,056%, the 1-year Treasury yield increased by 502.17%, and the 3-year Treasury yield increased by 181.15%. These are massive shifts that are not regular occurrences by any means.

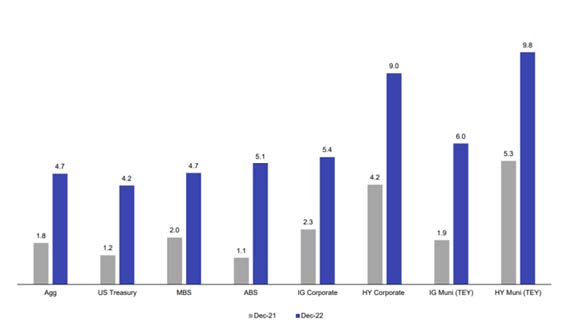

High-Quality Fixed Income Yields Surged in 2022

Source: Goldman Sachs Asset Management

As seen in the chart above, higher yields mean higher income, but this time around, that higher yield does not come with more risk. These higher yields will generate interest payments that are significantly larger than last year. As interest rates stabilize and eventually head lower toward the Fed’s neutral rate, today’s bonds with higher starting yields will benefit from price appreciation. This combination of a higher starting yield plus the opportunity for price appreciation creates a very attractive total return setup for investors not seen in a while for bonds. While 2022 has wreaked havoc on traditional bond investors, it has also created a fantastic opportunity moving forward.

Andrew Cialek, CFP®

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.