Biden Chooses Powell

As we all settle down to enjoy the holiday season, one concern affecting the markets has been decided. On Monday, November 22nd, President Biden nominated Jerome Powell for a second term as the Federal Reserve Chair. This choice gave the market a more precise direction about the future, acknowledging that no major policy changes were on the horizon. The markets, however, are still waiting to hear more about the potential tapering from the Fed and significant rate increases. There are still several more positions Biden will need to fill before year-end, so with each nomination, the market will better understand what to expect moving forward.

Growth Struggles

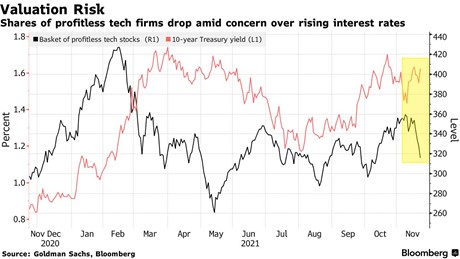

Growth stocks continued to struggle during the week of Thanksgiving as yields started to rise ever so slightly. The past few years have provided growth investors with fantastic results. While profitless growth companies have performed well, with very expensive valuations, those valuations only make sense if the interest rates stay low. Now that Biden has nominated Chairman Powell for a second term, the likeliness of rate hikes in 2022 increases in the bond market. This has caused the 10-year yield to rise, and on cue, these longer duration assets, such as non-profitable tech and growth, have dropped. While the future potential of some of these companies is still intact long-term, their short-term success could see volatility as investors look elsewhere. With year-end rebalancing, we may see investors take some profits, which could exacerbate these declines as investors exit their positions.New Variant Shakes Up Markets

In a sudden development of events, it seems a new Coronavirus variant has come to the surface from Africa. While much is still unknown about the variant, now called Omicron, the news was enough to shake the global markets on the shortened day after Thanksgiving, with some countries starting to inflict travel restrictions. While the “re-opening” stocks such as airlines suffered some of the biggest losses, the “work from home” group saw a significant bump on the day. Overall the drop looked severe, at least according to the media; however, the market came down to levels last seen at the beginning of the month.The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com