Optical Illusions

Source: Optics4Kids

Optical illusions occur when there's a disconnect between the eye and the brain, leading to a misinterpretation of what we see. Similarly, in investing, our natural instincts can mislead us, especially when navigating the complexities of the market. While investing is far more intricate than most optical illusions, the daily fluctuations in the market—and the complex data reported to us—can play tricks on our perception. In fact, many core investing principles are counterintuitive. Often, what feels like the right move can, at best, hinder progress or, at worst, cause significant setbacks in reaching financial goals.

Our goal is to help you become a more informed, sophisticated, and less emotional investor by learning from the mistakes others have made when they rely too heavily on instinct.

One of the most common mistakes we see is making quick judgments about an investment’s quality based on daily price changes, portfolio updates, or the gains and losses displayed in monthly statements or online portals. We refer to this as the “optics of investing,” much like "seeing how the sausage is made." The emotions triggered by watching these daily fluctuations can mislead you if not fully understood. Unfortunately, many investors—and even some professionals—don’t fully grasp what they’re seeing. But don’t worry; we’re here to help you become a smarter, more disciplined investor.

How Much Did I Make?

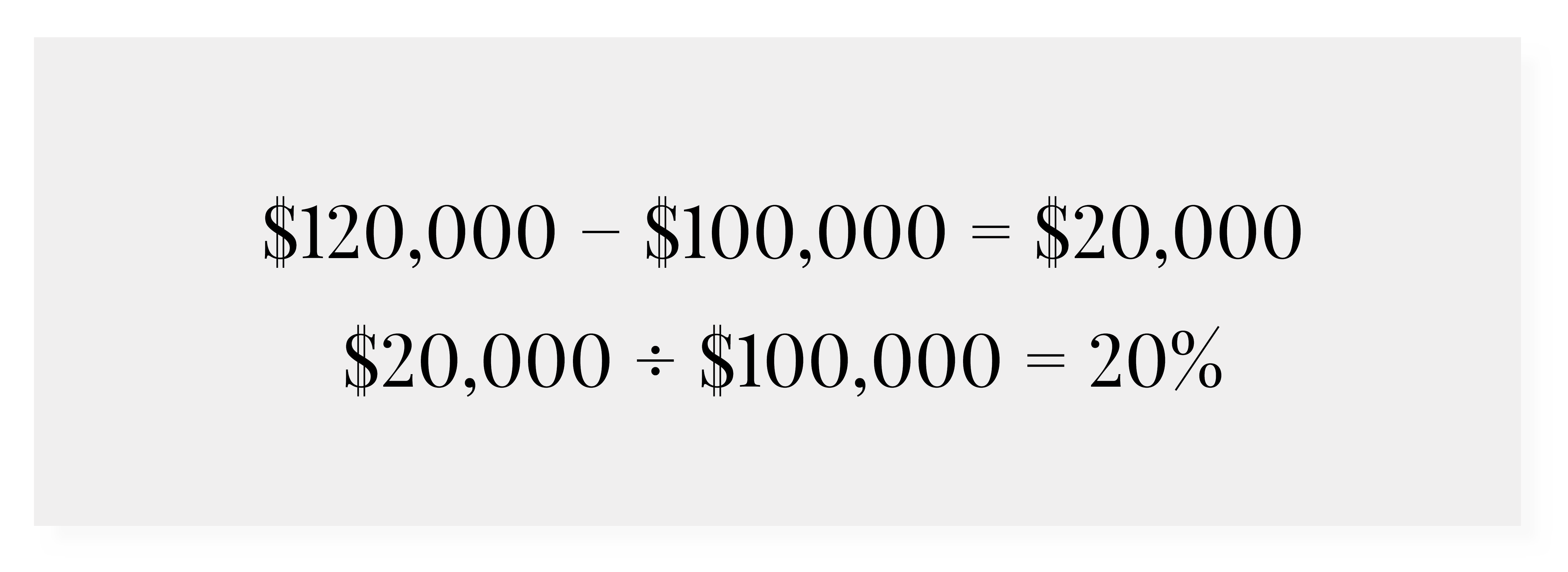

Let’s face it—you invest to grow your capital, and naturally, you want to know how your money is performing. Most people use a simple formula to calculate their return on investment:Basic Return Calculation = (Current Value – Beginning Value) / Beginning Value (or Cost Basis)

For example, if your shares in XYZ Fund are now worth $120,000 (including $20,000 of reinvested dividends) and your original investment was $100,000:

Follow the Rules

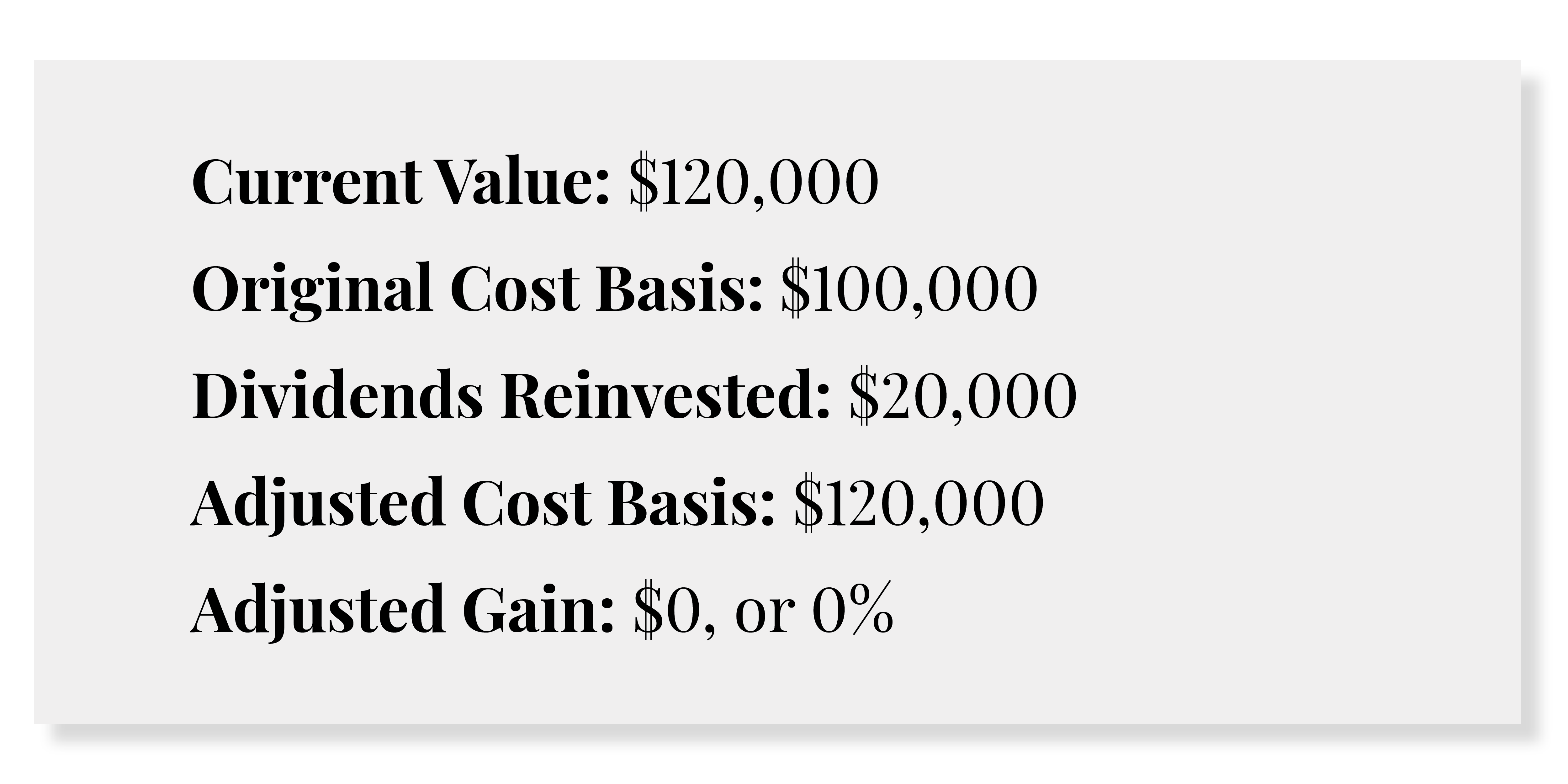

Let’s first explore how custodians are required to calculate and report this data, and how it differs from the basic formula above. In 2008, Congress passed the Energy Improvement and Extension Act, which included a provision requiring custodians to report the cost basis of certain securities to both the IRS and the taxpayer when a sale occurs. This reporting requirement, which was phased in starting January 1, 2011, gave institutions time to adapt.Custodians now track your purchases, sales, dividends, reinvestments, and more. This is where things get complicated. They also adjust your cost basis to reflect various transactions within each security and present this adjusted cost basis in tax forms, client statements, and online portals.

What Does This Mean?

You (or your accountant) no longer need to manually calculate and report gains or losses to the IRS—your custodian handles it for you. However, this also means that the gain/loss data reported to you is typically presented as an adjusted figure. So, about that simple math…not so simple anymore.Let’s revisit the same example above, but now incorporate dividend reinvestments. Custodians treat reinvested dividends as additional investments, which impact the cost basis, creating an adjusted cost basis:

This discrepancy occurs because custodial recordkeeping must account for dividends and other distributions, which require adjustments to the original cost. The more frequent the reinvestments, the more your cost basis changes.

Final Thoughts

As we approach the final quarter of the year, year-end distributions are upon us. This also means many adjustments to your cost basis. When reviewing your statements or checking your accounts online, it’s essential to understand this "optical illusion" in investing. With a bit more focus and a deeper understanding of the optics, you’ll better appreciate the long-term benefits of investing.If you have any questions or need further clarification, we’re always here to help.

Principle Wealth