Is Your Share Fair?

As the Presidential Election approaches, taxes are always a topic of conversation. Plenty of politicians and talking heads like to mention the wealthy aren’t paying their fair share. This raises questions about the progressiveness of our tax system and its effectiveness as a whole.

What does the data reveal? How do you define fair? Does the data agree with the premise? Are the wealthy truly paying less than their share? Additionally, what impact did the 2017 tax cuts have on different income groups?

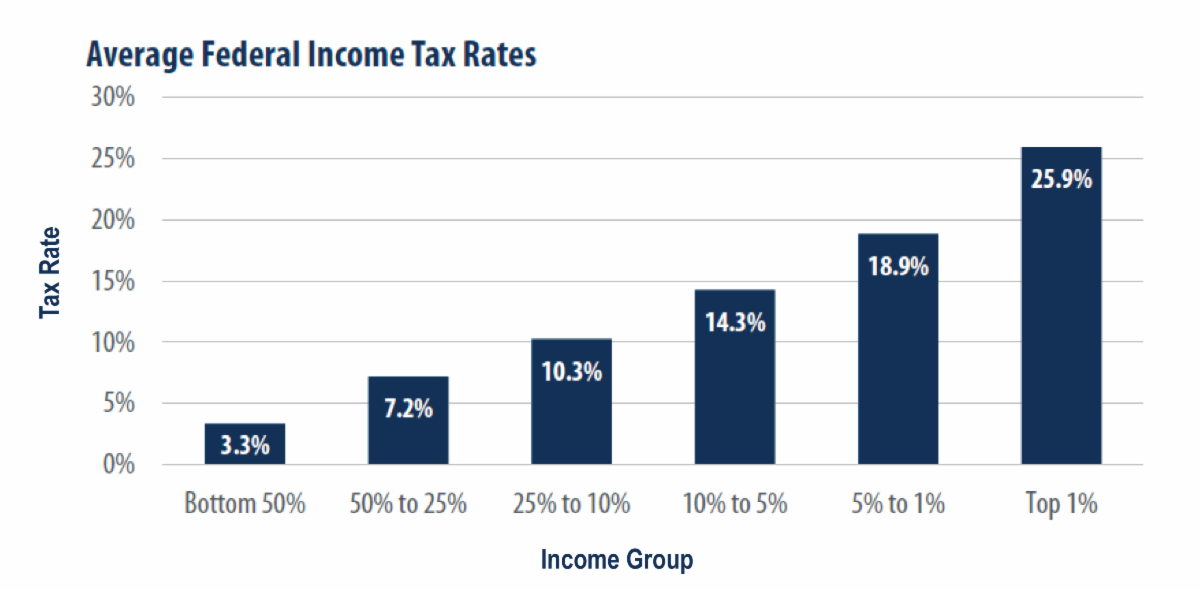

Source: IRS, First Trust Advisors. Data for 2021.

The IRS data from 2021 shows a progressive federal income tax system. Taxpayers in the top 1%—those with an adjusted gross income of $682,577 or more—paid an average tax rate of 25.9%. In contrast, individuals in the bottom 50%—earning $46,637 or less—had an average tax rate of only 3.3%. This significant difference indicates that the top 1% pay an average federal income tax rate more than eight times that of the bottom half of all taxpayers, challenging the notion that the wealthy are not contributing fairly.

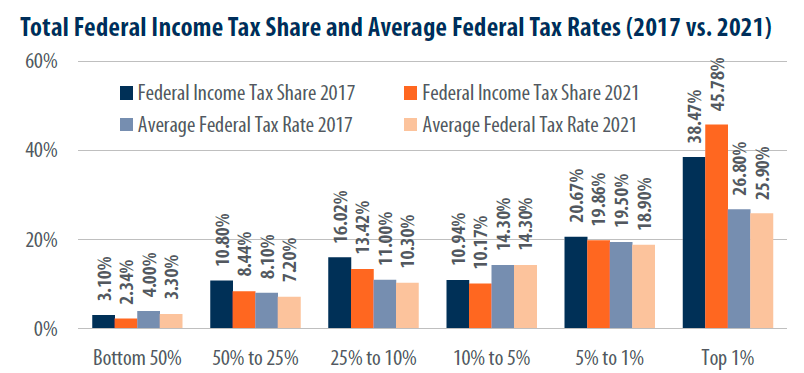

Source: IRS, First Trust Advisors. Data for 2017 and 2021.

The 2017 Tax Cuts and Jobs Act (TCJA) introduced various changes, including reduced tax rates, expanded tax brackets, increased standard deductions, and enhanced child tax credits. While there is debate about the benefits of these adjustments, the data indicates that tax burdens decreased on average across all income levels.

By 2021, average federal tax rates had declined for every income group compared to 2017, as shown in the chart above. Notably, the top 1% saw their share of total federal income taxes rise from 38.5% in 2017 to 45.8% in 2021, while the bottom 50% experienced a decline, dropping from 3.1% in 2017 to 2.3% in 2021.

These trends highlight a more complex picture of the impact of the TCJA on different income groups.

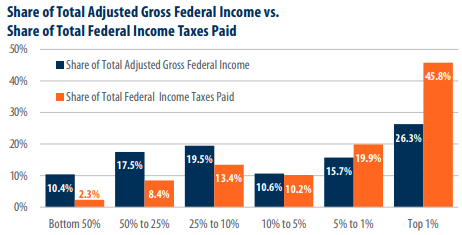

Source: IRS, First Trust Advisors. Data for 2021.

In 2021, the top 1% of taxpayers, approximately 1.54 million federal income tax returns, earned 26.3% of total adjusted gross income while accounting for 45.8% of the overall federal income tax burden, as shown in the chart above. Conversely, the bottom 50%, representing nearly 77 million tax returns, earned just 10.4% of total adjusted gross income and contributed only 2.3% of the federal tax burden.

Interestingly, the bottom 98% of taxpayers—around 150.5 million returns—earned 68.1% of adjusted gross income yet contributed only 46.2% of total federal income taxes, which is only slightly higher than that of the top 1%. This example highlights the complexities and disparities seen within the tax system.

Ultimately, the data shows a more nuanced view of tax contributions across different income groups than the media might suggest. The statistics indicate that the top earners do contribute a significant portion of federal income taxes, while the overall tax landscape reflects a complex interplay of rates and burdens across all income levels.

In the political arena, facts often morph into myths upon closer examination. Mind games are frequently at play, especially with those who don’t fact-check or look deeper. In our opinion, while ‘fairness’ is subjective, it deserves a clear definition. We believe that any discussion of increased income tax should also address how these funds will be allocated and explore ways to better balance government finances. After all, it’s the expenses that are the real issue.

Principle Wealth