A Wellness Check on Consumer Health

The holiday shopping season, characterized by a surge in retail spending, provides a unique opportunity to gain insights into the health and direction of our economy. The patterns of consumer spending during this period reveal valuable information about our economic state and our position in the market cycle. Despite contrary headlines, robust data from this year suggests that consumers are eager to continue spending.

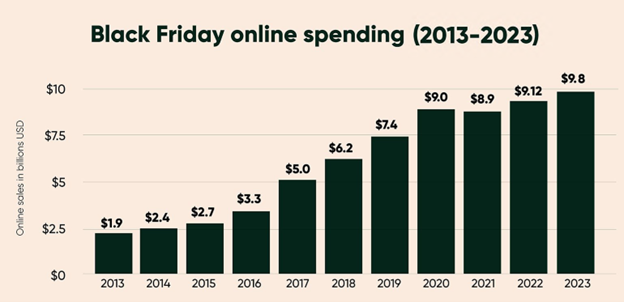

Source: Adobe, as of 11/30/2023

Retail spending, which constitutes a significant portion of our Gross Domestic Product (GDP), is a direct reflection of the health of the consumer. A robust holiday spending season often indicates that consumers have a positive outlook on the economy, fueled by factors such as low unemployment, stable inflation, and rising wages. Conversely, lower-than-expected holiday sales may signal consumer anxiety, often reflecting economic uncertainties.

The data received thus far is encouraging. According to Adobe, US online sales for Black Friday reached $9.8 billion, equating to about 7.5% year-on-year growth. In another study, Salesforce's early estimates showed nearly $70.9 billion was spent worldwide, during the post-Thanksgiving weekend, in stores and online.

Shoppers fight over TVs at an electronics retailer on Black Friday in 2018. Source: Cris Faga/NurPhoto via Getty Images

These figures seem to contradict some recent headlines. For instance, Walmart anticipated slower traffic this year. One plausible explanation is the convenience of online shopping. As the world moves on from the COVID-19 pandemic, it seems many are adopting online shopping to avoid the crowds and chaos of years past. It wasn't long ago when we would see footage of crowds camping out overnight in front of stores for the best deals.

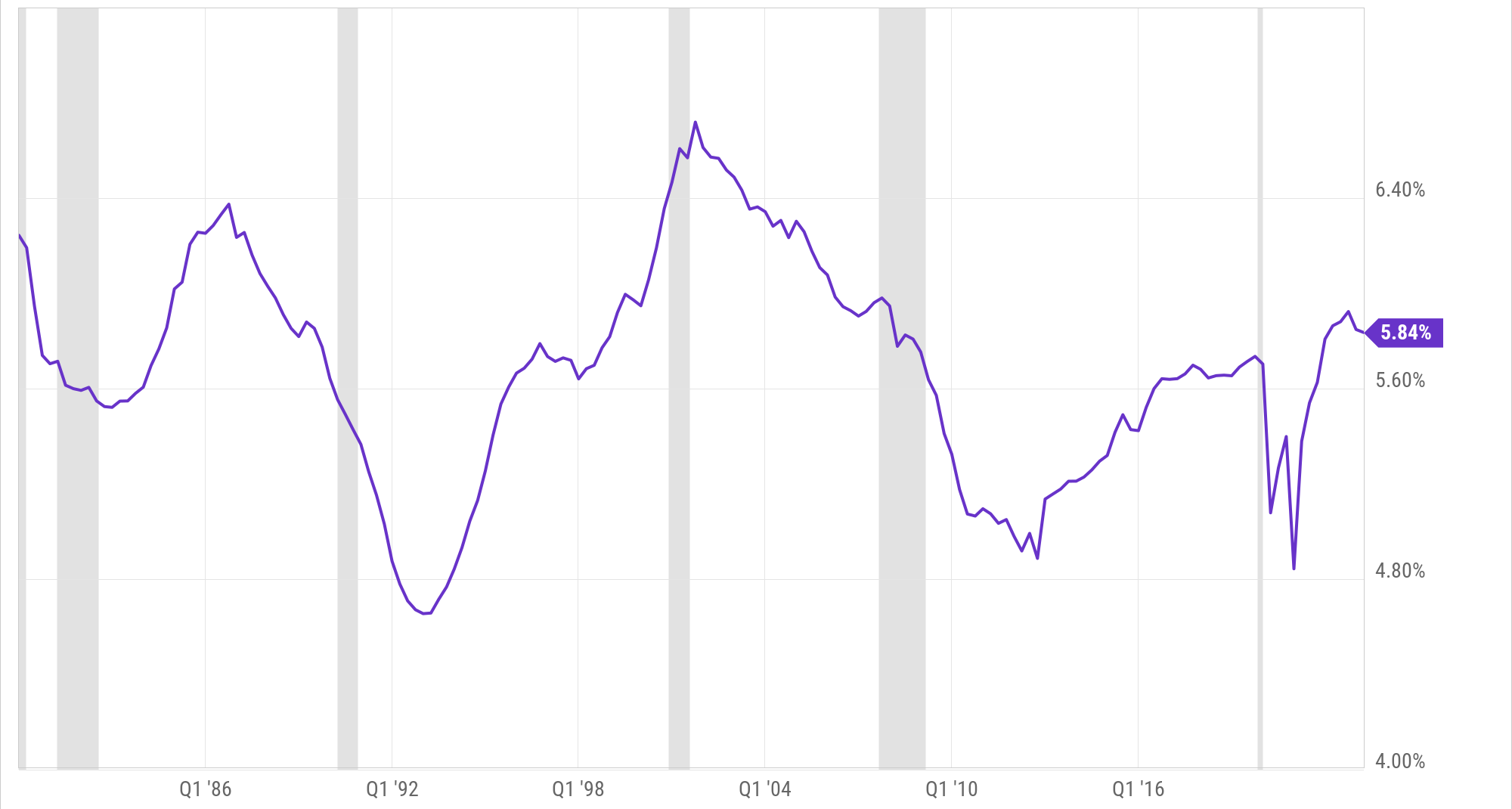

US Household Consumer Debt Service as a Percent of Disposable Income

Date Range: 03/31/1980 - 06/30/2023. Source: Federal Reserve

Headlines highlighting consumer credit debt reaching record levels can also be misleading. On the surface, this seems alarming, but the reality is more nuanced. Yes, absolute credit card debt levels appear high, but in proportion to overall net worth, deposits, and discretionary income, consumers are in a better position than previous years and decades. The stock market, housing market, labor, and wages are all up. While conditions are set to become tighter, consumers still have ample room to adjust over time.

In conclusion, the trends and figures from this holiday season hint at the resilience and adaptability of the consumer. Despite concerns and uncertainties, consumers continue to display significant spending power, indicating a robust and dynamic economy. Furthermore, the shift towards online shopping demonstrates a significant change in consumer behavior, which retailers must adapt to. High consumer credit debt remains a concern but must be viewed in a wider context overall.

Andrew Cialek, CFP®