Keep Calm and Let It Compound:

Dividend Income & the Power of Compounding

In times of market uncertainty, it can be helpful to remember a phrase first printed by Britain’s Ministry of Information during World War II: "Keep Calm and Carry On." This enduring message reminds us that maintaining focus and discipline is essential, particularly when it comes to investing.

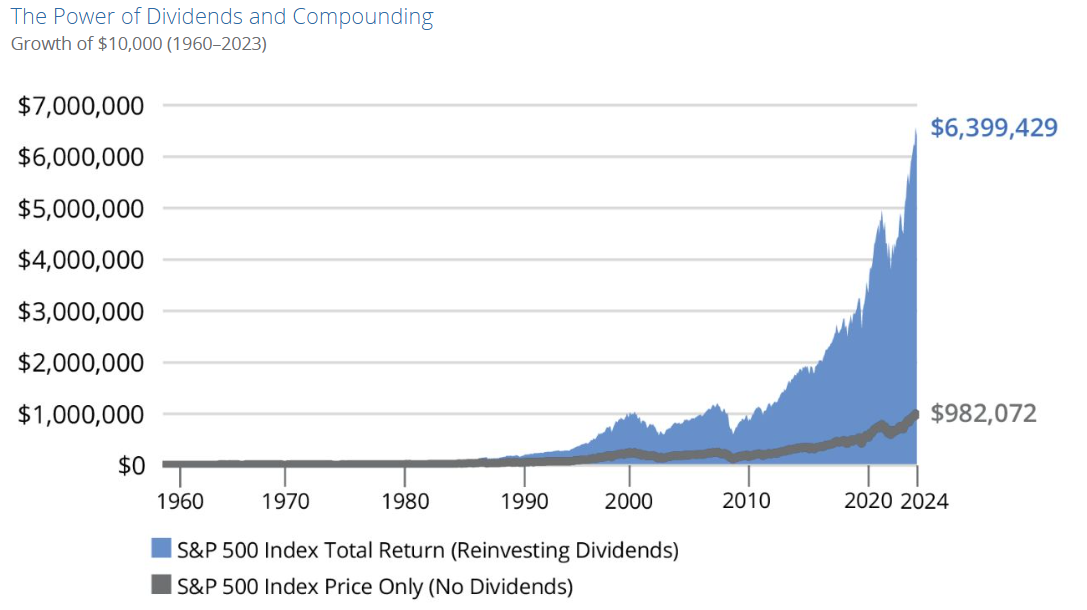

Dividends, in particular, represent one of the most time-tested pillars of long-term wealth creation. Historically, dividends have contributed approximately one-third of the total return of the S&P 500 Index. When dividends are reinvested and allowed to compound over time, their impact on wealth accumulation can be even more profound.

Many of the world’s most respected companies prioritize not only consistent dividend payments but also annual dividend growth—providing investors with both ongoing income and a powerful compounding effect, when reinvested.

Source: As of 12/31/24. Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. Dividend-paying stocks are not guaranteed to outperform non-dividend-paying stocks in a declining, flat, or rising market. For illustrative purposes only.

Data sources: Morningstar and Hartford Funds, 3/25.

Dispelling a Common Myth: Dividends vs. Share Prices

It is a common misconception that a decline in share price automatically signals a decline in dividend income.

In reality, while share prices fluctuate daily, dividend adjustments typically occur annually and are based on a company’s operational performance.

Consider the Dividend Aristocrats Index, which includes S&P 500 companies that have raised dividends for at least 25 consecutive years. These businesses are characterized by strong balance sheets, sustainable cash flows, and a commitment to rewarding long-term shareholders.

To illustrate:

- A company trading at $100 per share, paying a $4 dividend, offers a 4% yield.

- If the share price declines to $90 while the dividend remains constant, the yield rises to approximately 4.4%.

In other words, unless an investor sells during market downturns, their dividend income remains uninterrupted. Reinvesting dividends at lower prices enhances the compounding effect over time.

The Resilience of Dividend Income During Market Stress

Dividend income has historically provided a critical source of stability, especially for retirees.

For example, during the 2008 global financial crisis, Coca-Cola maintained—and even increased—its dividend despite a meaningful decline in its share price:

| Year | Stock Price | Dividend per Share |

| 2007 | $61.37 | $1.36 |

| 2008 | $45.27 | $1.52 |

| 2009 | $57.00 | $1.64 |

This commitment to dividend growth, even in challenging environments, reinforces the importance of investing in high-quality businesses. This strategy is a core tenant of our investment philosophy.

Compounding in Action: McDonald's Example

If an investor had purchased $10,000 worth of McDonald's stock in 1980, reinvested all dividends, and held the position, that investment would today be worth approximately $6.68 million. The dividend income alone would have grown from just $172 in the first year to over $142,000 annually as of 2024—highlighting the extraordinary benefits of time, patience, and reinvestment.

Maintaining Focus During Market Volatility

While it is natural to feel concern during periods of market decline, it is important to remember: Paper losses only become real losses if one sells.Dividend payments, meanwhile, continue—providing a steady stream of income much like rental income from a property, regardless of temporary changes in valuation.

Investor focus should look to dividend stability, corporate fundamentals, and long-term goals rather than reacting to short-term fluctuations.

Key Takeaways

- Income Stability: Dividends deliver reliable cash flow independent of short-term market swings.

- Reliable Retirement Planning: Dividend income allows retirees to meet living expenses without forced asset sales.

- Quality Emphasis: Strong, dividend-growing companies form the backbone of resilient portfolios.

- Emotional Resilience: Focusing on income growth over market price changes promotes sound, long-term decision-making.

Closing Thoughts

At Principle Wealth, we believe that building diversified portfolios anchored by reliable dividend payers is fundamental to achieving lasting financial success. Through discipline, patience, and a focus on compounding, investors can weather volatility and continue to grow their wealth over time.

Keep Calm and Let It Compound!

Principle Wealth