The World’s Factory is Exporting Deflation

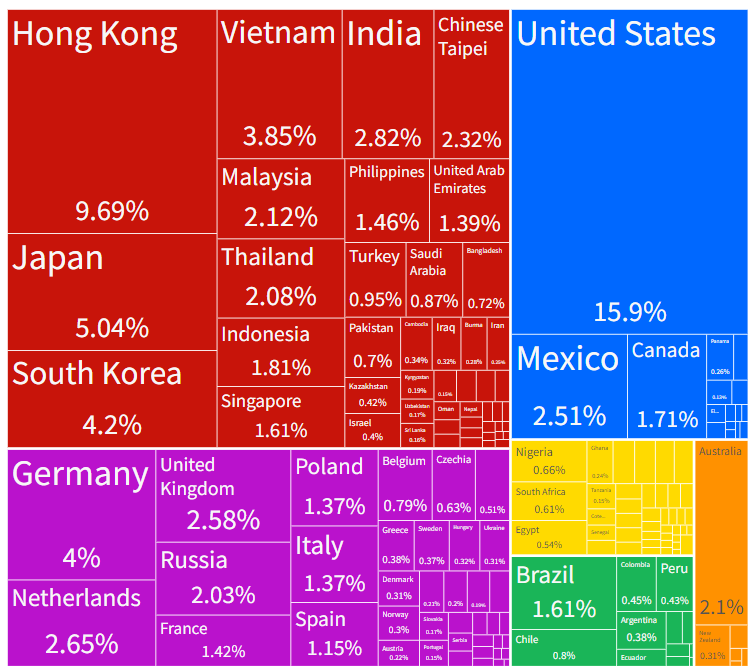

China sits atop the global supply and production chain as they are the largest manufacturer in the global economy and have been since 2009. Data from 2022 shows that China exported ~$3.59 trillion worth of goods to the rest of the world1. Below is an illustration of where China exports these goods.

Source: Observatory of Economic Complexity, 2021 data

Source: Observatory of Economic Complexity, 2021 data

For years, their economy flourished as they took over the world’s manufacturing through abundant cheap labor and a large supply of natural resources. This led to consistent 10% annualized GDP growth, making them the world’s second-largest economy.

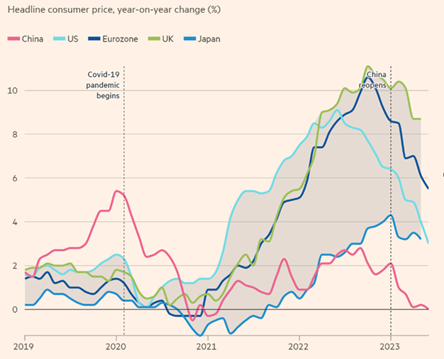

China’s mishandling of COVID-19 led to the “world’s factory” remaining closed while the rest of the world reopened. With the rest of the world open, the only things available to consume globally were goods. As mentioned above, China creates and ships goods. The supply/demand relationship was clearly out of sync. This contributed to some of the highest inflation numbers we have seen in decades, as shown in the figure below.

Source: Wind, Financial Times

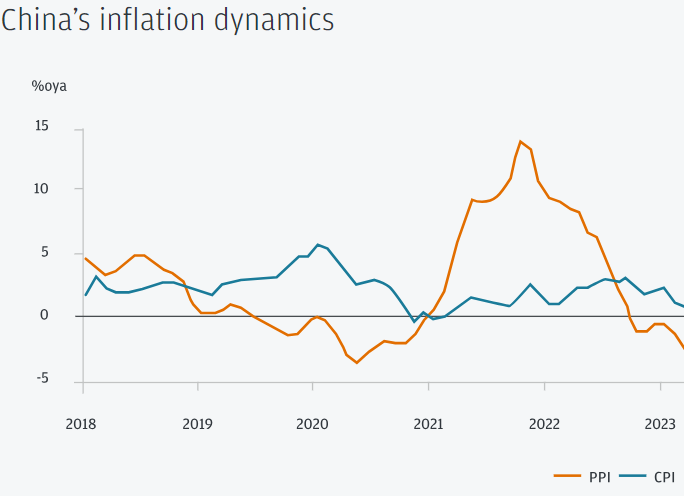

Fast forward to today. Supply chains are in sync, and global demand for goods is steady, but China’s largest consumer, its people, have slowed their consumption of everything. China’s inflation indicator (CPI) has turned negative, with a -.03% reading in July of this year, becoming the first and only major developed world economy to experience a year-over-year decline in consumer prices since COVID-19, as illustrated in the image below. This is what deflation looks like.

Source: NBS, J.P. Morgan; PPI = Producer Price Index; CPI = Consumer Price Index

Looking Ahead

The world has come to rely on China, and China now relies on the world for a significant portion of its economic growth. Global inflation is declining, and we think the next leg lower will be driven by deflationary exports from the world’s factory. Stay tuned!

Andrew Cialek, CFP®