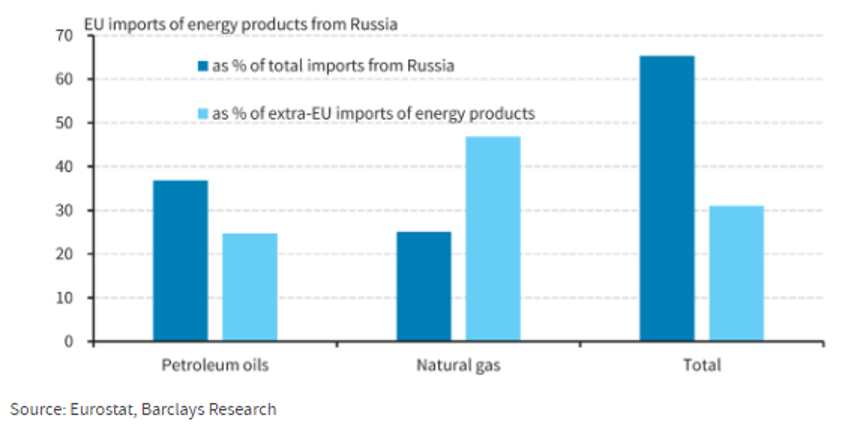

Early in the month, Russia’s threats to invade Ukraine triggered a stock market sell-off. An invasion had begun by the end of the month, leading to sanctions against Russia that caused a surge in oil, gas, and grain prices. Historically, geopolitical conflicts of this nature cause financial markets to react the most when energy prices spike and the Fed tightens monetary policy. The United States has become more self-sufficient in energy over the past decade (from energy conservation and the development of shale oil production), which may help steady prices here. Europe, however, is more likely to feel a more significant impact because it is heavily dependent on Russia for natural gas.1 Additionally, the market and the rest of the world continue to see how the U.S. and Europe react.2

Mortgage Rates Rise, Housing Supplies Drop

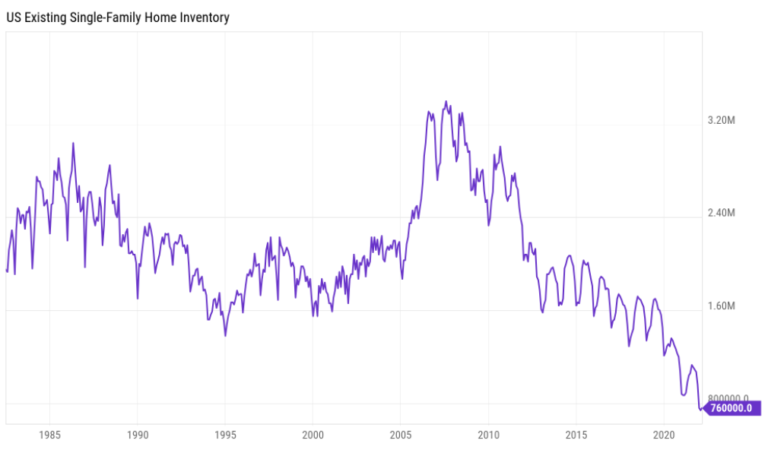

An index published by Bankrate.com has 30-year fixed mortgage rates up a full percentage point since Christmas.3 While some homebuyers still benefit from low rates that may have been locked in weeks ago, new mortgage applicants feel the increase’s effects, which will reduce their purchase power and affect demand. The National Association of Realtors reported an increase in home sales in January, contributing to today’s lower home supply levels (down 16.5 percent from January 2021). Housing inventory will decrease further following the decline of U.S. housing starts, although this may be temporary as future building permit applications are holding steady. Many homeowners are still looking to tap into the recent rise in their home equity. These “trade-up buyers” are now competing with first-time homebuyers over the scarcity of supply. Homebuilding has slowed because of supply chain challenges and product shortages, adding up to 12 months to completion dates (and dollars to the final costs to homebuyers).

1How War in Ukraine Threatens the World’s Economic Recovery, Bloomberg, 2/25/22

2Ukraine-Russia crisis: who’s winning the international influence war? | Ukraine | The Guardian, 2/19/22

3Housing Market Dysfunction Worsens With Higher Mortgage Rates – Bloomberg, 2/17/22

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com.