2022: Happy To See You Go!

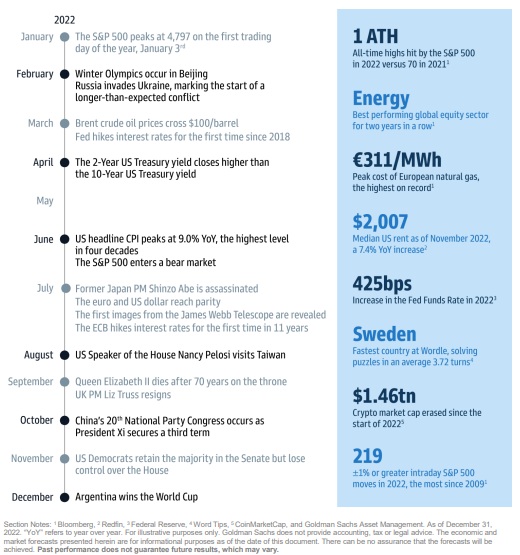

Here’s a quick recap, in chronological order, of some of the events that occurred throughout the year.

COVID-19’s Impact on the Consumer Price Index

Source: Bloomberg

The massive amount of fiscal spending and stimulus in 2020 and 2021 fueled the rapid rise in inflation in 2022. In February, Russia invaded Ukraine and unwound the decades-long push for globalization and stabilization in supply chain logistics. In the same quarter, we were dealing with supply chain disruptions stemming from the increased demand for goods and materials, which needed to be produced and delivered from parts of the world that were still partially locked down. Inflation peaked in the summer of 2022, and in the second half of the year, all inflationary signals declined. We also saw added stress in the energy industry. Prices were driven to their peaks; far away from the negative prices seen in 2020. Luckily, consumer balance sheets were strong enough to absorb most increases with minimal disruption. As seen in the chart above, inflation soared to levels not seen in decades.

The Fed’s Response

Source: YCharts1

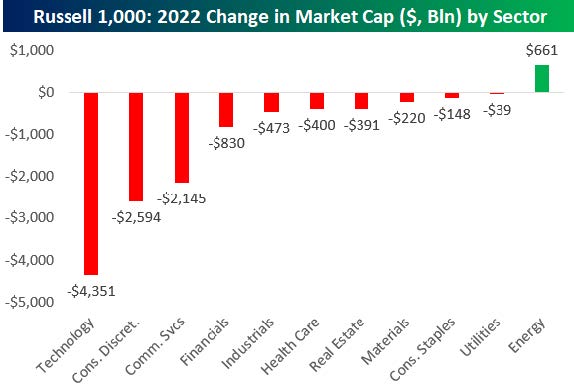

The rapid increase in inflation readings, mixed with the massive amount of cash via stimulus and the need to get back to a normal interest rate environment, led the Fed to increase rates by the largest amount in the shortest period of time in history. As interest rates increase, the cost of borrowing becomes more expensive. Companies that rely on borrowed money to fund future growth suffered, while companies that had on their balance sheet and generated free cash flow were less impacted. The chart below illustrates the sectors most impacted in 2022.

All Asset Classes Were Impacted

If you think things were bad in the stock market, let’s take a look at the bond market. Stocks and bonds rarely decline in tandem. So rare that it’s only occurred twice in history, in 1931 and 1969. The rapid decline in bond prices was directly linked to the rapid and extreme rise in interest rates enacted by the Federal Reserve. Two of the most widely traded and most liquid bond etfs, TLT, representing a proxy for government bonds and LQD, a proxy for corporate bonds, returned this net of expenses and yield last year. These are massively popular ETFs used by both institutions and retail investors alike for their bond exposure and perceived safety.

So, Where Does This Leave Us?

Looking forward, we see an abundance of opportunity in the bond market, as we believe the bull market for bonds started in mid-October. The stock market is priced for a recession and we will have confirmation whether or not we had a recession in the coming quarters. Like every other equity bull market in history, they begin before a recession is called. This leads us to believe that the bulls will be chasing the bears out of town very soon. Stay tuned.

Andrew Cialek, CFP®

1YCharts

2https://mcusercontent.com/d9df05124e64a31cb695b0f70/images/6ccf0072-8acb-8402- 5a38-6bcaae1ebf0a.png

3Sunday Start | What’s Next in Global Macro: Safety Varies Significantly; Morgan Stanley Research, 1-8-23

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.