Key Takeaways:

- Use a tax-advantaged education savings account to boost potential growth

- Start saving early to benefit from compounding

- Save consistently and invest for growth to achieve your savings goals

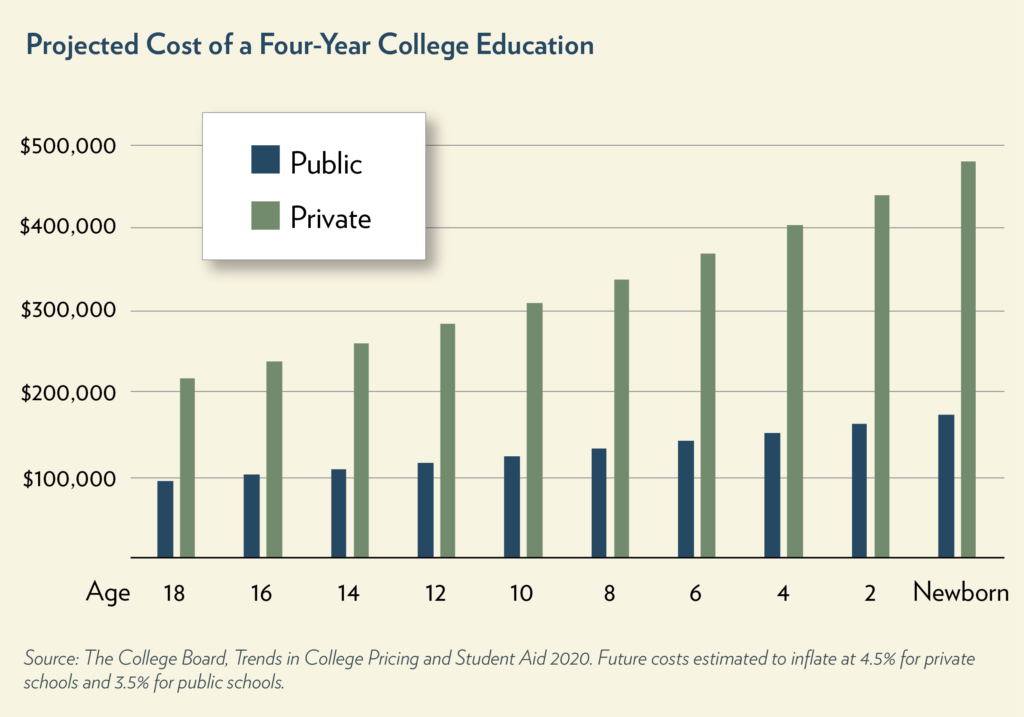

It’s no secret that college costs are rising fast and that paying for college often ends up being one of a family’s largest expenses. For students entering high school today (at around 14 years old), tuition, fees, and room and board for a four-year private college are likely to cost as much as a quarter of a million dollars. This price tag is expected to more than double for newborns today who begin attending a private college in 2039.

Fortunately, there are attractive options available to families to help them save for college. Among these are 529 plans. These plans are typically sponsored by individual states and offer significant tax advantages to donors. Connecticut’s version is the Connecticut Higher Education Trust or CHET plan.

Saving with a CHET Plan

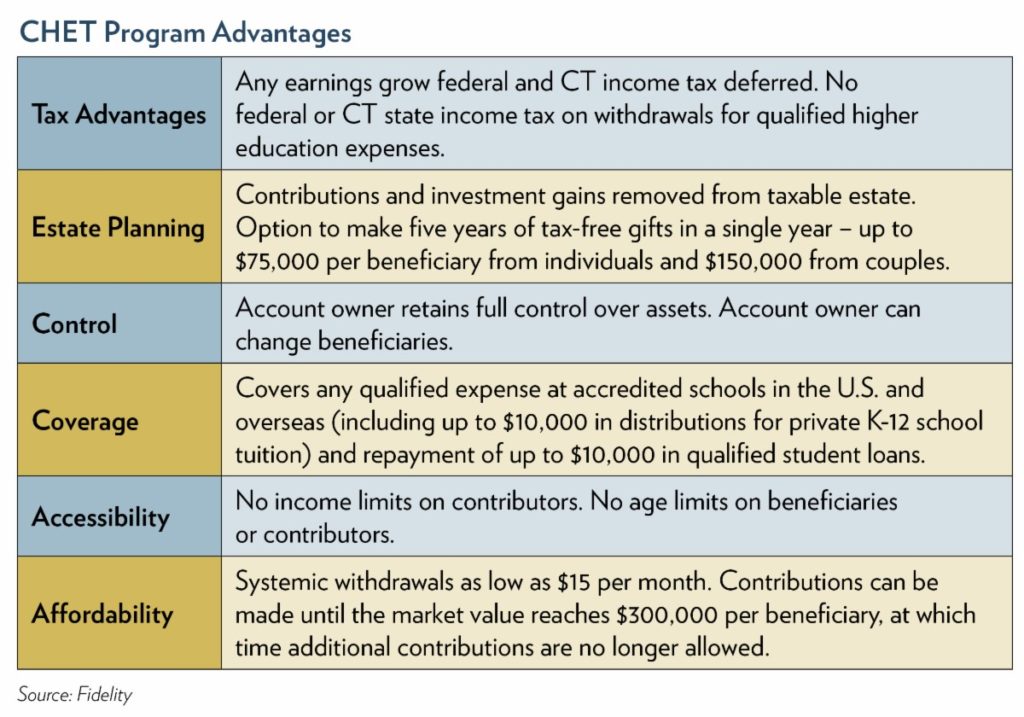

The table below highlights the important benefits of the CHET 529 program for college savings. There is no minimum required to open a CHET account. And, they allow for a state income tax deduction of up to $5,000 per year for single filers and $10,000 for those filing jointly. Account donors are not restricted to the student’s immediate family. In fact, anyone including a grandparent, friend, or neighbor can open an account.

These tax savings can add a significant boost to the growth potential for these plans. For example, we calculate that for a $10,000 initial investment with additional monthly contributions of $500 over 18 years (with an expected investment return of 6%, compounded monthly, and a federal tax rate of 32%), the benefits of tax-deferral could add up to a nearly 30% gain in proceeds over the total from a taxable account. And these assets may be protected from bankruptcy, depending upon who the beneficiary is and when the assets are deposited into the account.

Why it Pays to Save

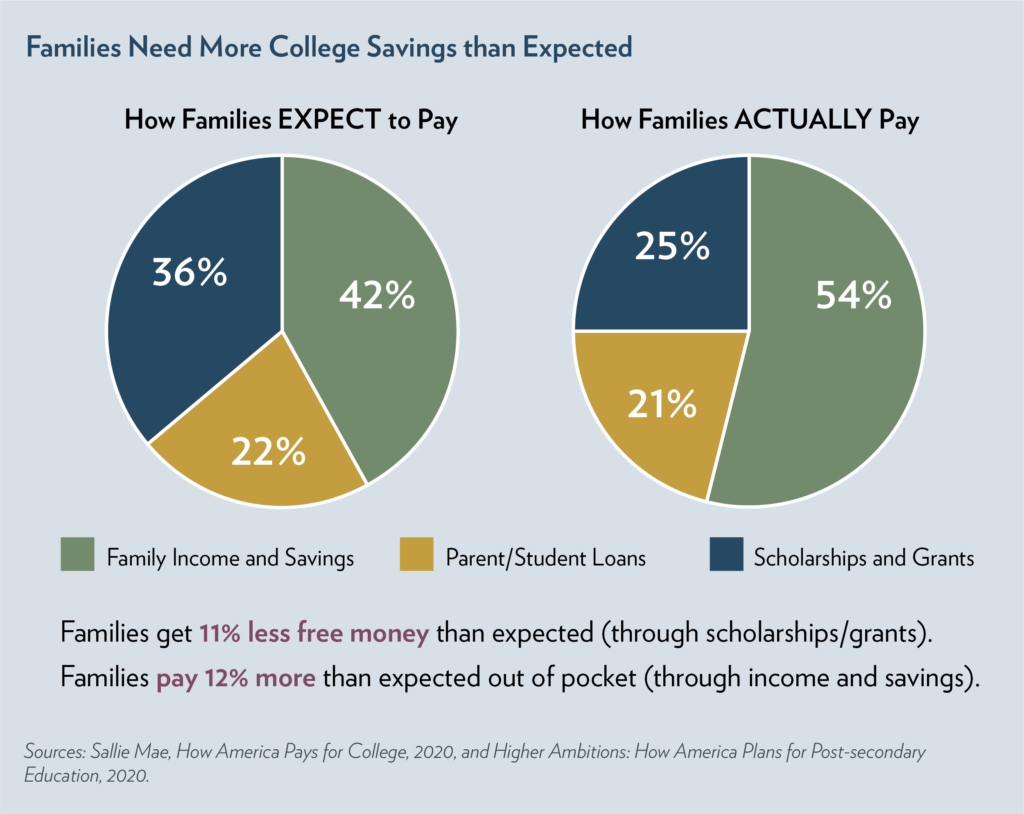

Recent studies have suggested that many families pay a larger share of college expenses from their own pocket than expected. Most families today budget for about 42% of total out-of-pocket college expenses with the balance covered by grants, scholarships, and student loans. But, in fact, the average family’s out-of-pocket share of total expenses is over half of the total. This differential can add up to tens of thousands of additional dollars.

Why it Pays to Start Saving Early

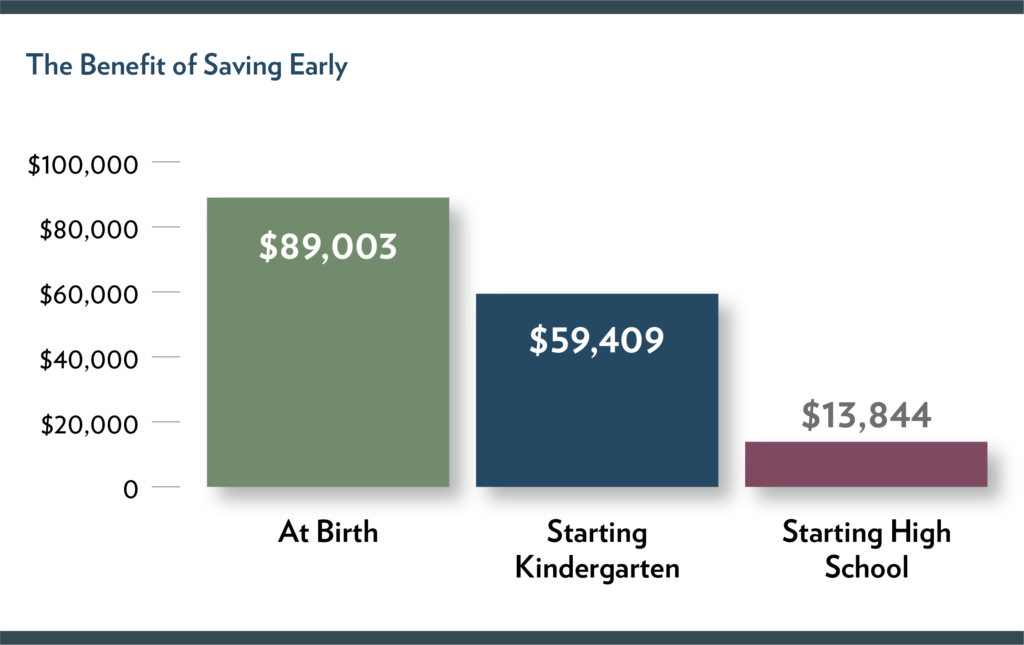

Because of the power of compounding, starting a 529 plan early in a child’s life can lead to significantly higher proceeds when college bills finally come due. The chart below shows the different amounts that result from contributing $250 per month to a 529 plan starting at various times in the beneficiary’s life, assuming 6% annual appreciation compounded monthly.

According to this analysis, starting your savings when your child is born generates more than six times the proceeds than beginning when your child enters high school (at age 14), and almost one and a half times the amount versus starting when your child enters kindergarten (at age 5). Much of this differential is due to compounding, which is more than twenty times higher if you open the plan at birth versus waiting until your child enters high school.

How We Can Help

All fifty states and the District of Columbia sponsor at least one type of 529 plan. Fidelity Investments was recently chosen by the State of Connecticut to administer the Connecticut CHET 529 program. Earnings in the plan grow tax-deferred, and qualified withdrawals from the plan are not subject to either federal or Connecticut income taxes.

For those considering opening a CHET plan, or even those that already have a 529 plan in place, we can assist you in:

- Setting up the account

- Determining your investment amount and schedule

- Selecting investments that suit your risk tolerance, timetable, and overall funding plan

- Coordinating and implementing tuition payments

- Ensuring that you realize the advantages of long-term tax-deferred growth and income tax reductions

- Monitoring and reporting on the performance of your portfolio and making sure you are on track to meet your funding goals

- Illustrating how the 529 plan fits within your broader financial plan

From account set-up to dispersing the proceeds when the time comes, we are your 529 partner, helping to ensure the plan achieves your goals.

Colin Dugan, CFP®