Initial Public Offerings (IPOs) often attract significant attention, as they are seen as a potential avenue to financial success. While they are often presented as a great opportunity for investors, it's critical to understand why companies go public and what the IPO process entails.

Why Do Companies IPO?

Understanding why companies decide to go public is fundamental. Initially, private companies secure most of their funding from friends and family. As they grow, additional capital may come from venture capital (firms that specialize in startup companies) and larger private equity firms (firms that look to inject cash into companies for a return). However, when a company requires additional funding, and early investors seek to cash out on their investment, they turn to the public market in the form of an IPO. In essence, a company undergoing an IPO is often doing so to provide liquidity to early investors, insiders, and to accumulate additional capital for future growth plans.

The Hype Surrounding IPOs

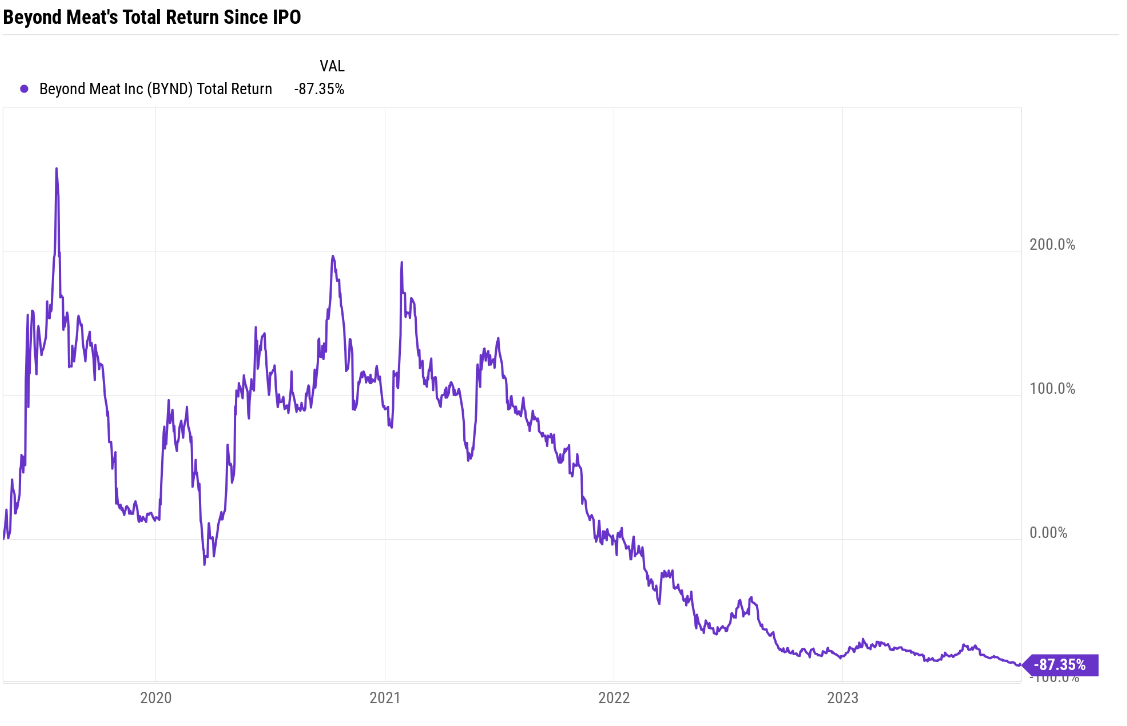

Media outlets often romanticize IPOs, highlighting the success stories of early investors in companies like Amazon, Google, and Facebook. However, these stories are exceptions, not the norm. Media hype can set unrealistic expectations for investors. Take Beyond Meat as an example, which received significant attention as a "greener" alternative to traditional meat products. Yet, since its IPO, the company has struggled to match the initial fanfare with its actual performance.

Source: YCharts

The Valuation Challenge

Before the initial public offering, the pricing of a company's shares typically involves investment banks marketing the shares to potential investors and the public. Initial prices can become inflated due to perceived demand, causing the shares to trade well above the company's tangible value. By the time the public enters the picture, share prices might have strayed far from reality, leaving investors to buy into the hype rather than the business's true fundamentals. It's essential to remember that investment banks hired to facilitate IPOs are paid to promote the company.

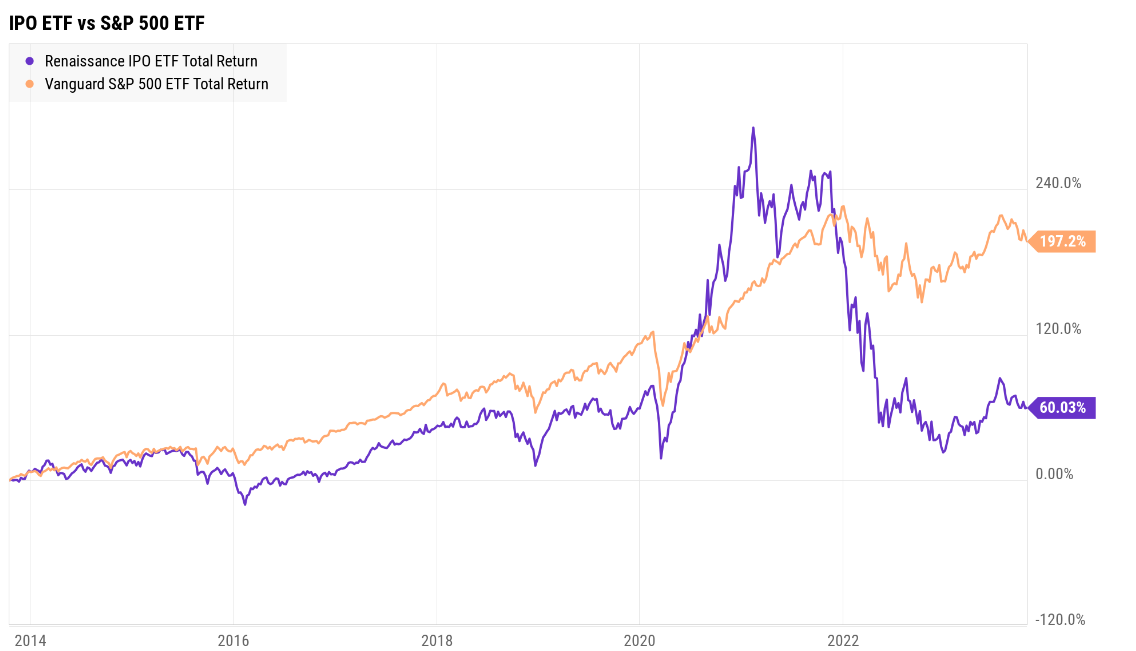

To emphasize this point, consider the figure below, which displays the total return of the IPO ETF over its lifetime versus an equivalent S&P 500 ETF. The IPO ETF represents a basket of recent IPO companies which are bought and held for three years and then sold for newer IPOs. As you can see below, the ETF significantly underperforms versus the S&P 500 over the long term with more volatility as well.

Source: YCharts

In Conclusion

IPO investing may sound promising, but it comes with its fair share of risks. To navigate this landscape successfully, it's crucial to maintain a healthy dose of skepticism, conduct thorough research, and adopt a diversified investment approach. If an opportunity seems too good to be true, it probably is.

Andrew Cialek, CFP®