The Velvet Rope Economy: Inside the World of Ultra-Luxury Goods

A few months back, we published an article on consumer health. The general agreement was that the consumer is maintaining good health, as seen in the recent holiday trends and shopping data. This month, we aim to delve deeper into a particular segment: the ultra-luxury economy. Economic cycles typically bring fluctuations in shopping habits, but this doesn’t hold true for the ultra-luxury consumer. Luxury brands have not only weathered economic challenges but have flourished despite prevailing contrary news.

Dynamics of Luxury Goods

Luxury goods transcend mere commodities; they embody symbols of status, quality, and exclusivity. Most luxury items command a premium price not only for their craftsmanship but also for the prestige they confer. In economic terms, these goods are known as Veblen goods. Interestingly, demand for these goods actually rises as prices increase, resulting in a remarkably resilient business model for brands that successfully appeal to this consumer audience.

Source: Pursebop.com

Most of these products have very limited production, preserving the exclusivity of the product itself. Some products, such as the Hermès Birkin Bag, are just flat-out unavailable to most. The ticket to play requires a well-documented and diversified purchase history with the brand, which demonstrates a willingness to spend to the level that warrants the exclusivity of the bag itself. Of course, you can buy this bag and most other luxury products on the resale market, but at a substantial premium to the actual retail cost. For example, at retail, the Birkin Bag might cost between $10,000 and $13,000, but most secondary markets will make them available for anywhere between $25,000 and $2,000,000, depending on the style, condition, and demand.

Source: Chrono24.com

A similar situation can be seen in the luxury watch market, specifically with brands like Rolex, Audemars Piguet, and Patek Philippe. When you look at a brand like Rolex, the supply/demand dynamics can be seen firsthand. Rolex cannot produce watches fast enough to satisfy current demand nor the pent-up demand that has been seen over the past few years. This has led to very elevated secondary market prices for many of their watches when compared to the retail price. Looking at recent price data, the Rolex Stainless Steel “Panda” Daytona model, pictured above, retails for $15,100 if you are lucky enough to be allocated one by the authorized dealer, keeping in mind the estimated wait time for this watch is approaching eight years! That same watch is available on the secondary market for upwards of $30,000 or a 100% premium to the retail price!

Historical Performance of Luxury Brands

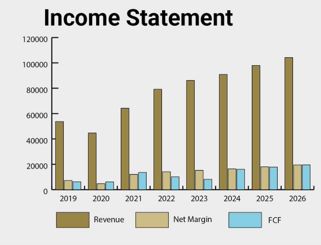

Looking deeper into the actual business performance of these companies, we see a pattern of consistent growth throughout most market cycles. This is illustrated below with LVMH (Moët Hennessy Louis Vuitton.)

Moët Hennessy Louis Vuitton Income Over Time

Source: Compounding Quality

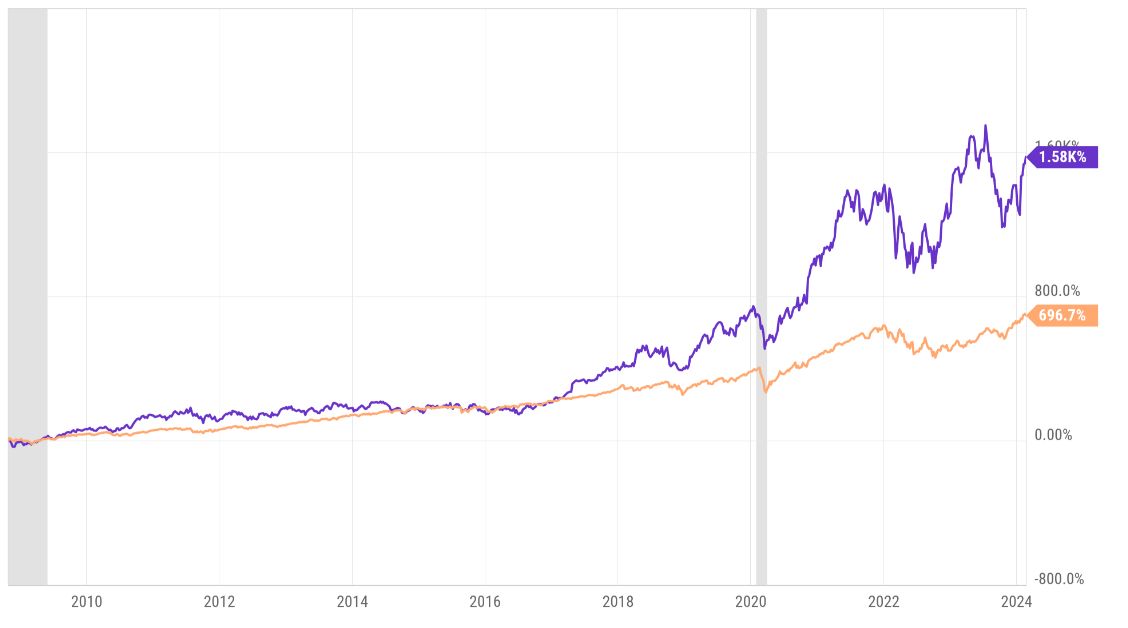

LVMH Stock vs. S&P 500 Over 10 Years

Source: YCharts

The ultra-luxury economy continues to thrive. While it does ride the wave of traditional economic cycles, it has historically been more resilient and more profitable than the traditional economy. We have a hunch that social media and its promotion of these ultra-rare, high-end goods will provide further support for this niche, ultra-exclusive segment.

Andrew Cialek, CFP®