Putting Student Loan Forgiveness in Perspective

Federal student loan payments were halted in March of 2020 in response to the pandemic, and the pause policy was extended nine times. Payments are finally resuming because further deferrals were banned as part of the debt-ceiling agreement reached in early June. After a three and a half year pause on federal student loan repayment, time is up. Interest begins to accrue again on federal loans as of the beginning of September, and repayment starts in October.

The Pause’s Effect on Households

Deferrals affected 43.2 million eligible borrowers1, about two-thirds of whom2 did stop payments. With the restart, those paused months will be tacked on to the end of the loan’s maturity, extending the repayment timeline for most.3 Some borrowers will find that their loan servicer changed in the interim and they have administrative catch-up to do.

The impact on their wallets will be the real shock. On average, student loan borrowers were repaying $200 to $299 per month in 20191, according to the Federal Reserve. For 3.5 years, they could save those extra dollars or spend them on discretionary items. About half of pause-eligible households1 took on other new debts during the pause, including mortgages and auto loans. Come October, it could be even harder for those borrowers to make loan payments than it was pre-pandemic.

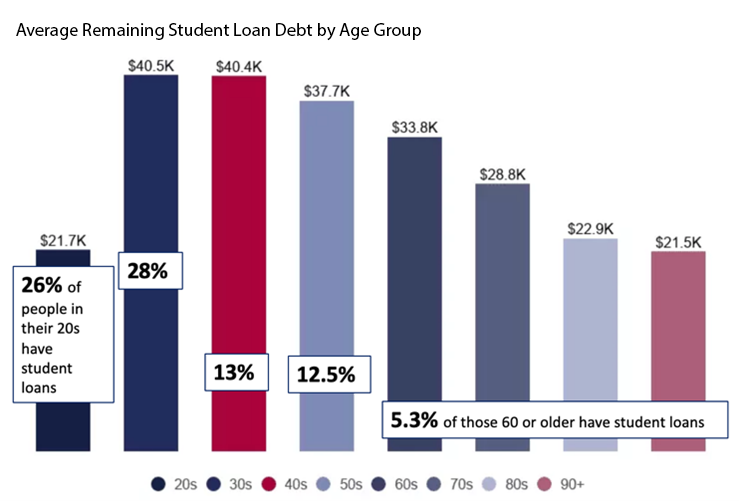

Source: Education Data Initiative

What It Means for the Economy

It is estimated that $185B in loan payments would have been made if there was no pause.1 That’s about $53B per year. Compared to annual U.S. consumer spending of $15.9T (2021), that’s just 0.3%. It may not seem like much – but it could be the difference between GDP growth and no growth. It also hurts certain demographics more than others. As you can see above, consumers in their 20s, 30s and 40s have the most student loan debt and are in their earlier earning years.

We expect a small adjustment to discretionary spending to make room for the restarting of student loan payments. This comes at a time when the average US consumer is saving money, net worth is near all-time highs, unemployment levels are very low, and we have a near-record amount of help-wanted ads. Through our lens, this healthy consumer backdrop does not support forgiveness of any kind.

Teaching the public that debt accumulation has no consequences is not only dangerous and unfair, but it also flies in the face of one of the most important global initiatives, financial literacy.

Andrew Cialek, CFP®