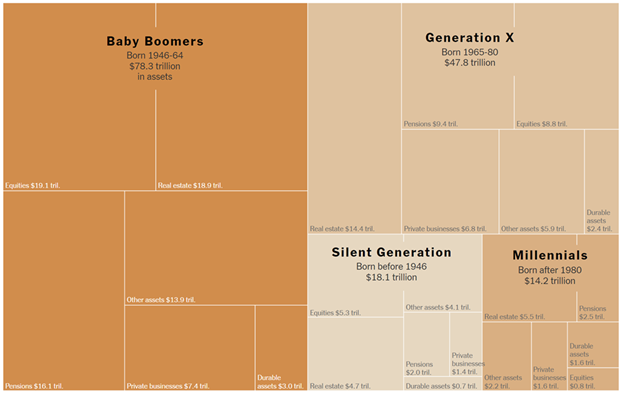

Generational Wealth Transfer

This month, we want the charts to do the talking. We’ve seen an increase in headlines about transferring this wealth from the Baby Boomers to the next generations. Let’s dive into the data and see how this may shape the economy and our world.

Source: Federal Reserve

Notes: As of the fourth quarter of 2022. The total amount accounts for liabilities, but the individual asset categories do not account for liabilities and do not add up to the $140 trillion total. The total assets when not accounting for liabilities is $158 trillion. Pensions include the present value of future benefits as well as the value of annuities sold by life insurance companies.

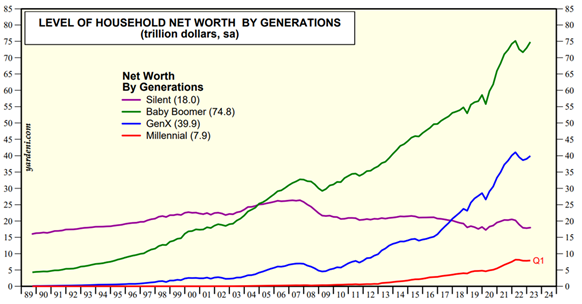

Looking at the chart below, the Baby Boomers have the lion’s share of wealth.

Source: Federal Reserve Board Financial Accounts of the United States, Distributional Financial Accounts (DFA).

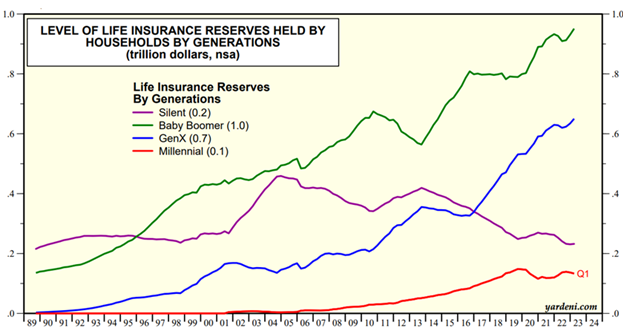

In addition to the 74.8 trillion in net worth referenced above, there is an additional $1 trillion in life insurance proceeds that will be transferred to the next generations.

Source: Federal Reserve Board Financial Accounts of the United States, Distributional Financial Accounts (DFA).

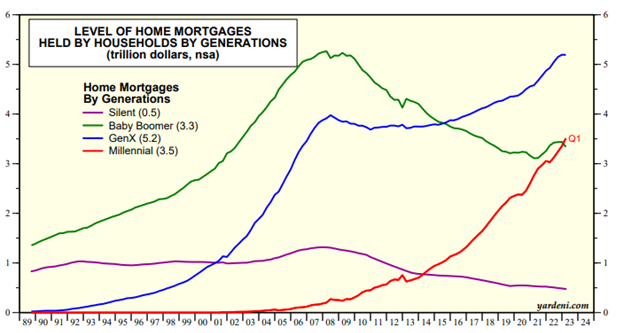

At the same time, GenX and Millennials are taking on bigger mortgages and payments as they try to grow their families.

Source: Federal Reserve Board Financial Accounts of the United States, Distributional Financial Accounts (DFA).

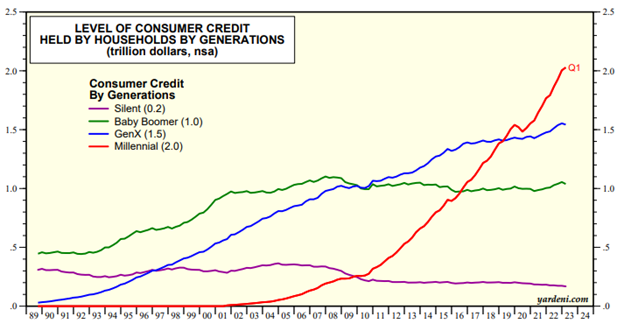

In addition to the higher mortgage balances, GenX & Millennials have a growing level of credit card, auto, and personal loans.

Source: Federal Reserve Board Financial Accounts of the United States, Distributional Financial Accounts (DFA).

This wealth transfer will shape and mold government, policies, taxation, and more in the coming decades. Does the government use this tidal wave of assets to restructure how estates are taxed? Does the increase in potential inheritance motivate or demotivate the younger generations? Only time will tell!

Andrew Cialek, CFP®