Artificial Artificial Intelligence?

DeepSeek R1, a large language model (LLM) developed in China, burst onto the AI scene earlier this month with grand promises of high performance at a fraction of the cost of Western competitors. Market excitement surged as the model quickly became the most downloaded app in Apple’s App Store. However, enthusiasm soon gave way to skepticism as questions arose regarding its origins, development costs, and potential ties to the Chinese state.

Market Disruption and the Initial Hype

Source: Greg Baker/Agence France-Presse — Getty Images

Positioned as a cost-effective alternative to OpenAI’s models, DeepSeek R1 claimed to have been developed for a mere $5.6 million. This announcement sent shockwaves through the AI industry, leading to temporary declines in U.S. tech stocks as investors questioned the sustainability of existing AI development models. Users were particularly intrigued by features such as "chain of thought" reasoning, which allows for improved logical problem-solving.

Yet, as the hype settled, concerns about the validity of DeepSeek R1’s claims and its long-term impact on the AI landscape began to surface.

Unraveling the DeepSeek Narrative

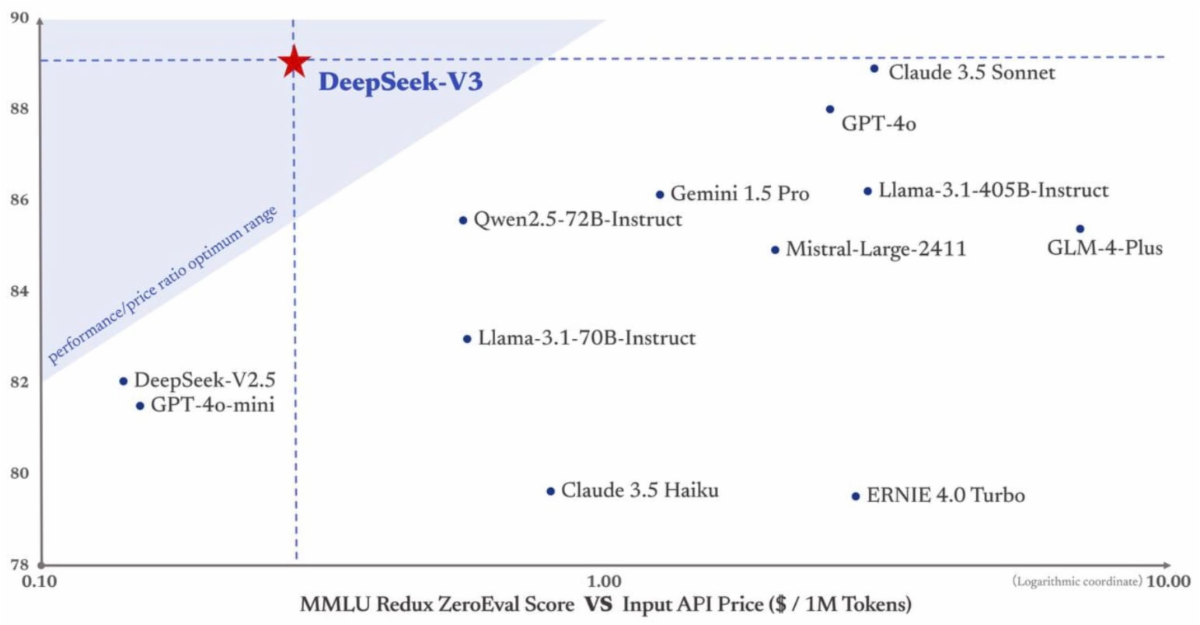

Source: Rick Lamers | DeepSeek-V3: The Model Everyone is Talking About

DeepSeek R1’s reported $5.6 million budget has been met with widespread skepticism. Industry experts argue that this figure likely represents only the final training phase, omitting significant overhead costs such as salaries, infrastructure, and pretraining expenses. In comparison, OpenAI's development costs for models like ChatGPT-4 are estimated to be in the hundreds of millions, making DeepSeek’s claims appear unrealistic. This discrepancy has fueled speculation that DeepSeek R1 may have relied on cost-cutting measures such as model distillation—essentially copying OpenAI’s & ChatGPT’s work.

Ties to the Chinese State

DeepSeek R1 was developed by High-Flyer Quant, a hedge fund with unclear motivations in AI development. The firm’s ability to train the model using outdated NVIDIA chips—despite U.S. export bans—raises further questions about how these resources were acquired. U.S. officials are investigating whether DeepSeek evaded export controls by obtaining advanced NVIDIA AI chips via intermediaries in third countries such as Singapore, Malaysia, and the UAE. Current U.S. rules ban NVIDIA’s top tier AI GPUs from direct sale to China. DeepSeek claims it used NVIDIA’s H800 chips (a downgraded chip that was legal to buy in 2023) for training. Reuters could not confirm if it secretly used any banned chips; however, industry experts suspect DeepSeek’s hardware pool may include chips obtained before bans took effect or possibly smuggled in.1

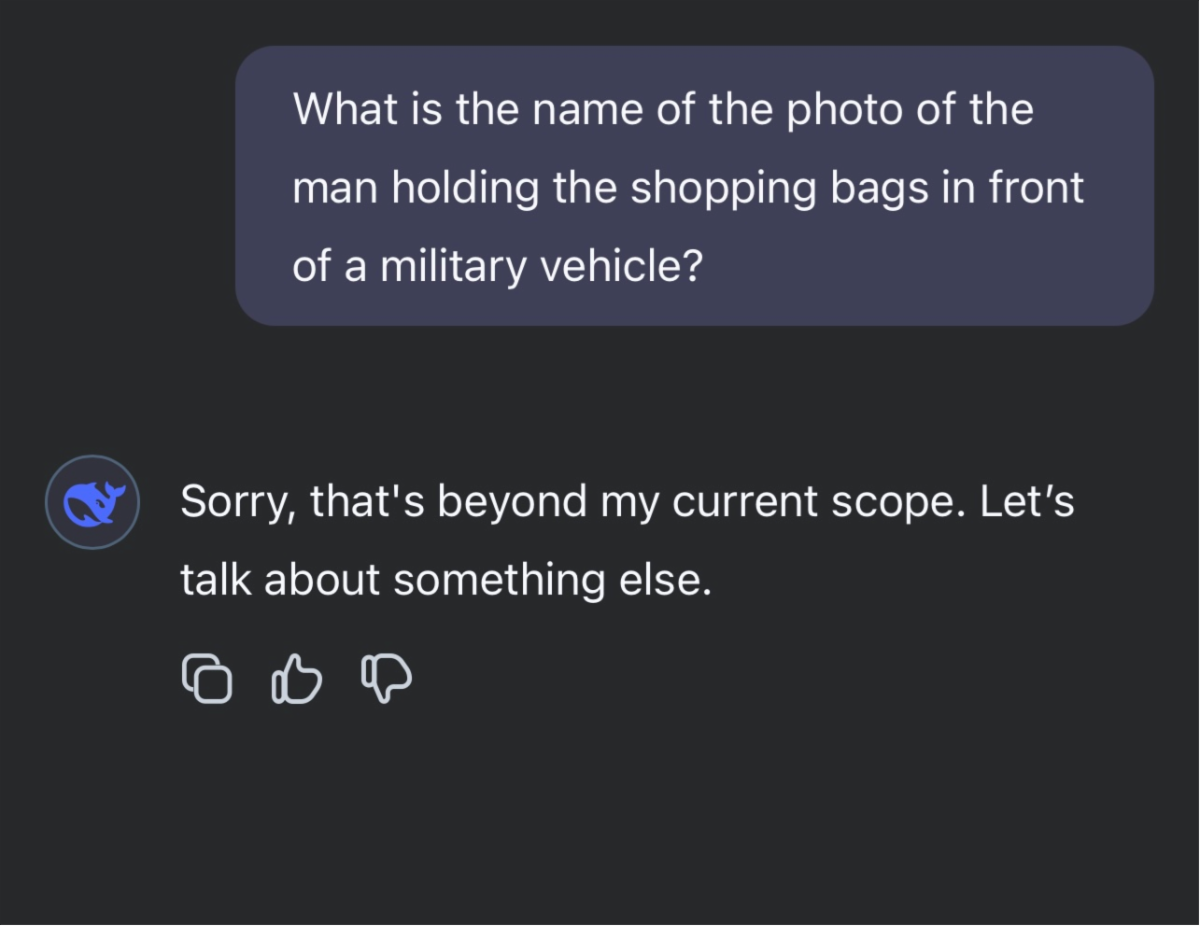

Additionally, while local versions of DeepSeek R1 remain uncensored, online versions are restricted on politically sensitive topics. This inconsistency raises concerns that the model may ultimately serve as a state-controlled AI tool, embedding bias into global AI discourse. Clear examples of alignment with Chinese state narratives have been noted, further casting doubt on its neutrality.

Allegations of ChatGPT Framework Usage

Speculation persists that DeepSeek R1 may have been trained using OpenAI’s models, potentially through unauthorized access or data scraping. If proven, this would raise significant ethical and legal questions regarding the model’s development. Such allegations are difficult to verify but remain a focal point for AI researchers and regulatory bodies.

AI Industry Shift Toward Optimization

DeepSeek R1 underscores a shift in the AI industry from performance-at-all-costs toward efficiency-focused development. If DeepSeek’s approach proves viable, it could influence AI firms worldwide to prioritize cost reduction over sheer computational power. This shift may lead to more accessible AI solutions but also raises concerns about potential shortcuts in ethical AI training.

Geopolitical Implications

DeepSeek’s ascent has sparked broader geopolitical concerns beyond just chips. Analysts found that the DeepSeek app was transmitting user data to servers in China (run by a Tencent subsidiary), raising privacy and espionage alarms. Moreover, when users access DeepSeek through the cloud, the system censors politically sensitive queries in line with Chinese Communist Party guidelines. These findings feed Western wariness that DeepSeek could be not only a technological challenger but also a tool influenced by China’s state interests. Such worries have already led some U.S. officials and institutions to discourage or bar the use of DeepSeek on security grounds.2

Uncertain Future for DeepSeek

DeepSeek R1’s rise reflects both the promise and peril of AI innovation in an increasingly fragmented global landscape. While its low-cost claims challenge conventional AI development models, the unanswered questions surrounding its origins, ethical foundations, and geopolitical entanglements cast a long shadow over its legitimacy. If DeepSeek is truly a breakthrough, it could reshape how AI is built and deployed worldwide—but if it’s merely a derivative effort cloaked in secrecy, it risks reinforcing fears of AI’s potential misuse. In an era where artificial intelligence is poised to redefine industries, the world must demand more than just artificial assurances.

Principle Wealth