Stay Home

Over the past two decades, the U.S. stock market's performance has been notably superior to that of the global stock market. This phenomenon can be attributed to a combination of economic, technological, and structural factors that have uniquely favored the United States. We will explore these areas to understand why these factors have led to such outperformance over time. Here’s a hint: Investing in the best companies, regardless of domicile, is a winning strategy over time…and those companies happen to be in the U.S.

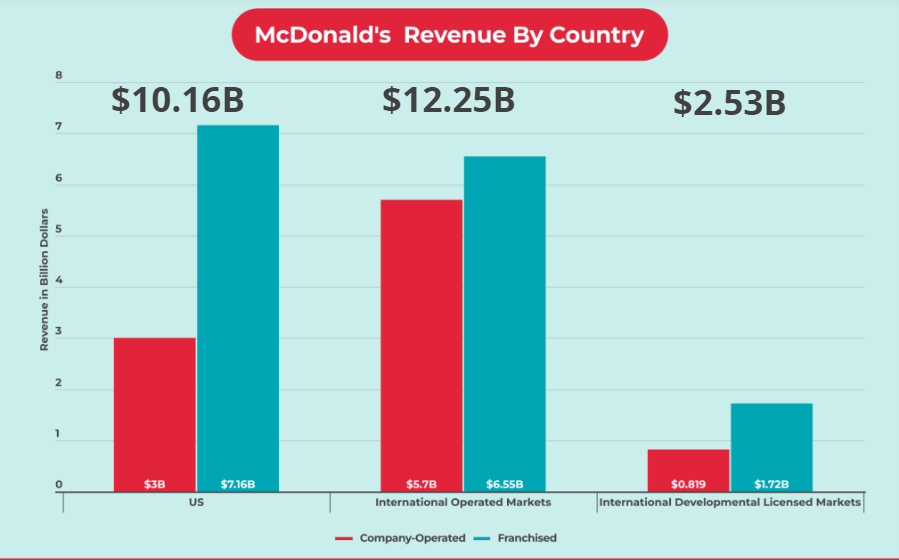

U.S. vs. The World (Cumulative Return Since 2011)

Source: YCharts

One of the most significant drivers behind the U.S. stock market's superior performance is the country's dominance in the technology sector1. Giants like Apple, Google, Amazon, and Microsoft have not only revolutionized the consumer and business landscapes but have also brought substantial returns to investors. The S&P 500, often used as a barometer for the U.S. market, is heavily weighted towards these tech behemoths. As technology increasingly becomes the backbone of the economy, the U.S. market's heavy tech exposure continues to be a boon.

When comparing Europe and other developed international markets, the exposure to technology is not as prominent as in the U.S. The developed international markets have greater exposure to slower growth sectors like Financials and Energy, which tend to lag Technology over time. The U.S. economy is growth-focused, diversified and has less of a regulatory burden when compared to Europe and other large developed foreign economies. Another long-term contributor to these changing trends is and was the push toward socialist behavior and policy in the Eurozone.

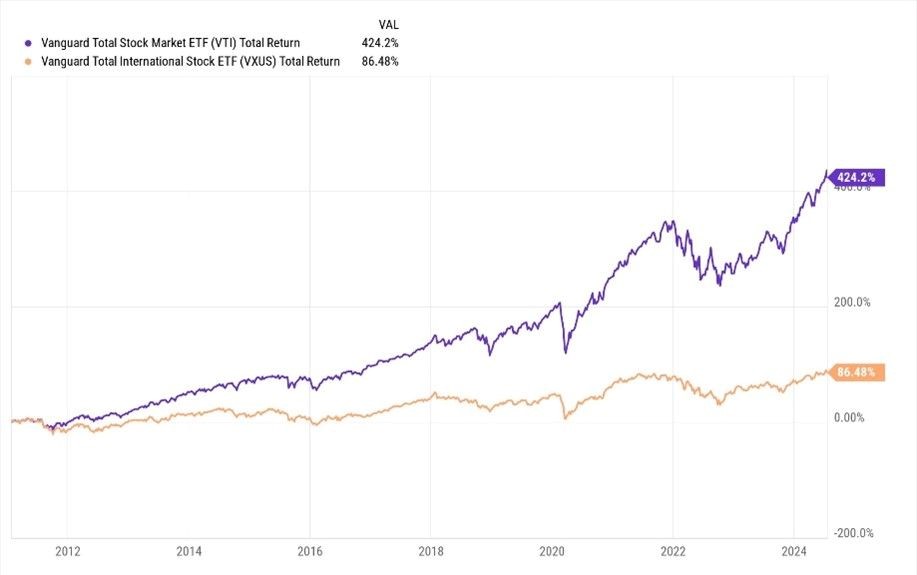

Share of GDP spent on R&D Worldwide by Region (2023)

Source: Statista 2024

Additionally, what a country spends on research and development (R&D) generally correlates to its overall economic growth. According to the European Union, its goal of R&D spending is three percent of Gross Domestic Product (GDP), but it’s fallen closer to two percent historically. As seen in the chart above, this is much lower than North America’s, which has led to lower growth in comparison over the past decades.2

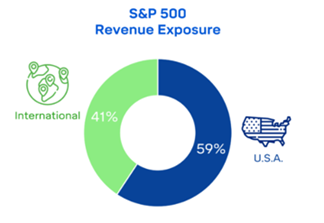

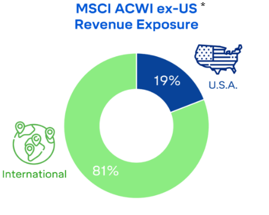

In prior decades, exposure to foreign-domiciled companies was the only way to gain access to the foreign consumer. Globalization over the past 30 years has changed that. What were once the largest U.S. companies are now the largest global companies. The U.S. investor can get global access without having to go overseas. As seen in the figures below, 41% of the S&P 500’s revenue recorded comes from outside the U.S.A.

Source: FactSet, Revenue exposure by Country/Region. Based on revenue over the last 12 months.

*MSCI ACWI ex-US = Morgan Stanley Capital International Indices All Countries World Index without U.S.

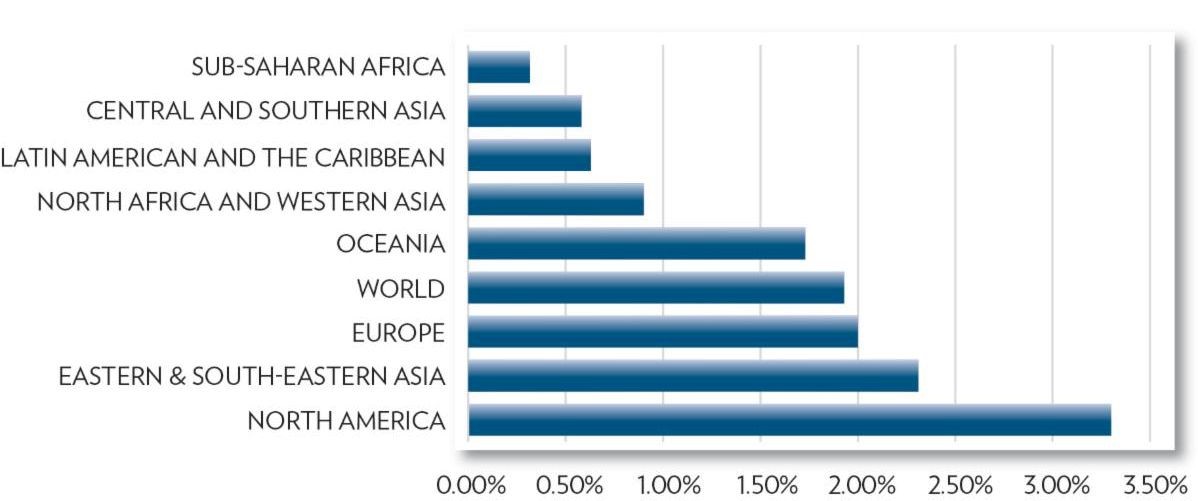

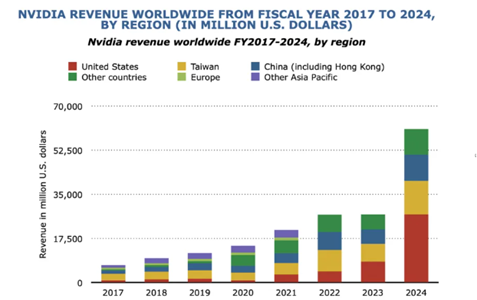

Taking a closer look below at the revenue exposure of two of the largest and most popular companies in the U.S., growth-oriented Nvidia and the more value-oriented McDonald's, we can see that both derive a large overall percentage of their revenue outside the U.S.

Note: Worldwide, FY2017 to 2024. Source: Nvidia

Source: FourWeekMBA

U.S. companies, with their extensive international operations and exposure, provide investors with an effective gateway to global markets. This integration not only enhances the growth potential of U.S. stocks but also simplifies the process of investing globally. Investors looking to capitalize on global economic trends might find ample opportunities within the U.S. market, making the case for a domestic focus in a globally connected world stronger than ever.

At Principle Wealth, we challenge the traditional views of asset allocation. Rather than focusing on owning everything, everywhere, all the time, we believe our investors are best served when allocated to the highest-quality companies regardless of domicile.

Principle Wealth