Crackdown in China

China recently put a dent on the booming educational tutoring industry, sending many high-flying stocks plummeting. This occurrence is not the first time we’ve seen China flex their regulatory muscle (see the Alipay IPO failure in 2020), and investors are currently trying to figure out if this most recent drop provides a long term buying opportunity for these promising businesses, or a stern warning that the Chinese state is always in power when it comes to their markets. This comes after an increasing push to look to China and other Asian emerging markets as areas of long-term opportunity and value in the investing world. The largest growing middle class plus ever increasing technology and wealth should create a recipe for success, but it is instances like the above that cause investors to pause.

Source: https://bloom.bg/3laxgpw

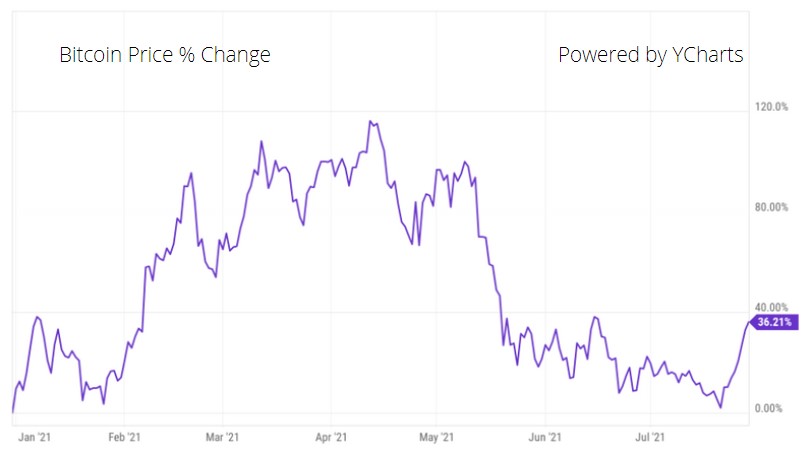

Bitcoin Bounce

Bitcoin and other Cryptocurrencies finally showed some life after slumping lower since May. As of this writing, Bitcoin’s price has appreciated 20%+ since July 23rd, and this recent gain has sparked life in many retail crypto traders looking to profit off the price movement once again. The past few months were seen as a period of consolidation in the price after reaching all-time highs earlier in the year. According to some sources from CoinDesk, this recent price spike was in part due to 2,000+ short positions liquidating in the market, cause a squeeze in the price over the short-term. Now that the price has started to come back up, we’ll see if there is enough retail and institutional support to continue this upward trend. Bitcoin is positive in 2021 overall.Source: https://bit.ly/2WoWS7G

Delta Wave Incoming?

This month was marked by the Delta variant of COVID-19 causing rapid increases in positive tests around the country after a strong start to the summer gave consumers good feelings that maybe we’ve gotten over the hump. Now, politicians and businesses alike are trying to figure out how to prevent further lockdowns from occurring. It seems the states with the lowest vaccination rates have the highest positive tests coming back, but these states also tend to be the ones that didn’t lock down as hard to begin with, so it may be hard for them to change course now. In states that have higher vaccination rates, the positive test results seem to be fewer, so the impact of the Delta variant may not be as harsh from a financial standpoint compared to last year. Time will tell, but the markets have certainly acted like this re-emergence could put a damper on a fun summer.Source: https://coronavirus.jhu.edu

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com