Interest Rates, Volatility, and the Fed…Oh My

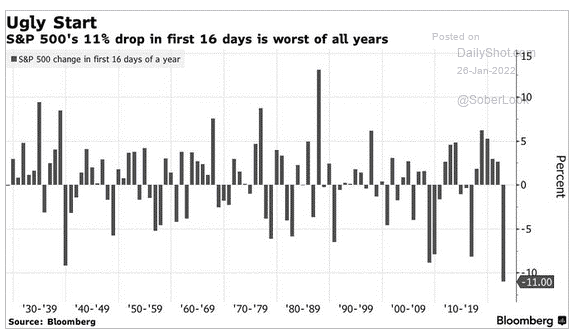

The start to 2022 was anything but calm as the S&P saw the worst start to the year ever. While this may seem concerning at first glance, I want to highlight several issues that contributed to this.

Stock Market Sell-Off

The beginning of this recent sell-off seemed to be concentrated in high growth and speculative companies that some would deem lower quality. These stock prices fell rapidly because of thoughts around rising interest rates. The valuations of these companies benefit from low-interest rates, so as rates rise, the discounted cash flows change, resulting in a lower current value.1 This causes investors to sell these companies as they try to find others whose value might be more resilient.

Fear of Inflation

Much of the volatility can also be attributed to the reaction of higher inflation readings. The Federal Reserve is contemplating raising interest rates and shrinking bond purchases to combat inflation. Before Chairman Jerome Powell’s press conference on Wednesday, January 26th , the market was trying to factor these possibilities in, resulting in additional market uncertainty that caused some large intraday swings. During his speech, Chairman Powell confirmed that no action was being taken in January, but he did not make it clear when the Fed would start the corrective actions in the near term.2 The Fed’s next meeting is in March, so all eyes will be watching and waiting.

The Impact of the Fed’s Words

The overall goal of the Federal Reserve is to maintain full employment and price stability within the economy. The Chairman currently believes that we have reached close to full employment. Therefore, price stability is the next goal to tackle, given that inflation is running above its long-term target of 2%. The hawkish tone in Chairman Powell’s speech led the S&P to post back-to-back losses, while the 2-Year Treasury yield experienced its most significant one-day increase since March 2020.

What is fascinating about Chairman Powell’s recent comments is that the Fed didn’t do anything in terms of direct action, yet the markets still reacted strongly. Just through the suggestion of future actions, the Fed can influence the markets and begin to shift them without raising rates just yet. While the Fed may have waited too long to intervene regarding inflation, we’re seeing targeted actions to mitigate further damage and better control the situation. From Chairman Powell’s perspective, the Fed needs to be “nimble” and move “steadily,” which is quite different from the talk about being “gradual,” a term used by the Fed the last time it raised rates between 2015-2018.3 With the 2-Year yield getting close to 1.25%, analysts are now pricing in five rate hikes this year.

In Summary

Companies continue to post record earnings. As we move further into the business cycle, it’s important that we identify the areas poised to potentially perform in a rising interest rate environment and those to be cautious of in the future, given the expectation of more volatility.

1https://arxiv.org/ftp/arxiv/papers/1003/1003.4881.pdf

2https://www.cnbc.com/2022/01/26/real-time-updates-of-the-big-fed-decision-and-jerome-powells-press-conference.html

3https://www.bloomberg.com/news/articles/2022-01-27/powell-s-different-expansion-spurs-calls-for-faster-fed-hikes

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com