Buy Now, Pay Later

In recent years, Buy Now, Pay Later (BNPL) services have emerged as a popular payment option, enticing consumers with the promise of immediate gratification without the upfront financial burden. Companies like Afterpay, Klarna, and Affirm have capitalized on this trend, offering easy-to-use platforms that allow shoppers to spread the cost of their purchases over several installments. While BNPL schemes can seem like a convenient solution, they carry significant risks that can have long-term financial repercussions for consumers.

The Allure of Buy Now, Pay Later

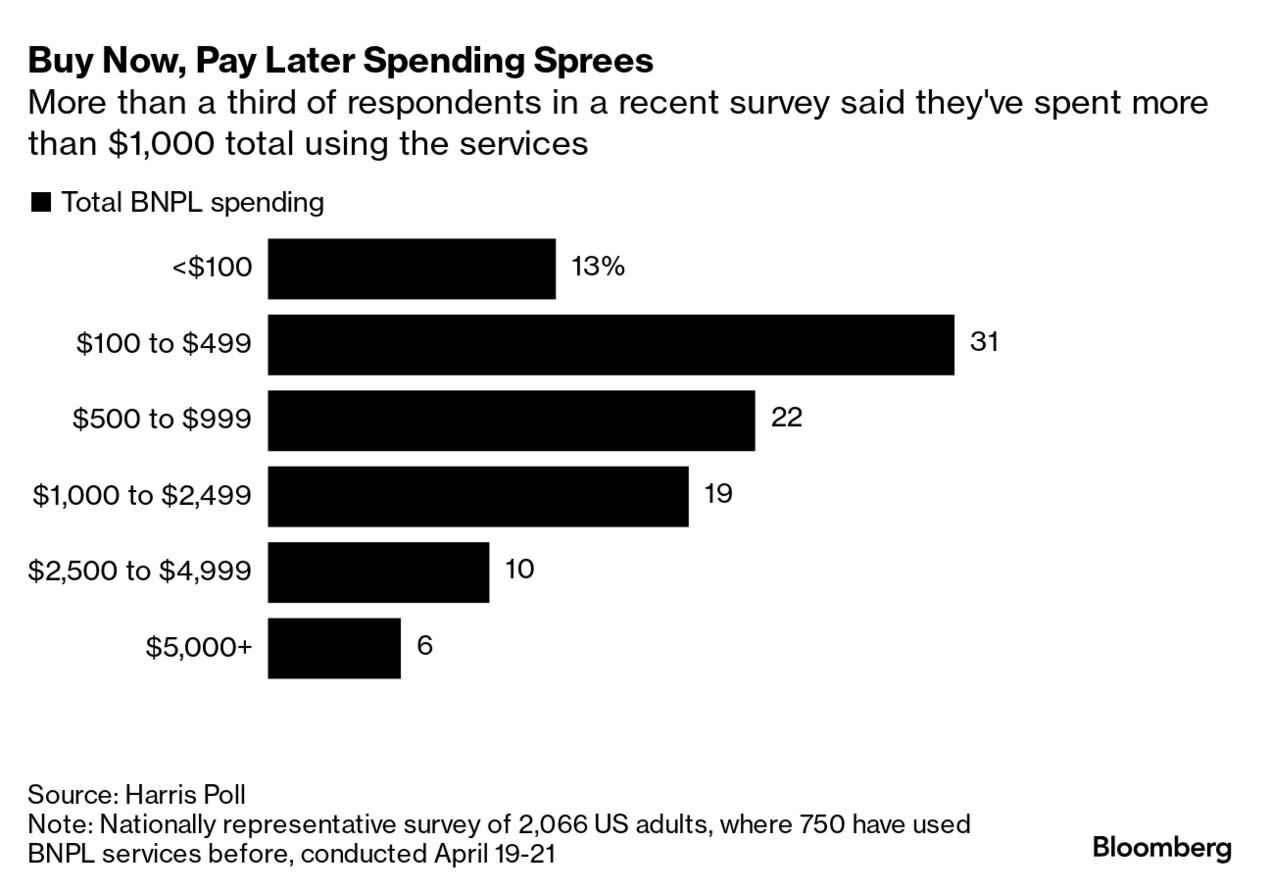

BNPL services appeal to a wide range of people, however consumers ages 35 and under currently make up 53% of "buy now, pay later" users.1 The process is simple: a shopper selects BNPL at checkout, often with minimal credit checks, if any, and agrees to pay for the purchase in a series of interest-free installments. This model can be incredibly enticing, especially for those who may not have access to traditional credit or who are wary of high-interest credit cards.

Source: Harris Poll

Note: Nationally representative survey of 2,066 US adults, where 750 have used BNPL services before, conducted April 19-21.

The Perception of Affordability

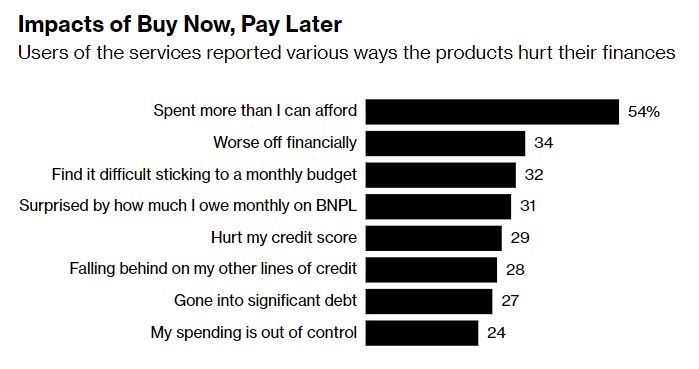

One of the primary dangers of BNPL programs is the illusion of affordability they create. By breaking down the total cost into smaller, more manageable payments, consumers may be lulled into a false sense of financial security. This perceived affordability can lead to overconsumption and impulse buying, as the immediate cost appears significantly lower than the full price of the item. Consequently, consumers may end up spending more than they can afford, accumulating debt that can quickly become unmanageable. According to Adobe Analytics2 from January through April of this year, BNPL drove $25.9 billion in online spending. BNPL drove 7.8% of all online sales through the first four months of the year – online spending totaled $331.6 billion for the first 4 months of this year, up 7% year-over- year.

Lack of Regulatory Oversight

Another significant concern is the relative lack of regulatory oversight compared to traditional credit products. BNPL services often operate in a gray area, avoiding some of the stringent regulations that apply to credit cards and loans. This lack of regulation means that consumers may not receive the same level of protection, such as clear disclosure of fees and interest rates, or the ability to dispute charges. Without these safeguards, consumers are at greater risk of falling into debt traps. Additionally, there are plans, like Pay-In-4 loans, that don’t show up on credit reports. This means when looking to take a bigger loan out such as a mortgage, the bank won’t know you have multiple payment plans already going unless they investigate your bank statement history.

Hidden Fees and Interest Charges

While many BNPL services advertise themselves as interest-free, they often come with hidden fees that can add up quickly. Late payment fees, account maintenance fees, and other charges can significantly increase the overall cost of using these services. If a consumer misses a payment or struggles to keep up with the installment schedule, they can find themselves facing steep penalties. In some cases, an initially interest-free purchase can end up costing more than if it had been financed through a traditional credit card. With an average APR* of 36.99% most BNPL plans are significantly more expensive than credit cards which range somewhere in the range of 20-24% APR.

Impact on Credit Scores

The impact of BNPL on credit scores is another area of concern. Although many BNPL providers do not conduct hard credit checks when approving a transaction, they may report missed or late payments to credit bureaus. This can negatively affect a consumer's credit score, making it more difficult to secure loans or credit in the future. Additionally, the ease of access to BNPL can lead to multiple concurrent payment plans, increasing the likelihood of missed payments and further damaging credit health.

Financial Stress and Mental Health

Source: Harris Poll

Note: Nationally representative survey of 2,066 US adults, where 750 have used BNPL services before, conducted April 19-21.

The financial stress associated with accumulating BNPL debt can also have serious implications for mental health. The anxiety of managing multiple payment schedules, coupled with the fear of falling behind and incurring penalties, can lead to significant psychological strain. This stress can affect overall well-being and quality of life, creating a vicious cycle of financial and emotional distress. Nearly 60% of financially fragile consumers have used BNPL five or more times a year, with nearly 30% of them conducting 10 or more BNPL transactions annually. Those with financial difficulties and those with the greatest unmet credit needs were the largest users of BNPL programs, accounting for one-third of the overall user base.

Conclusion

While Buy Now, Pay Later services offer a convenient and seemingly harmless way to make purchases, they come with hidden dangers that can have lasting financial and personal consequences. Consumers should be aware of the potential pitfalls, including the illusion of affordability, hidden fees, lack of regulatory protection, and the impact on credit scores and mental health. By approaching BNPL with caution and a clear understanding of the risks involved, consumers can make more informed decisions and avoid the debt traps that these programs can create.Principle Wealth

Sources: