The Tax Man Cometh:

Understanding Your Income Tax

Why did the taxpayer bring a ladder to the IRS office? Because he heard the tax rates were so high, he needed help reaching them! The United States employs a federal progressive tax system for personal income taxation. This system dictates that the tax rate someone is required to pay increases as the taxable income of an individual or household increases. The principle behind this system is based on the ability-to-pay concept, which suggests that those who earn more can afford to contribute a larger percentage of their income toward the nation's welfare. Is this system effective? Is that a fair concept? Should things change? You be the judge.

The Mechanics of Progressive Taxation

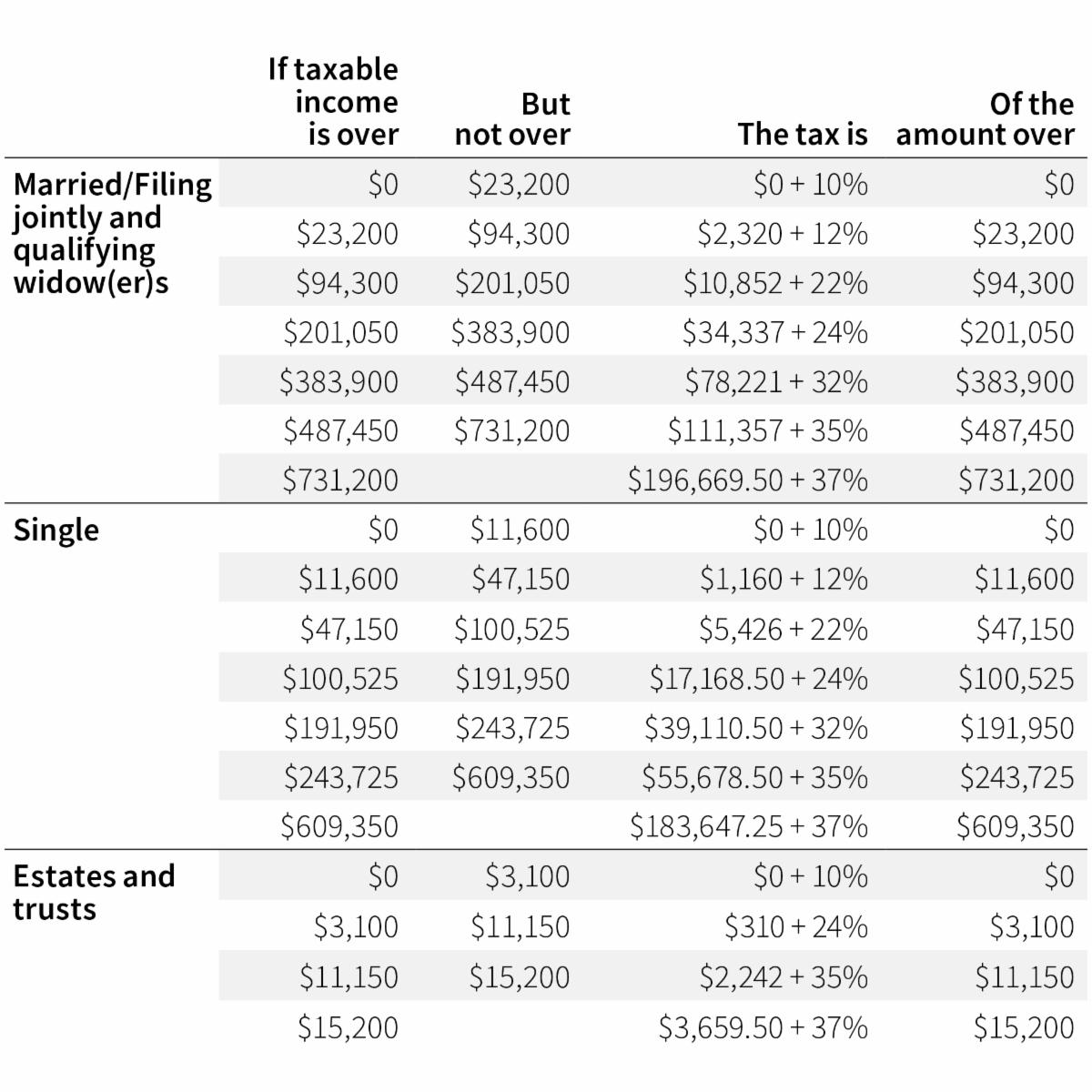

Source: Internal Revenue Service and Social Security Administration updates 2024

At its core, the progressive tax system divides income into segments known as tax brackets. Each bracket corresponds to a specific tax rate. For the 2024 tax year, for instance, these rates range from 0% on the lowest end of the income scale to 37% on the highest. It’s important to note that these rates apply only to income within their specific brackets, making the system "marginal." This means that if a taxpayer earns enough to cross into a higher tax bracket, only the income above the previous bracket's threshold is taxed at the higher rate.

Here's a simplified example: if a single filer earns $50,000, their first $11,600 is taxed at 10%, the income between $11,600 and $47,150 is taxed at 12%, and the remaining amount up to $50,000 is taxed at 22%. This tiered approach ensures that everyone pays the same rate on income in the same bracket, preserving fairness.

Impact on High-Income Earners

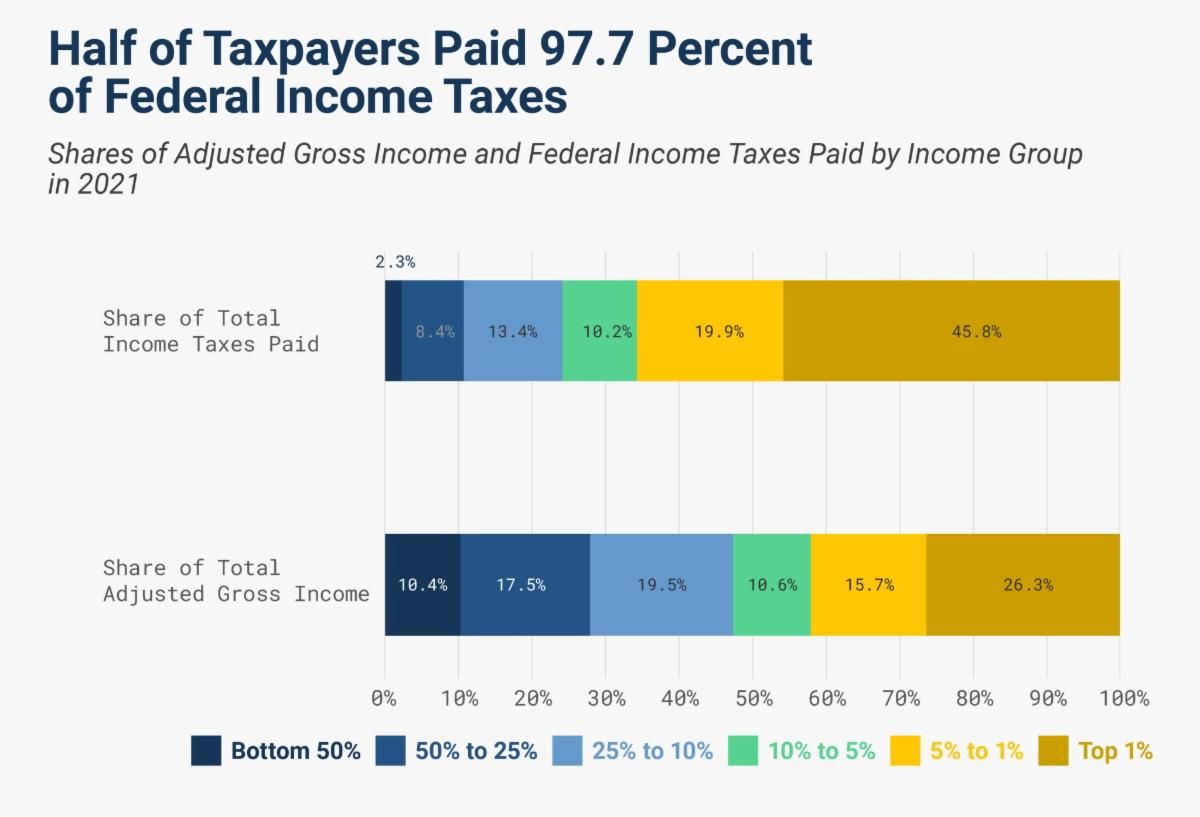

Source: IRS, SOI tax stats - individual statistical tables by tax rate and income percentile.

High-income earners, those in the top tax brackets, pay a higher percentage of their income in taxes compared to those in lower brackets. This system reflects the principle concept alluded to earlier: those with more significant financial resources have a greater capacity to contribute. For high earners, a significant portion of their income exceeds the threshold for the highest tax rate, resulting in a larger absolute amount of taxes paid. This distribution makes sense, assuming the funds are used to create an equitable welfare environment.

Additionally, taxpayers in the higher income brackets often have more complex finances, including capital gains, dividends, rental incomes, and possibly income from business activities, all of which might be subject to different rates and rules. Despite various deductions and credits that can mitigate tax liabilities, the progressive nature of the tax system ensures that their effective tax rate (the percentage of their total income paid in taxes) remains higher than that of lower-income earners.

Justification and Criticism

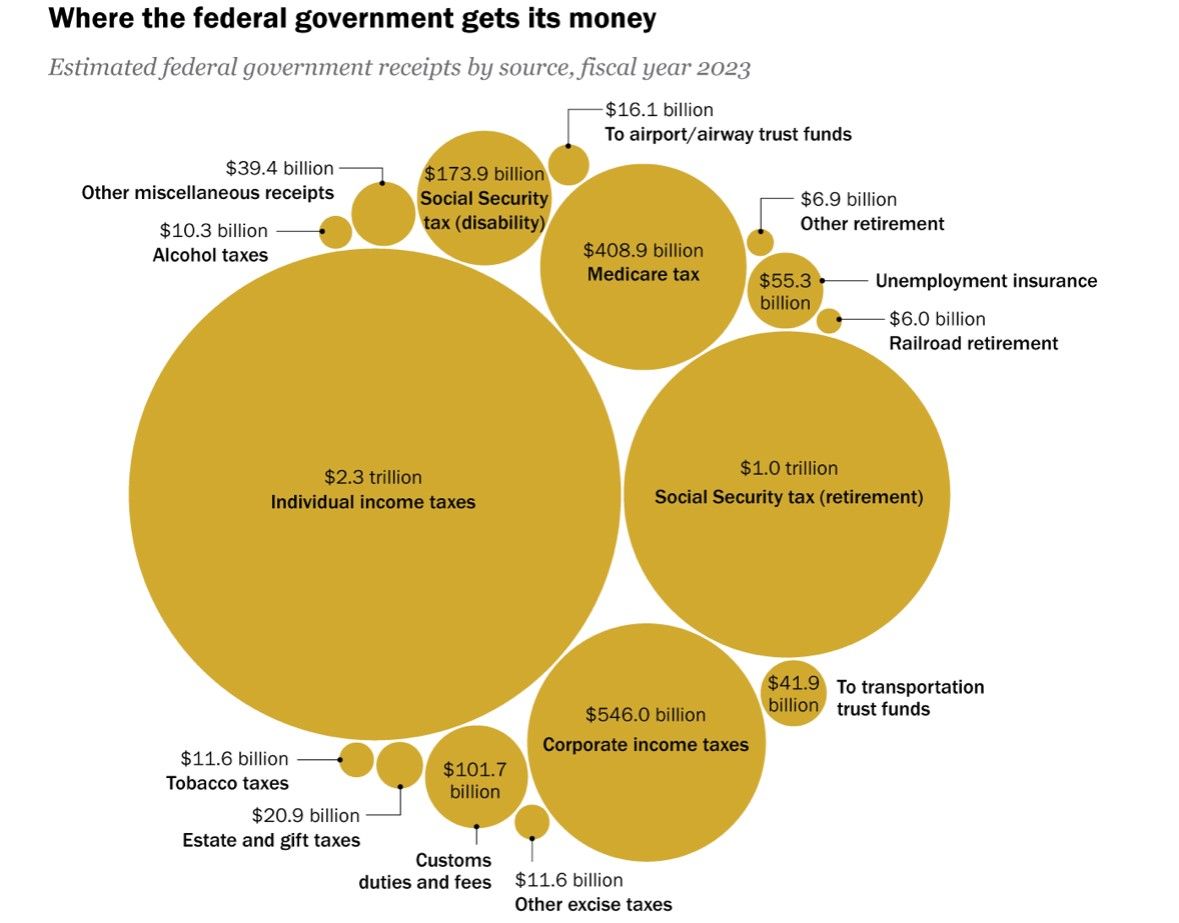

Note: Excise taxes to transportation trust funds and to airport/airway trust funds are mostly funded through taxes on motor vehicle fuel an airplane fuel, respectively. Source: Pew Research Center analysis of data from the Office of Management and Budget.

Proponents of the progressive tax system argue that it is a tool for reducing income inequality by redistributing wealth. By taxing higher-income individuals at higher rates, the government can fund programs and services that primarily benefit the lower and middle-income groups, such as education, health care, and social security.

Critics, however, argue that too much progressive taxation can discourage economic initiative and investment. They claim that it punishes success and reduces the incentives for earning a higher income, potentially leading to slower economic growth.

One often proposed alternative is the same percentage rate paid by all earners across all tax income levels. While the percentage would stay the same, the absolute dollar value would fluctuate, thus still leading high-income earners to pay more in total dollars than those at lower income levels.

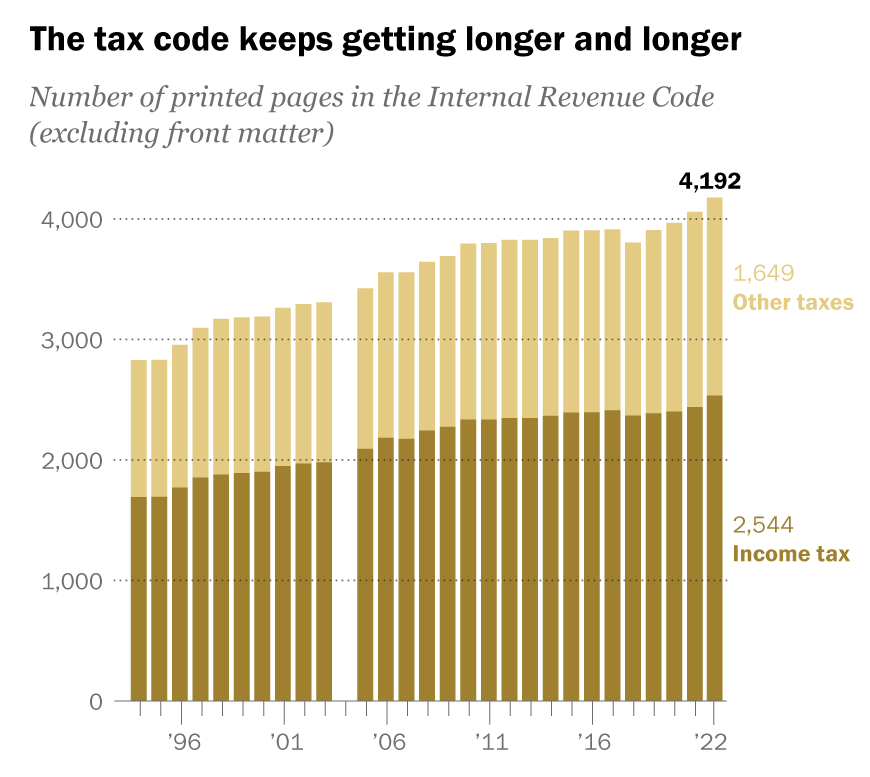

Note: Title 26 missing from the online version of the 2004 edition of the United States Code. Pages concerning both income taxes and other taxes were counted in both categories, so subtotals may not sum. Source: United States Code, via Govinfo.

The federal progressive tax system is a foundational element of fiscal policy in the United States, aimed at ensuring that taxpayers contribute to government revenues proportionately to their financial ability. While high-income earners pay a disproportionate amount of their income in taxes, this system is an attempt to balance the economic burden and ensure that those who can afford to pay more do so. This helps manage social progress and fund essential public services that support the broader society. Having a good understanding of how federal tax policy works is critical and plays an important role in the long-term plan for our clients. We will continue to stay diligent and up-to-date to make sure we can provide the best guidance when it comes to this complex issue.

Andrew Cialek, CFP®