Private Equity: Balancing Opportunity and Risk

Private equity (PE) has become a buzzword in financial media, but what exactly does it entail? How does it differ from public equity (the stock market), and what risks does it pose to investors? Is it the future of investing or merely a product of today’s highly regulated, low-rate environment?

What is Private Equity?

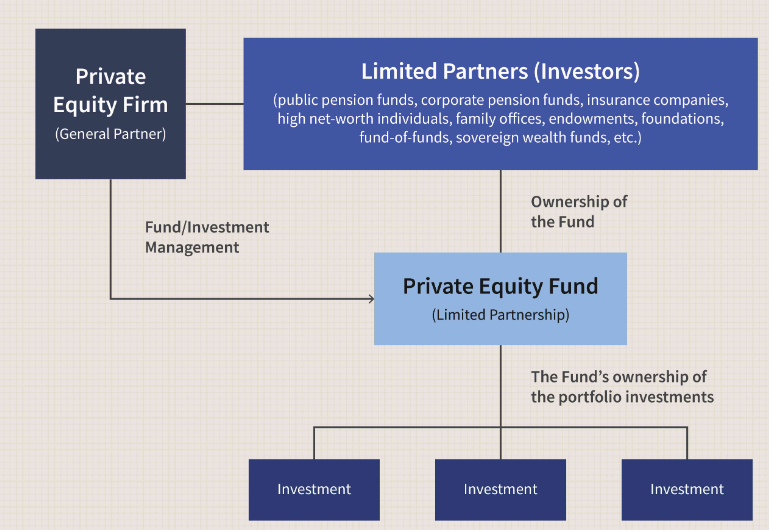

Source: Investopedia

Private equity (PE) refers to investments made in private companies or assets that are not publicly traded on stock exchanges. It involves funds typically managed by specialized firms or investors who pool money from various sources, such as high-net-worth individuals, pension funds, endowments, and institutional investors. Private equity firms use this pooled capital to acquire ownership stakes in private companies to achieve significant returns over time.

Private equity investments can take various forms, including leveraged buyouts (LBOs), venture capital (VC), growth capital, distressed debt, and mezzanine financing. Each type of investment has its own risk-return profile and investment horizon.

Managers of these funds benefit directly from profitability through carried interest tax benefits and lofty management and incentive fees.

The Risks

One of the main risks in private equity is the lack of liquidity. While some investors can afford to lock up funds for extended periods, for many, this lack of access to capital is a concern. Additionally, investing in private equity often means tolerating minimal transparency. With limited regulatory oversight, investors must rely on what the PE sponsor communicates about the investment’s value, demanding trust and patience.

What We're Watching

In recent years, private equity has seen a surge in investments and media coverage. However, rising interest rates pose challenges, particularly for companies with high debt levels. Moreover, as interest rates rise, business valuations tend to decrease, potentially impacting investment attractiveness.

Pricing is a central issue in private equity, given these investments’ limited transparency and liquidity. Bloomberg1 recently highlighted the challenges associated with pricing private equity investments and the risks involved. Typically, private equity firms report a stable net asset value until underlying transactions trigger adjustments to reflect real market value.

Assessing overall investment returns often requires a 7-10-year timeframe, as private equity funds must liquidate investments to distribute capital to shareholders. While daunting, this process is necessary for realizing returns.

At Principle Wealth, we prioritize liquidity, transparency, and investability for our clients. While private investments may diverge from these principles, they can still play a role in a well-diversified portfolio. However, understanding their unique characteristics and risks is crucial before considering them as investment options.

Andrew Cialek, CFP®