Be a Goldfish

Source: Apple TV Plus

Ted Lasso, the beloved character from Apple TV, once advised a struggling player to “be a goldfish.” Why? Because a goldfish is believed to have a ten-second memory, allowing it to quickly forget negative experiences and move forward. This metaphor serves as a powerful reminder to let go of short-term setbacks and approach the future with a clear, focused mind.

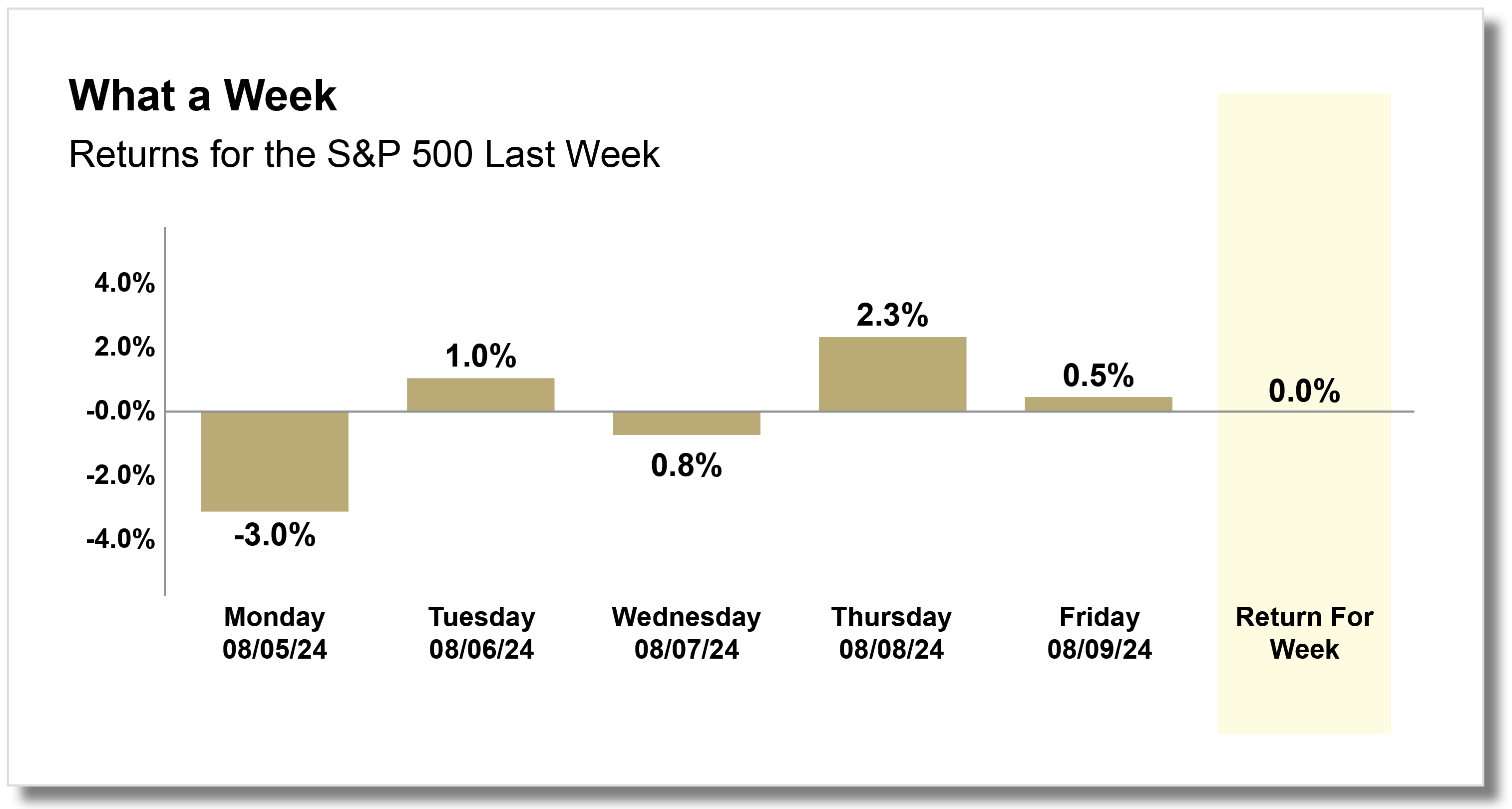

In the world of investing, adopting a similar mindset is crucial. Financial news outlets often sensationalize market movements with alarming "breaking news" headlines designed to grab attention and generate fear. A perfect example is the week of August 5th, 2024, which began with predictions of market collapse. Yet, by the week's end, it was as if nothing had happened.

Source: CNBC

Source: CNBC

Source: Carson Investment Research 08/09/2024

Source: Carson Investment Research 08/09/2024

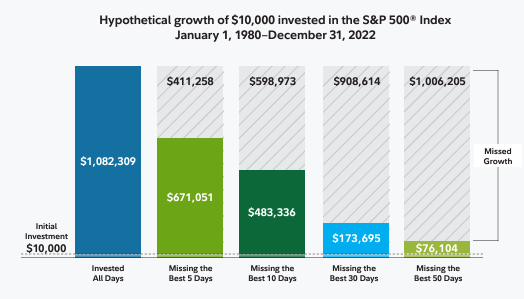

Over the past few decades, the investment landscape has transformed dramatically. Gone are the days when investors routinely held onto securities for the long term, patiently riding out market fluctuations in pursuit of sustainable returns. Today’s investment world is characterized by shorter time horizons, with investors increasingly chasing quick gains and rapid exits. As the charts below demonstrate, patience and the ability to endure short-term market turbulence often lead to superior results.

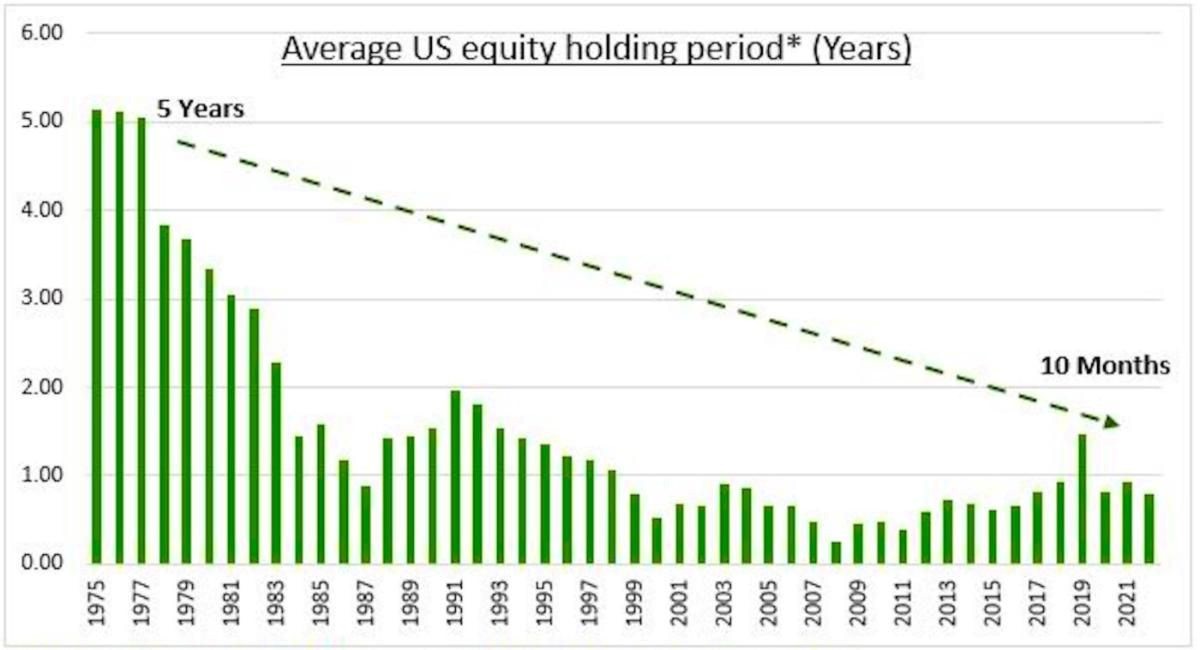

Source: Seeking Alpha

The rise of high-frequency trading, algorithmic systems, leveraged financial instruments, and day-trading websites has enabled investors to react instantly to market movements, often holding positions for mere seconds or minutes. The proliferation of online trading platforms, coupled with the constant stream of financial information and media opinions, has further fueled this behavior, empowering investors to make decisions with unprecedented speed. The gamification of investing has only intensified this shift, as illustrated by the accompanying chart showing how holding periods have dramatically shortened over time.

Source: WFE, IMF. *NYSE and NASDAQ market capitalization divided by total turnover value.

Source: WFE, IMF. *NYSE and NASDAQ market capitalization divided by total turnover value.

The greatest investors have long advocated for the virtues of staying calm and patient under pressure. Warren Buffett famously said, "The stock market is a device for transferring money from the impatient to the patient." We believe that superior returns are a byproduct of good behavior over extended periods of time. When combined with high-quality investments and a strategy aligned with your goals, the ability to "be a goldfish" emerges as a vital tool for success.

Principle Wealth