"So Emotional"

Investor Emotions and the Market

Source: People Magazine

Whitney Houston's "So Emotional", a standout track from her 1987 album Whitney, is a dazzling showcase of her vocal prowess and emotional depth. The song’s lyrics explore the complexities of love, capturing the rollercoaster of feelings that many listeners can relate to. With its catchy hook, the chorus encapsulates the highs and lows of romantic entanglements, while Houston’s powerful delivery imbues the lyrics with urgency and authenticity. Her performance makes listeners feel every ounce of the emotional turmoil she conveys.

Surprisingly, these same emotional swings might remind you of something else—the unpredictable ride investors often face as they navigate the markets. (Didn’t see that coming, did you? 😉)

As we step into 2025, it’s the perfect time to reflect on how investor emotions influence decision-making and, ultimately, investment outcomes. Let’s delve into the emotional cycles of investing and how they impact the broader capital markets.

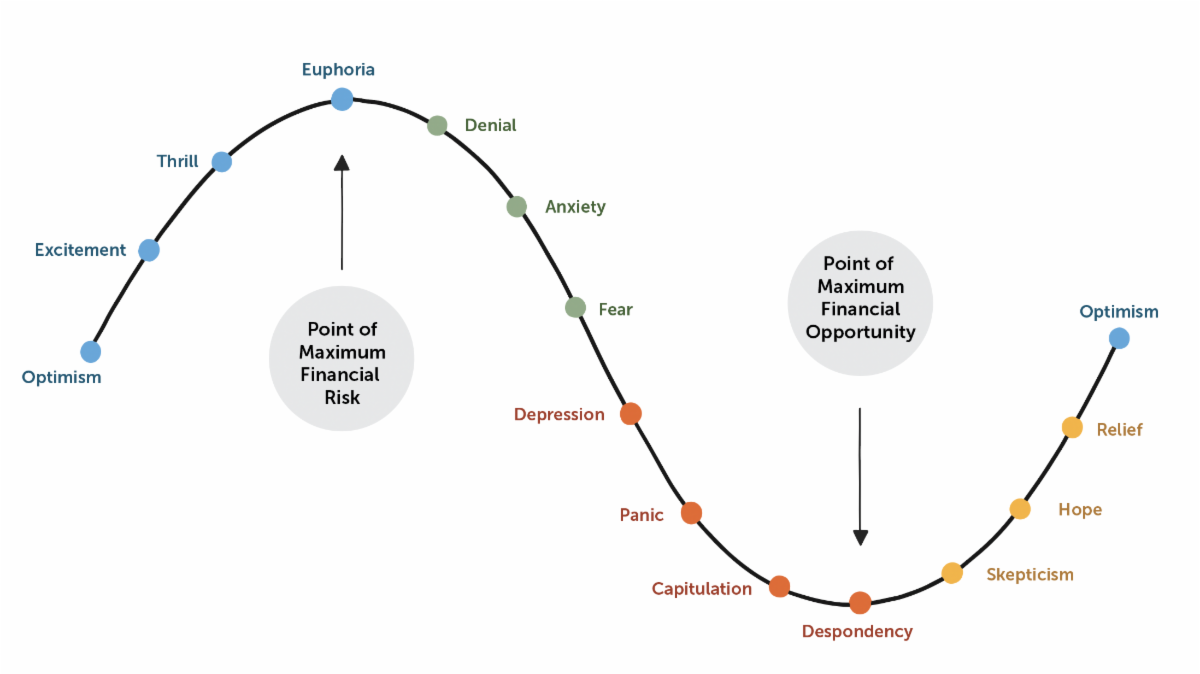

The Emotional Cycles of Investing

Source: Russell Investments - Cycle of Investor Emotions

Financial markets are widely recognized as cyclical, moving through distinct phases that mirror the broader economic environment and investor sentiment. But these cycles aren’t just about numbers—they’re deeply tied to human emotions.

Investors often find themselves caught in an emotional tug-of-war as markets evolve, leading to behaviors that can amplify both the peaks and troughs of the market cycle. Throughout these cycles, different emotions dominate at various stages. The most vulnerable moments for investors tend to occur during two extremes: peak euphoria and peak despondency.

- Peak Euphoria brings about feelings that the good times will continue forever, and we might even fool ourselves into thinking we should be taking on more risk so we don’t miss out…

- Peak Despondency, on the other hand, is the exact opposite. We question why we were ever invested in the first place and constantly wonder if we should just go to cash…

Historically, these emotions have contributed to poor decision-making, such as selling at market lows due to fear or buying at highs driven by greed, resulting in a recurring cycle.

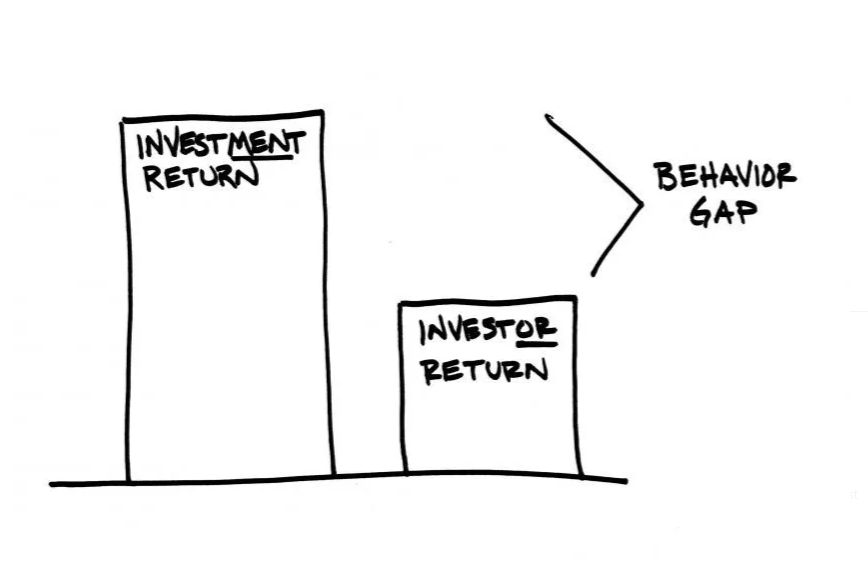

Understanding the Behavior Gap

Source: Carl Richards, “The Behavior Gap”

Most of us like to think we’re immune to the emotional rollercoaster of investing. However, as seasoned investors will tell you, resisting emotional impulses is easier said than done. Investors often struggle to manage their emotions, resulting in suboptimal decisions that hurt their long-term returns. This phenomenon, known as the Behavior Gap, highlights the difference between the returns investors could achieve if they stuck to a sound strategy versus the returns they actually achieve due to emotional decision-making.

Practical Steps to Avoid the Behavior Gap

To minimize the impact of emotions on your investments, here are some practical steps you can take:

- Leverage External Advisors: Trusted advisors can provide objective, data-driven guidance and act as a sounding board to help you stay the course during turbulent times.

- Establish Internal Checkpoints: Create personal checkpoints to regularly evaluate your investment decisions. This can help you avoid impulsive actions during periods of extreme market volatility.

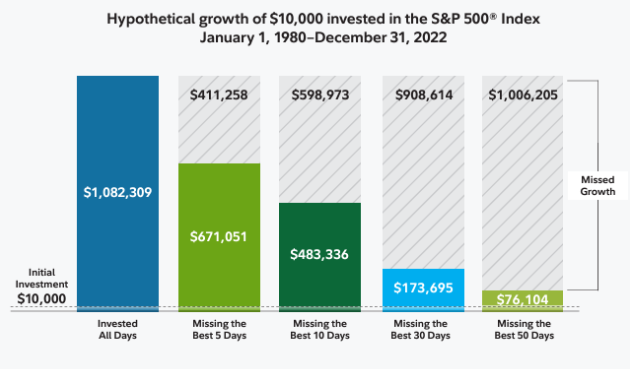

Time is on Your Side

Source: Fidelity Investments

A common challenge for investors is the tendency to wait for the “perfect” moment to invest or to find reasons to remain on the sidelines. However, historical data, as shown in the illustration above, consistently demonstrates that staying invested over time yields better results than attempting to time the market. By maintaining a long-term investment strategy, investors can harness the power of compounding growth while mitigating the risks associated with emotionally driven decision-making.

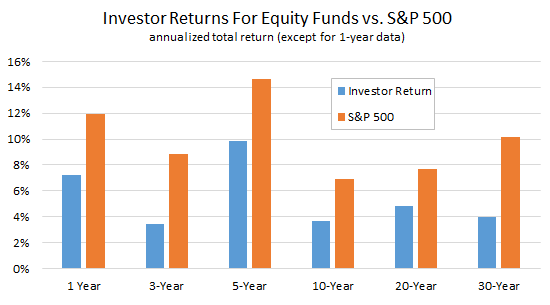

The Cost of Emotional Decisions

Source: Dalbar (1994-2024)

A long-term study by Dalbar (1994–2024) found that the average investor consistently underperforms their benchmark. This underperformance is often the result of emotional decisions, such as misjudging risk tolerance or reacting impulsively to short-term market fluctuations.

As Warren Buffett famously said, “The stock market is a device to transfer money from the impatient to the patient.” This quote serves as a valuable reminder to approach investing with patience, discipline, and a long-term perspective—even during periods of volatility.

Embracing the Emotional Journey

The investment journey is often marked by emotional highs and lows. By recognizing and understanding these psychological stages, investors can better manage their emotions and make more informed, rational decisions.

At Principle Wealth, our role is to help safeguard you from the emotional pitfalls that often lead investors astray. With our expert guidance and a disciplined approach, you can navigate market fluctuations with confidence and clarity.

Principle Wealth