Direct Payments ($166 billion)

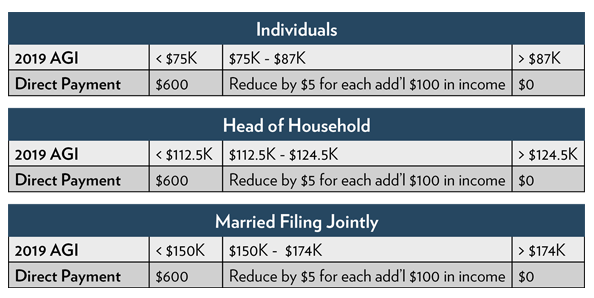

In recent days, there has been considerable back and forth in Washington regarding the level of direct payments to qualified Americans. While amounts of up to $2,000 have been floated by the President and some in Congress, the final bill approved the following amounts (based on 2019 Adjusted Gross Income) for individuals and dependent children under age 17, for the 2019 tax year:

This means that a married couple filing jointly, who earns less than $150,000 and has two dependent children under 17 years of age, could be eligible for direct payments totaling $2,400.

Unemployment Insurance ($120 billion)

The new bill resurrects the enhanced federal unemployment insurance bump from the original CARES Act that expired last summer. It provides an additional $300 per week (down from $600 per week under the CARES Act) for all workers receiving unemployment benefits through March 14, 2021. It also expands the Pandemic Unemployment Assistance program coverage to include self-employed, gig workers, and others in non-traditional employment and the Pandemic Emergency Unemployment Compensation program to provide an additional 13 weeks of federally funded unemployment benefits to individuals who exhaust their regular state benefits. The extension of benefits applies to over 14 million Americans who are at risk of losing unemployment relief.

Small Businesses ($325 billion)

There is significant funding in the bill to help small businesses and non-profits survive through the pandemic. This includes over $284 billion for first and second forgivable PPP loans, set-asides for very small businesses, and lending through community-based lenders like Community Development Financial Institutions and Minority Depository Institutions. Note that of the $284 billion, just $35 billion is set aside for first time PPP borrowers, so those that missed getting a PPP loan through the CARES Act should apply quickly for this program in 2021.

There is also targeted relief that includes $20 billion for new EIDL grants for businesses in low-income communities and $15 billion in dedicated funding for live venues, independent movie theaters, and cultural institutions.

Miscellaneous Provisions ($276 billion)

Besides direct relief to individuals and businesses, the stimulus bill provides significant funds to meet other pandemic related needs. For example:

- $82 billion in critical funding for states, K-12 schools, and institutions of higher learning that have been impacted by the virus.

- $69 billion for vaccine procurement and distribution, with $22 billion sent directly to the states for testing, tracing, and COVID-19 mitigation programs.

- $45 billion to provide relief for transit agencies, airlines and airline contractors, airports, state DOTs, bus companies, and Amtrak.

- $25 billion distributed to the states for families who need rental assistance for past due rent, future rent payments, as well as money to pay utility and energy bills.

The Impact

Although much smaller than the CARES Act, the current stimulus bill is expected to provide much needed support to keep the economy going and to prevent a COVID-19 related recession in the new year. Financial markets are also expected to respond positively, particularly if the Biden administration succeeds in passing additional stimulus support early in 2021.

Be well,

Colin Dugan