The First 100 Days of Build Back Better

Key Takeaways:

- Since Franklin D. Roosevelt (FDR), American presidents have been measured by their accomplishments in the first 100 days.

- President Biden has introduced several programs to “Build Back Better” and the S&P has reacted positively thus far.

- President Biden’s three stimulus plans come with a steep price tag and proposed tax increases for financing

President Biden’s First 100 Days

David Axelrod, a top aide to President Obama, once referred to the first 100 days of a presidency as a “Hallmark holiday” – lots of attention but no significance.The 100-day benchmark began with the presidency of FDR, whose legislative and regulatory actions set the bar high. New presidential administrations often begin with ideas for policy reform to take advantage of opportunities, especially when there is a political regime change. Regardless of party affiliation, the stock market generally sees this as a sign of optimism and has delivered positive returns most of the time. The S&P 500 Index has risen an average of 3.8% during the first 100 days of the 24 presidential terms since 1929.1 During President Biden’s first 100 days in office, the S&P 500 Index is up 10.86%.2

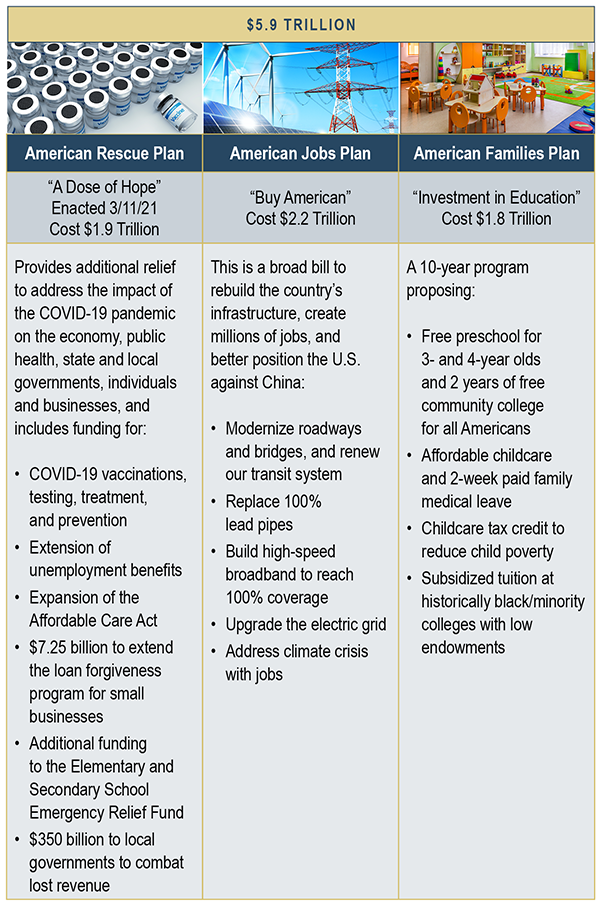

Some presidents are praised . . . or suffer based on the contrast from their predecessors, and this time around has been no different. In fact, the response has only been enhanced as the economy recovers from the pandemic and benefits from the trillions of dollars in stimulus. We review below the three plans President Biden has introduced this year: The American Rescue Plan, The American Jobs Plan, and The American Families Plan.

President Biden’s Three Stimulus Plans

In addition to these three plans, there are many smaller initiatives on the agenda for the new administration including immigration reform, rejoining the World Health Organization, rejoining the Paris Climate Accord, ending U.S. involvement in the war in Afghanistan, and addressing gun violence in America.

What Impact Does This Have on Consumers?

The question on many minds, and a primary focus for the media, is how we will pay for all of these plans, totaling $5.9 trillion.

- Taxes – One option could be raising taxes. The Made in America Tax Plan was unveiled in response to these proposals and includes, most notably, raising the corporate tax rate from 21% to 28%.

- Capital gains – President Biden recently announced a proposal to increase the tax rate on capital gains and qualified dividends from 20% to 39.6% for those earning more than $1 million. When you add in the 3.8% Obamacare tax, this could potentially reach 43.4% for top earners.

- Income tax brackets – The proposal also includes an increase in the top income tax bracket, previously lowered to 37% in 2017 by President Trump’s Tax Cuts and Jobs Act, back to 39.6%.

- Step-up in basis – The elimination, at death, of the step-up in basis for gains over $1 million for individuals and $2 million for married couples has also been included. Currently, an heir benefits from a “step-up,” which adjusts the cost basis of the inherited property to the fair market value at the decedent’s date of death. Heirs may defer taxes on an inherited home or property until they sell the property. This proposal may require heirs to pay the full gain on the appreciated asset when they receive it, based on the decedent’s original cost basis.

Will the Stimulus Plans Lead to Inflation?

There is concern that all this spending will create a surge in inflation. Too much inflation could pressure the Federal Reserve to respond by tightening monetary policy sooner than planned. This could lead to the Federal Reserve reducing or terminating its current asset purchase program (a provider of liquidity to the markets) and/or raising interest rates.

We deem any recent spikes in inflation to be temporary due to a variety of factors such as supply chain disruption, re-opening of economies, and related pent-up demand. The Federal Reserve is likely to interpret a fairly stable 10-year treasury bond yield as an indicator that any spike in inflation would be temporary. In addition, despite the media attention to this, history tells us that periods of high debt do not always lead to surging inflation.3

What Happens Next?

Ultimately, we anticipate a long and drawn-out legislative process to attempt to pass the proposals as they stand today. In all likelihood, we expect spending and taxes to go up, but not to the extent of the current proposal.

If the proposals pass, the tax implications affect a small percentage of Americans.

- Personal income tax increases would impact single individuals whose taxable income exceeds $452,700, couples filing a joint return with taxable income exceeding $509,300, head of household filers exceeding $481,000 in taxable income, and married couples filing separately with taxable income over $254,650.

- A smaller cohort would be impacted by the capital gains proposal, which applies to taxpayers whose taxable income exceeds $1,000,000.

The media suggests these proposals may have a negative impact on the stock market, but historically, periods of rising taxes have not had major implications for markets. We continue to monitor the progress on these programs, their impact on your portfolio, and the opportunities they present. Please don’t hesitate to reach out to us if you have questions about the stimulus packages.

Julina Ogilvie, CIMA®, CPWA®

Megan Maruzo, MBA

Sources:

1 Biden’s First 100 Days Were Historic for the Stock Market. What History Says Happens Next, Nicholas Janiski, Barron, May 2, 2021, https://www.barrons.com/articles/stocks-soared-during-bidens-first-100-days-what-history-says-happens-next-51619479357

2 Biden’s first 100 days mark best such stretch for S&P 500, Dow since FDR, MarketWatch, 4/29/2021, https://www.marketwatch.com/story/bidens-first-100-days-poised-as-best-such-stretch-for-s-p-500-dow-since-fdr-11619654492

3 Is 1970s-Style Inflation Coming Back? Bloomberg, using quarterly data as of 12/31/20, Federal Debt Total Public Debt as Percent of GDP, https://www.schwab.com/resource-center/insights/content/is-1970s-style-inflation-coming-back