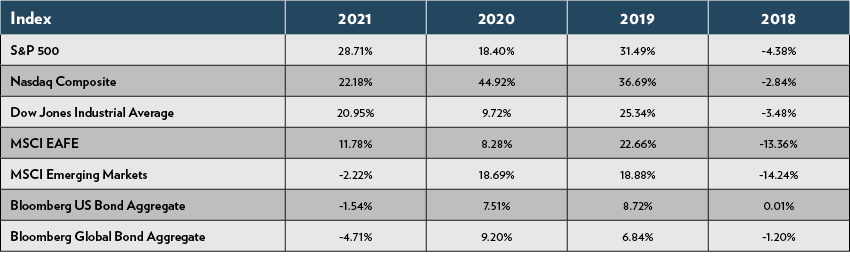

This year had its struggles, but all major domestic equity markets finished higher in the end.1 While uncertainty was common throughout the year, the market remained fairly calm and did not see many dips. The easing of COVID-19 restrictions led to more of the economy reopening, while government stimulus programs helped keep household and corporate balance sheets healthy. Strong consumer demand across the states kept sustained pressure on supply chains, home prices continued to climb, and unemployment declined to almost pre-pandemic levels.

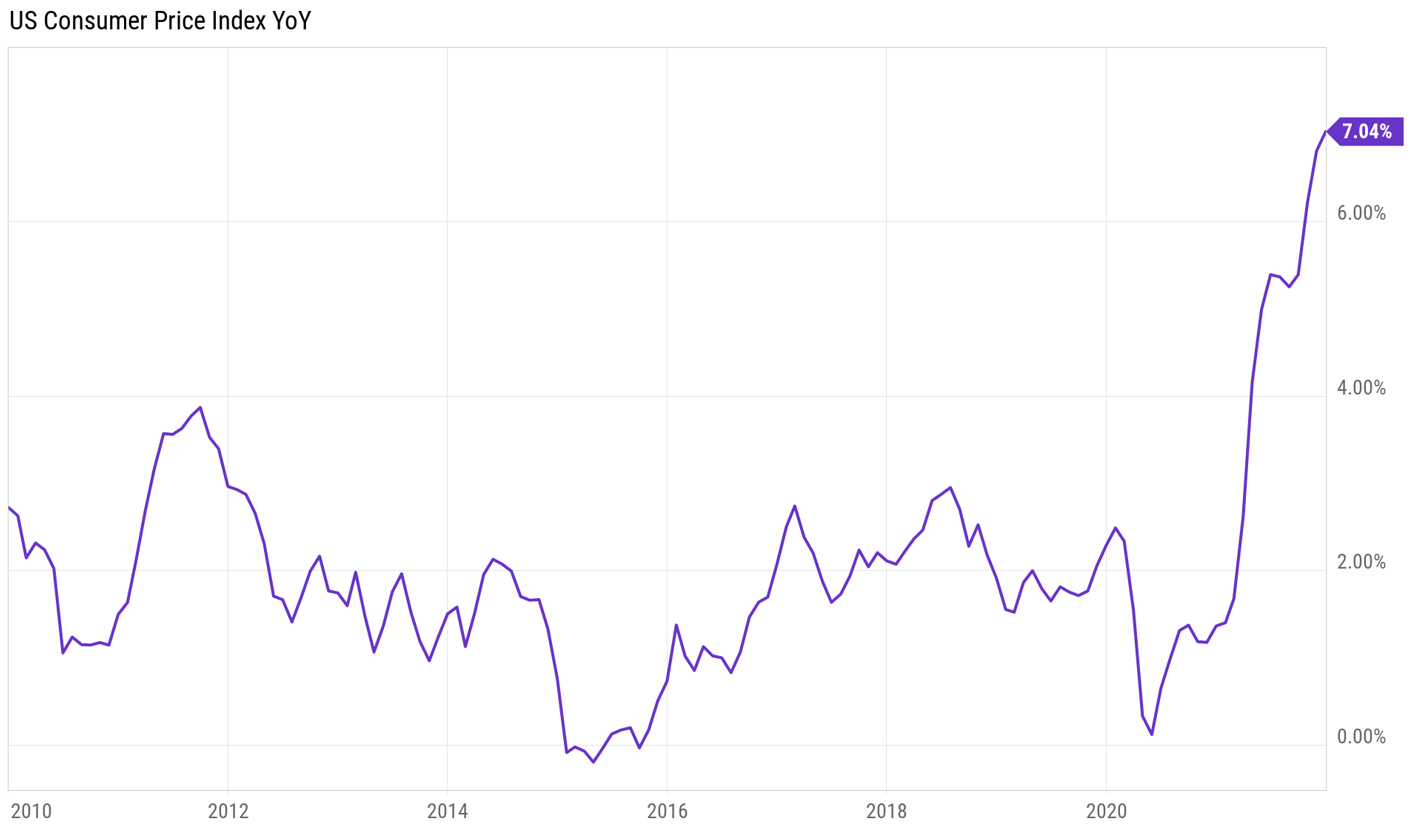

Inflation Continues

The notable downside to this rebound has been a change in inflation rates across many goods and services in the economy. The Consumer Price Index (CPI) continues to increase with Energy, New & Used Cars, Durable Goods all reading higher.3 As supply chain issues are resolved, some of these pressures should subside over time. It will be important to continue to monitor the makeup of the Inflation Reading.

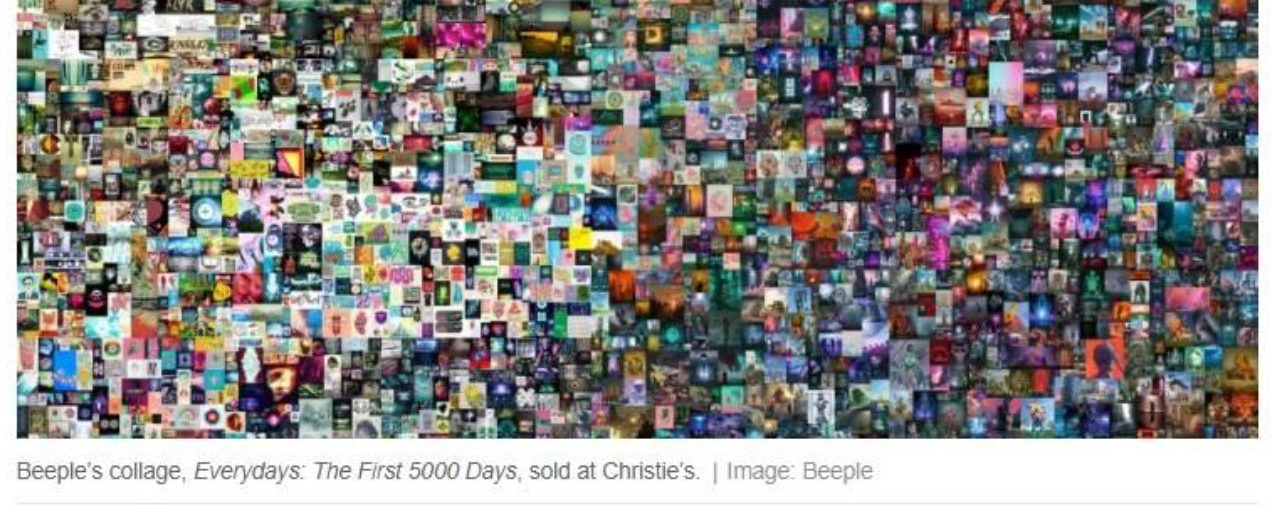

Moving Cryptocurrency Forward

Cryptocurrency continued to gain steam and popularity. The first “Bitcoin ETF” started trading on exchanges using Bitcoin futures, and Non-Fungible Tokens (NFTs) became frequent news ticker items. Christie’s auctioned the first-ever purely digital artwork (Beeple, “Everydays: The First 5000 Days,” pictured above), which was the first with a unique NFT — a guarantee of its authenticity. For the first time, Christie’s accepted Ether, a form of cryptocurrency, in addition to standard forms of payment for the sale ($69 million). This is a major step in the evolution of cryptocurrency and the valuation of digital assets for investors.

1YCharts, FactSet

2US Bureau of Labor Statistics

3YCharts, FactSet

4Christie’s Auction House, Beeple’s Opus

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com